Hard Asset Digest September 2020

September 2020

This month, I’m sitting down with Mr. John Kaiser — founder and editor of Kaiser Research Online.

Click here to jump straight to the interview.

John has been intimately involved with the natural resource investment sector since 1983 wherein he began cutting his teeth as a research assistant with Continental Carlisle Douglas — a Vancouver-based brokerage firm specializing in VSE-listed securities.

Back then, information about speculative ventures existed only in paper files stored at the stock exchanges and in the heads of experienced industry personnel — placing the individual investor at a distinct disadvantage with regard to natural resource speculation.

Recognizing that imbalance, Mr. Kaiser began spearheading a program to digitize key elements of the speculative market – namely the people involved and the paper created to finance ventures – as a means of leveling the playing field for the individual investor.

His groundbreaking database became the foundation of the Longshot List — a popular compilation of cheap Vancouver Stock Exchange listings still in their early development stages.

Around that same time, John immersed himself in the study of geology — a field that had fascinated him since childhood. That led him directly into the diamond exploration and discovery sector where he was among the first market analysts to recognize the broad implications of Chuck Fipke's diamond discovery at Lac de Gras in 1992. The availability of the Sheahan Diamond Literature Compilation on Kaiser Research Online reflects his continuing interest in that sector.

In 1994, John began working with the legendary Bob Bishop of Gold Stock Mining Report as a researcher, and, 6 months later, published the first issue of the Kaiser Bottom-Fishing Report — a print newsletter focusing on Vancouver-based resource stock opportunities.

That timing proved fortuitous as his bi-monthly newsletter became widely popular during the resource sector bull market of 1995-97.

Years later, in anticipation of a exploration boom involving junior companies, Mr. Kaiser began work on developing a framework enabling investors to make rational speculative bets on the outcome of high-risk mineral exploration plays.

Today, that framework is widely known in the resource space as Kaiser Research Online and reflects John’s shift to a comprehensive online portal covering the Canadian-listed resource sector.

I’ve known John for many years, and I’m continually fascinated by his deep knowledge and understanding of science, markets, history, and commodities of all types.

In the interview, John and I delve into a number of relevant topics encompassing a variety of metals – some quite rare – and the below-radar, small-cap exploration companies seeking to produce them.

I think you’ll get a good sense of John’s passion for markets and resource speculation in our discussion below.

Yet, before we get to that, let’s take a quick look at the markets and the big picture for gold.

Market Sell-Off = Buying Opportunity!

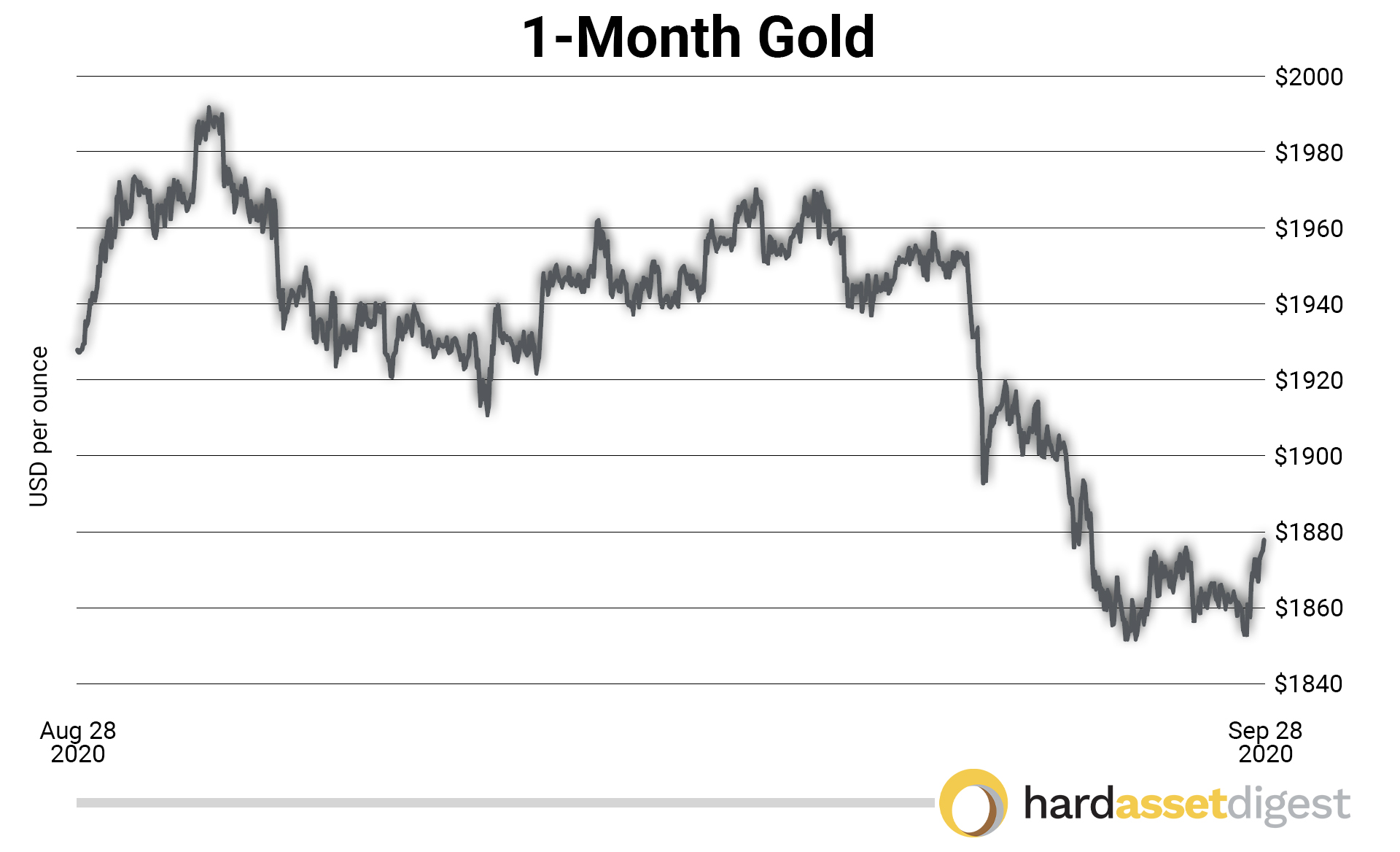

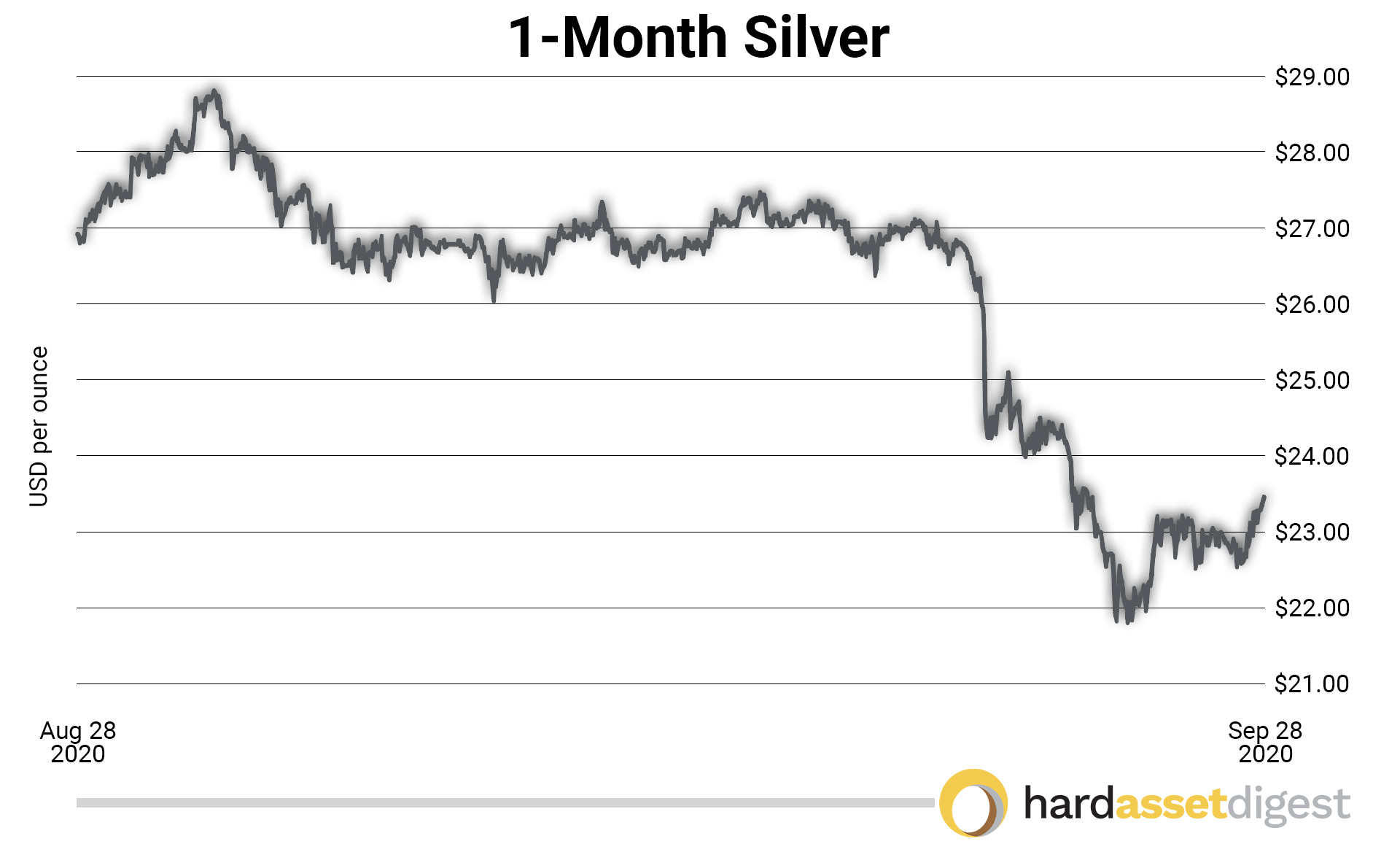

The broader market has been in correction mode for the better part of September… dragging gold and silver down with it.

And there certainly has been no dearth of culprits to choose from with a major one being the passing of Supreme Court Justice Ruth Bader Ginsburg and the highly charged political atmosphere that’s sure to only intensify in the days and weeks leading up to the election.

Another was the steep rise in COVID-19 infections in the UK that’s now threatening yet another lockdown there while also serving up fresh concerns over what the fall may look like here as we brace for a one-two-punch of influenza and coronavirus.

Nervousness and uncertainty about the future IS our new normal, which means we can expect this sort of Jekyll & Hyde market mania to remain in play — at least until a vaccine is approved.

Looking at precious metals, we should see correction lows set in both gold and silver sometime within the next few days to the next few weeks. Beyond that, all signs point to a choppy trading environment over the next couple of months as gold and silver set up for their next major tandem move higher.

From a big-picture perspective, you really could not ask for a more bullish scenario for gold.

Unrestrained money-printing and debt creation in response to the coronavirus has put the US in an entrenched negative real rate environment with no clear path out — which, of course, is extremely bullish for gold.

Just last month, Jeff Phillips stated, “In the short-term, it’s really difficult to know what gold is going to do. We’ve had a big run up above $2,000 an ounce, and now we’re experiencing what I would call a very predictable pullback.Yet, that’s what you want in a healthy bull market. You’re always going to see intermittent profit-taking. I think the next move up could be substantial. In fact, it wouldn’t surprise me to see gold reach $2,400 an ounce by year-end.”

Another expert of ours, Rick Rule, has always told us that the best gold bull markets are the ones that sort of grind higher. And that’s precisely what we’re seeing now: Strong upward moves to all-time highs followed by predictable corrections.

These pullbacks in the precious metals can be thought of as anticipated periods of consolidation marked by intermittent profit-taking wherein specific resistance levels are tested prior to the resumption of the overall upward trend.

That’s what resilient precious metals bull markets do. Gold, silver, and the equities that comprise our sector-of-choice are now consolidating and gathering energy for their next major leg-up in value.

Ideally, the next round of gold/silver highs will be 15%-25% above previous resistance levels – and so on and so on – thereby solidifying and strengthening the overall bull market trend we’re in now.

Last month, I mentioned the upcoming launch of our brand new portfolio service: Mike Fagan’s Precious Portfolio.

I'm excited to announce that it’s here and ready for you to check out now!

Our first issue is live and we’re already starting to construct a precious metals stock portfolio for the record books.

As a current Hard Asset Digest member, you can click here to learn more about it and get access now.

And… the timing could not be better as this temporary pullback is handing us a brief window to pick up shares in quality resource companies at temporarily reduced prices.

The longer-term precious metals bull market we’ve been collectively enjoying since our very first issue remains firmly in place — and, as always, our expert team has you covered every step of the way.

With our new portfolio service, we’ll be taking all of the ideas and insights from Hard Asset Digest and mobilizing them into a live precious metals portfolio you can personally emulate and track.

Our first two portfolio positions are in, and our next two picks will be announced within the next couple of weeks.

I hope to see you over at Mike Fagan’s Precious Portfolio soon. Please enjoy my exclusive interview with Mr. John Kaiser.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with John Kaiser

Founder of Kaiser Research Online

Mike Fagan: John, it’s wonderful to have you on. I think the last time we hung out was at one of the Vancouver mining conferences — back when there actually were conferences!

John Kaiser: Yeah, I remember those days!

MF: Hopefully they’ll be coming back soon!

John, following a dreadful near-decade-long resource bear market, we finally seem to be entering what looks to be a very powerful gold bull market that can last for multiple years. And not just in the metals themselves but also in exploration, discovery, and mine development.

What’s your take on today’s gold bull market; what’s driving it, and what role, if any, is COVID playing?

JK: Well, Mike, a year ago I was arguing that gold was going to reprice possibly in the $2,000 to $3,000 per ounce range because the current administration’s policies have accelerated our growing conflict with China.

Now mind you, several years ago, during the Obama period, it was well understood that China's economy would eventually match that of the United States and that there would be a significant change in “who’s the top dog” economically and militarily.

But that day of reckoning was pushed out to 2030 and possibly beyond. The hope has always been that China would eventually become much more like Western democracies — and that the whole world could carry on as a globalized trading unit with China's advantage of lousy emission standards and low labor costs sort of fading away.

But the free market policies of the United States – which translated into capital moving jobs overseas into China – are hollowing out America's productive capacity and have fueled citizen resentment. That resonated with Trump, and when he got elected, it became his major policy agenda to reverse this flow of manufacturing capacity through a trade war with China.

And that has been manifested in an America First policy that has served to alienate not just China but all of our allies as well. And it’s accelerating this conflict between the two great superpowers of China and the US.

I see the price of gold moving up as the world realizes they cannot rely on the United States as the enforcer of Western democracy principles and even free trade type principles. And the US dollar will, at a much sooner date than necessary, no longer be the sole reserve currency.

Mind you, none of the other currencies are in any position to become an equal to the US dollar. So gold is emerging as a transitional asset class, which is why we’re seeing this move into the $2,000 to $3,000 range — which is a real price range.

There's no inflation really associated with it. It's a rethinking of the role of gold as an asset class.

And at $2,000 an ounce, the 6 billion ounces of above-ground gold stockpile that exists in the world today is worth $12 trillion. Make it $3,000 an ounce, and that figure goes to $18 trillion.

The European sovereign debt that's negative yielding right now is already $12 to $15 trillion. The US debt isn't negative yielding as of yet, but it is negative in real terms — and it’s close to zero in nominal terms.

The arrival of COVID-19 has accelerated this even further because the Chinese – once they exited from their denial that the virus was happening – cracked down very, very seriously and nipped it in the bud.

But in the United States, we have a President who understood this to be a very big problem, yet was more focused on how it would affect the economy and the stock market and blew it off as just a scam that the media was perpetrating to harm his reelection chances.

So the United States missed its opportunity and is now the most infected country in the world. Our employment has taken a huge hit as a result of the lockdown response.

Plus, the lockdown response ended too abruptly for the curve to be sufficiently flattened to enable everything to come back open. And so the economy has not recovered; employment has recovered somewhat, but the US economy is still severely damaged.

Heading into flu season where everybody has to go back indoors, there’s this fresh risk of a new viral surge postponing our exit from COVID-19 until at least 2022 in terms of things returning to any sense of normalcy. And that’s assuming a vaccine actually becomes available and is successfully deployed early next year.

China has recovered, and its economy is now doing quite well. They just reported a quarter that was better than their last quarter of 2019.

So the COVID crisis has made the situation worse by exacerbating the rivalry between the US and China in terms of who's going to be top dog in the world.

MF: John, let’s talk about the concept of discovery exploration, which I know is an important component of your overall platform. The focus here is less on macro forces and future metals prices and more on the prospects for economic discovery at current metals prices.

What are you seeing right now in that space?

JK: Mike, the importance of gold moving into the $2,000 to $3,000 range after languishing between $1,100 and $1,300 for 8 to 9 years and being a foundation for the previous bear market in the juniors cannot be overstated.

Of course, it’s not a huge percentage gain… certainly nothing like going from $260 to $1,900 and back to $1,100 an ounce. But in real price terms, it's very significant because 1980 gold at $400 inflation-adjusted to the present is only about $1,275 today.

So what we’re seeing today is a very significant real gain in the price of gold.

And what this does is it lowers the bar for what counts as a meaningful gold discovery. We were already seeing a response to the apparently endless bear market in the past few years, and as the market got tired of waiting for gold to develop an uptrend move to $2,000 an ounce, the market wanted companies to be in charge of their value creation destiny. And waiting for macro forces to make gold move up, well… that wasn't really happening.

So the approach I saw taking place was that capital was being invested in juniors that were taking a new look at existing mineralized systems outlined in past exploration cycles that, even with a higher gold price, probably weren't going to make it in their current form.

But they wanted to see if you put “new geological thinking” to bear – by digitizing data and using computational power that's available today – to see if what they saw before is all that there will ever be to see. What if you started going deeper or sideways… Is there something bigger and better for this deposit that can make this system worth developing at the metal prices we currently have?

And while gold was bumbling between $1,200 and $1,300 an ounce, you needed something geologically pretty good. Here at $1,900 an ounce, if it stays here — it’s an extraordinary boon for exploration discovery.

And in the last three to four months, we’ve seen $769 million raised by TSX Venture resource listings… all generally going into these types of explorations plays.

It's not going into feasibility demonstration to show… Okay, these million and a half ounces that we have at 0.6 grams per tonne, this is now in-the-money so start upgrading the resource category, move on to a prefeasibility study and so on and so forth.

No, it's about making the geologic systems bigger and better. And for this rethink process, we have a very recent poster-child example, which is the Great Bear Resources story.

Several years ago, Great Bear Resources (TSXV: GBR)(OTC: GTBAF) optioned a deposit called Dixie Lake from Newmont for not very much money at all. And that's because the resource that had been outlined by 100 holes or so was really not that interesting even at $1,900/gold.

But the team at Great Bear had looked at the whole geological context and ended up discovering the Dixie Limb Hinge Zone, which was Red Lake-style high-grade mineralization — and that got the stock going.

But even more interesting… this was sort of a rethink of an existing system and, layered on top of that, a conceptual thought process by a team looking at the entire land package as a whole. They looked at the LITHOPROBE data from a decade or so ago when the Canadian government was searching for a place to store radioactive waste.

And they recognized this 22 km LP Fault and said… What if this geologic structure, which seems to tap into the same deep mantle structure that feeds the Red Lake system… what if this was also fertile with gold?

So they started drilling along the strike of this structure with great success, and the stock has since achieved a near billion dollar valuation going from the original 20-cent range to as high as C$19 or C$20… currently around C$16 per share.

And now, they’re busy delineating what they think is a Hemlo-style gold system. They've only drilled around half of the depth of what the Hemlo deposit reached. They've got a similar strike of this type of disseminated mineralization with high-grade gold within it.

And, remember, Hemlo itself was a 22 million ounce gold system! So this type of process is capturing the market's imagination — and it's moving down the food chain.

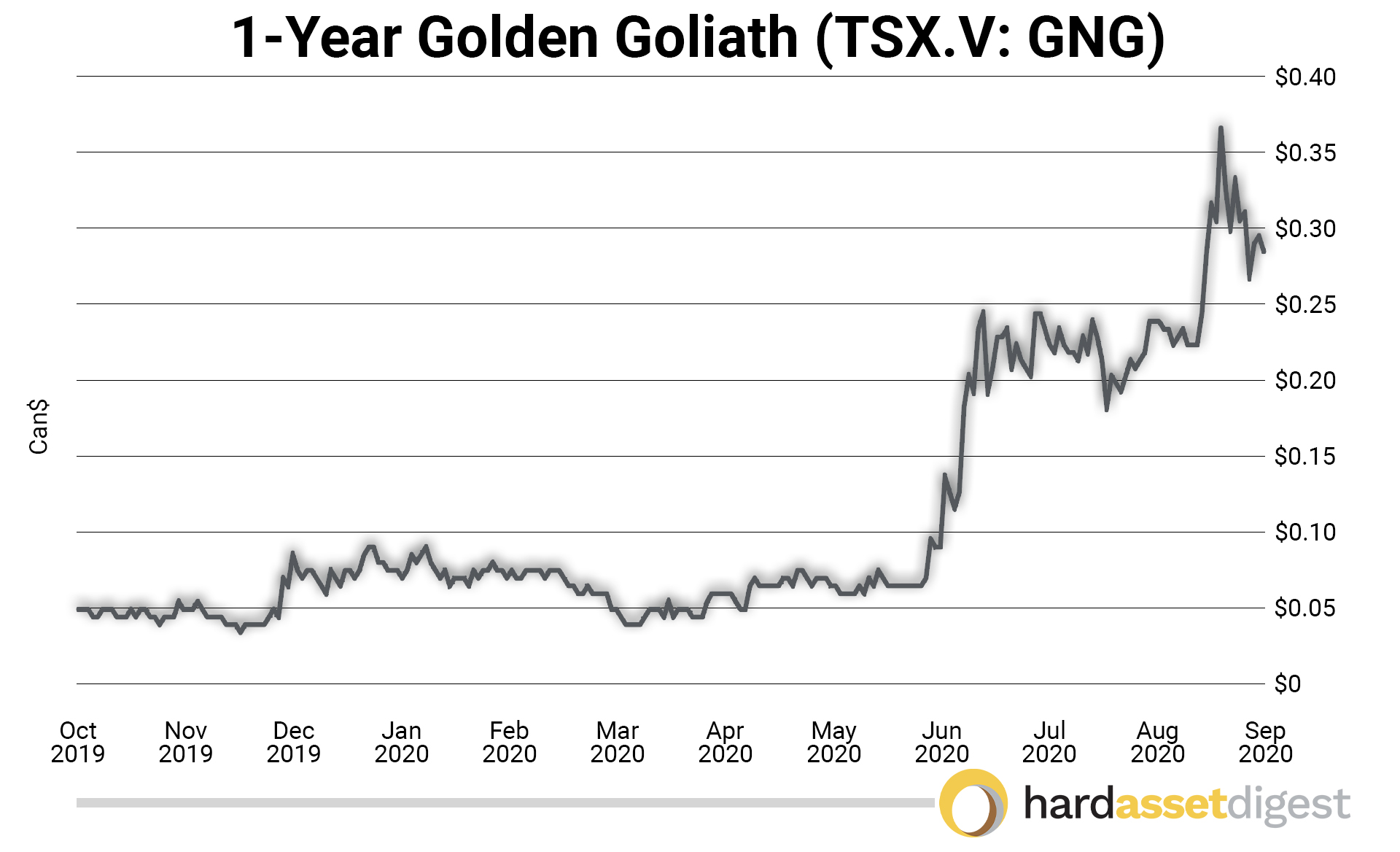

A similar fault to the south called Pakwash ended up being acquired by a little junior called Golden Goliath (TSX.V: GNG)(OTC: GGTHF), which had given up on their Mexico project because the drug cartel problems became just unworkable for them to be down there.

So with this new Canadian project, it’s an overburden covered area that had never seen a single drill hole; zero outcroppings, etc. And they've done the old fashioned basic work of geophysics, basal till sampling… and they’ve just started a drill program.

The LITHOPROBE data shows that this fault structure also appears to link to that deep seated structure that’s obviously feeding the LP Fault and that also fed the Red Lake District.

So in comparison to Great Bear Resources, Golden Goliath has only gone from 5-cents to about 30-cents and its valuation right now is maybe C$40 million. But it’s attracting an appetite in the market.

So discovery exploration is, I think, a very significant component of this new gold bull cycle that's awakening. It's not just about existing old systems that are being dragged into the money by a higher gold price.

It’s about the higher gold price and “geology smarts” being put to work along with exploration capital that knows that… Hey, if we give you $5 million now, we know we're going to be giving you $10 million more later because you're building a system and making it bigger.

And if someone like Golden Goliath is able to make a grassroots discovery out of this Pakwash Fault, then that expands the narrative beyond just a rethink of existing systems. It starts turning the glass half-full for conceptual plays, especially blind targets hidden under barren cover rocks or overburden.

And that probably will be the next wave for discovery exploration in 2021… once 2020 is finally behind us.

MF: Yeah, I think it’s safe to say we’re all counting down the days til 2021!

John, I’ll be asking you about some of the discovery exploration stocks you’re following in a minute.

First, looking a bit further out, say, a year or two — do you think it’s going to require a major infrastructure boom to really get us out of the economic paralysis the COVID crisis has us in now?

JK: Mike, there were a lot of people who, after the 2008 crash, pointed out that the United States had neglected its infrastructure; had not really renewed it in the name of not spending money and going into debt. Thus, allowing it to become kind of worn down and in need of renewal.

But the politics of the 2009-16 democratic administration was such that fiscal stimulus of that nature was not allowed. So everything was just about quantitative easing… the printing of more money to buy bonds and securities mortgages and to repair a damaged financial system.

So to this day, the issue of infrastructure decay in the United States has not gone away.

And we also have this problem that's becoming more and more evident that climate change, regardless of what’s causing it, is changing all of our infrastructure assumptions going forward.

And the COVID-19 situation — well, this thing is an absolute morale buster. It has helped to divide people, to polarize them into pro-Trump and anti-Trump camps. And into somehow denying COVID or imagining it as some sort of Chinese conspiracy that has become part of the whole pro-Trump camp.

This all needs to be unwound. At some point, COVID-19 will come under control. But the deep funk that has been created – especially for the younger generations who are more harshly affected by this lockdown and this slowdown – is putting everything on pause as we gradually try to navigate our way back to normal.

This is going to need to be jump started sometime in the next year… maybe in 2022.

And the way to do that – now that we're stuck with interest rates that are going to be very low for a very long time according to the federal reserve chairman – is to take on massive fiscal stimulus; to build something that's going to be there for the younger generations.

Not just printing more money to ship more medication to the boomers so they can sit there and live forever. No, something has got to be done to rekindle the hope of the Gen-Z’ers, the Millennials, and even the Gen-X’ers to say… YES, we care about the future!

And infrastructure is physical work; it’s not IT work or anything like that; it's not peddling stuff on the internet or call centers and things of that nature.

It's real work; it's visible. And if it's done in a manner that changes the way infrastructure operates — then it will be a real shot in the arm for the American economy.

It’ll also have very positive implications for other metals out there because the mining industry, in the last decade, has not really moved to mobilize new supply. That’s because metals prices were flat and the global economy was not roaring the way it was during the supercycle decade.

So we’ll have the usual metals prices going up as demand ratchets higher… but supply won’t be able to rise to accommodate that increased demand. And the underlying debt funded infrastructure spending, of course, will be positive for gold as well!

Ultimately, what we’re looking at is a dual bull market for the resource juniors. Gold staying in that $2,000 to $3,000 range with predictions of $5,000 to $6,000 and beyond driving even more people into the yellow metal. And in terms of the real world metals, the base metals, the critical metals… all of those will also be attracting attention especially in the context of this escalating conflict between the US and China.

The fact that the world may carve itself into separate trading jurisdictions so that metals that predominantly come from China – or jurisdictions where it has control – are not available to other parts of the world… there’ll be this scramble to develop a more diverse supply chain of these raw materials.

And that means some of these weirder metals will start gaining attention. Rare earths are going to become prominent at some point; a rare earths confrontation 2.0 will happen unless, for some reason, China and the United States make up and decide we're going to be peaceful traders like we were in prior decades.

MF: Tying into that, John, the previous gold bear market we were discussing also put the clamps on exploration and mine development in the base metals.

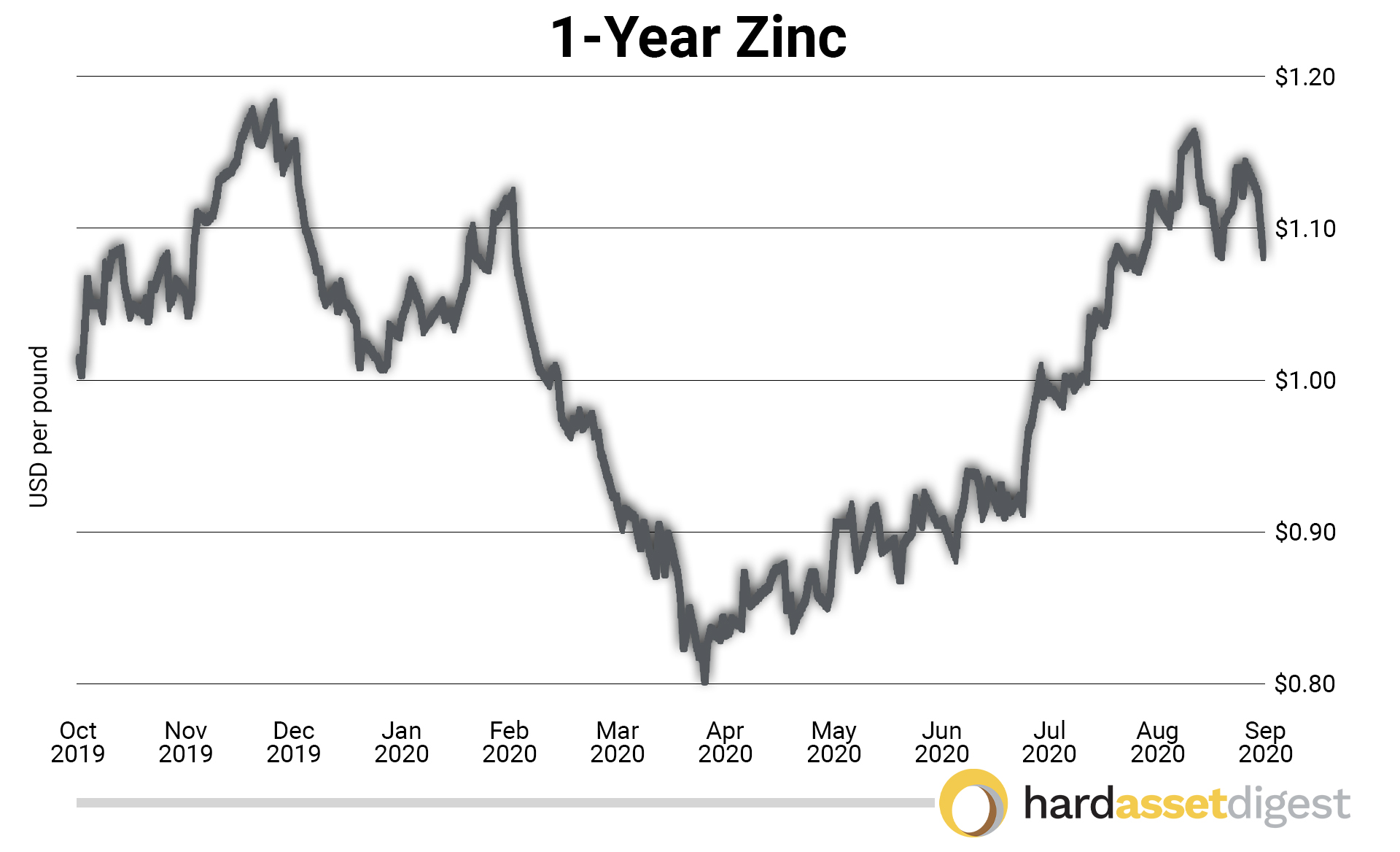

What would an infrastructure boom mean for metals like copper, nickel, and zinc and, as well, for the companies that explore for them?

JK: Well, Mike, in terms of an infrastructure-driven demand boom, we're already beginning to see the base metals move up as China's own economy recovers. And they've kind of realized they cannot just depend on the United States as an export market. That’s going to change one way or another.

So we've seen copper go from around $2 to $3 per pound; we’ve seen nickel move to $6.75 after spending a long period between $4 and $5 a pound. And this will require developing new deposits.

Now, during the supercycle boom, there were a lot of these deposits that had been found in earlier decades that companies like Lumina acquired and did feasibility demonstration work on and that were later acquired by majors. So there is a significant inventory of deposits that will be able to be developed if copper is going to remain at $3 to $4 per pound.

But of course, the permitting and construction period… that's another three to five years. So the supply response is going to be farther down the road.

I do not see a significant M&A type of binge like we witnessed in the supercycle because there isn’t a similar inventory of undeveloped deposits held by juniors. And that is where the exploration emphasis becomes so important.

And it's not just about taking an old geologic system and rethinking it and trying to make it a little bit better. It’s a more conceptual way of thinking... looking for big deposits that can feed the copper and nickel market.

Looking at zinc, for example, there are already a number of existing deposits out there that are waiting for evidence that zinc is going to be at $1.20 per pound or higher for the long-term in order for them to be developed.

So in the case of zinc, unless you're looking for, say, a Sullivan-type ore body where you're drilling a thousand meters deep and hoping to find a 150 million tonne deposit that's worth $5 to $10 billion… near surface exploration for new zinc deposits simply is not going to appeal to the market.

But there's also something else that's coming into play, and that is the ESG [Environmental, Social and Governance] status of a deposit.

The mining industry is under pressure to demonstrate its environmental, social, and governance credentials. And part of that demand is coming from technology such as electric vehicles, which are marketing themselves as… Hey, we represent a clean future! But that doesn't really work if your raw materials are coming from very dirty carbon dioxide producing sources.

So a lot of interest will go into looking at projects that qualify for ESG status. And one that I have put my attention on is FPX Nickel (TSX.V: FPX)(OTC: FPOCF) which, a decade ago, found a very low-grade nickel deposit in central British Columbia called Decar which is unusual in that the nickel is in the form of awaruite which is actually natural stainless steel.

There is no sulfide anywhere in this largely homogenous deposit.

And there's billions of tonnes of this 0.1% to 0.12% nickel that can be recovered through a simple flow-sheet of crushing, grinding, magnetic separation and flotation to produce a concentrate. A concentrate that can go directly into the stainless steel mills; not needing to be shipped abroad to a nasty smelter spewing all of its emissions into the atmosphere with the nickel ending up in the LME warehouse.

So projects like that could become a certifiably clean source of nickel for, say, a manufacturer such as Tesla. Elon Musk has come out and said.. Yes, we're interested in future long-term supply of raw material inputs that qualify as clean.

And that's going to be an interesting focus, and it's coming back into secure jurisdictions like North America where there are very tough environmental standards as opposed to places like Africa where very poor emission standards exist.

When you produce a modern mine, it is not the nasty, dirty hole in the ground with everything dumped into the surrounding area that the mining industry was once infamous for. Things have changed substantially.

The mining industry has an undeserved knock against it right now, especially among younger folks who don't understand that – at least in jurisdictions that have rules for responsible mining practices – things have changed dramatically.

MF: John, Midas Gold is a company you’ve been covering for a number of years, and they’re probably a good example of that as part of the plan for their Stibnite Gold Project is to reclaim the giant mess that was left behind by previous operators.

Also, that project has an antimony component that – when they finally get the green-light to move forward with mine construction – would become the only domestically mined source of that strategic metal.

What’s happening currently with Midas Gold, and how does the antimony component play into the broader China/strategic-metals paradox we were just discussing?

JK: Mike, the Stibnite Gold Project that Midas Gold (TSX: MAX)(OTC: MDRPF) is developing is located in Idaho — and during the 1940’s, it was the primary source of antimony for America’s war effort against Nazi Germany and Japan.

And that, as you noted, made a mess of the area.

But there's also gold in that system that was mined in the 50’s and 60’s which made the problem even worse. So the Stibnite mine site is really an environmental disaster area; a US Superfund site.

The Midas Gold team has gone in there with the idea that this site is capable of producing 350,000 ounces of gold per year from an open pit mining operation yet with the additional understanding that permitting is going to be a headache.

So what Midas has proposed to do is make the Stibnite Gold Project a dual project of developing a large-scale mine in accordance with contemporary standards for non-polluting mines and minimal footprint while simultaneously reclaiming the mess that was left behind from previous operators.

They kicked off the permitting process in 2016, and it has been an ordeal to say the least. By the time they’re finished, they expect they'll have spent $72 million just on the permitting process relative to about $120 million spent on feasibility demonstration and exploring the deposit.

Yet, they finally received a draft EIS [Environmental Impact Statement] approved by the US Forest Service in August of this year. It’s currently in a 60-day comment period that ends in mid-October.

After that, the Forest Service will deal with all of the comments. And then, a final EIS will be released by the Forest Service probably in Q2 2021. That will allow for another short response period for those who made comments and feel that their comments have not been properly addressed.

And then, hopefully, there's a decision-of-record sometime in Q3 of 2021, which would form the basis for getting the final smaller permits needed to move forward with mine construction. So after this 4 to 5 year ordeal of permitting, the Stibnite Mine could be ready to be built by the end of 2021.

And this is the sort of project where you look at it and say… Does the world really need more gold? Well, the Idaho area certainly needs that salmon watershed opened back up so the salmon can migrate back into it and lay their eggs and then go back out to sea and help replenish the salmon fishery.

And the antimony byproduct credit; this is a huge, huge problem for the United States because the three biggest suppliers in the world are China with 80%, Russia with some, and Tajikistan with some more. And then the rest — it all comes from a hodge-podge of different countries.

The antimony byproduct credit of the Stibnite Project will be more than what the United States needs annually as part of its macro economy.

And, of course, if you get into a military type of footing, you’ll need even more of it because it’s a flame retardant that plays an important role in military armaments.

And so, by getting this, investing in this, and having it go ahead… it enables the country to gain self-sufficiency in antimony. Plus, the ability to export it to other countries such as Canada in case supply from these other parts of the world ends up disrupted because of an escalating conflict between the United States and China.

I've done the numbers on this project; at $1,900/gold, they’ll publish a Feasibility Study in Q4 of this year, which will outline all of the changes in relation to capital costs and operating costs. Body language suggests there will be higher capital costs but not a hideous blowout like doubling it and making the project uninteresting even at $1,900 an ounce gold.

So this is my top pick because when you buy this company you can feel good about the fact that… Yeah, if this becomes reality, there's a greater good beyond simply making money! And it has the potential to make you a lot of money, because right now, it's bumbling around $1.50 per share.

When you do the numbers at $1,900/gold, you kind of adjust what the PFS numbers were in 2014 — and you’re talking about a stock that's going to be $5 to $10 a share and will likely end up being bought out by one of the big producers who wants a 350,000 ounce per year new mine in a reasonably secure jurisdiction like the United States.

And if gold tracks to $3,000 an ounce… well then we're talking substantially bigger numbers. So this is an example of the kind of stock that's out there that people can look at and feel really good about owning.

MF: John, you mentioned ESG — so staying with that theme, are there any companies you’re currently following that fit neatly into the broader ESG discussion about responsible environmental policies and sustainability?

JK: Yes, I have two favorites right now, Mike.

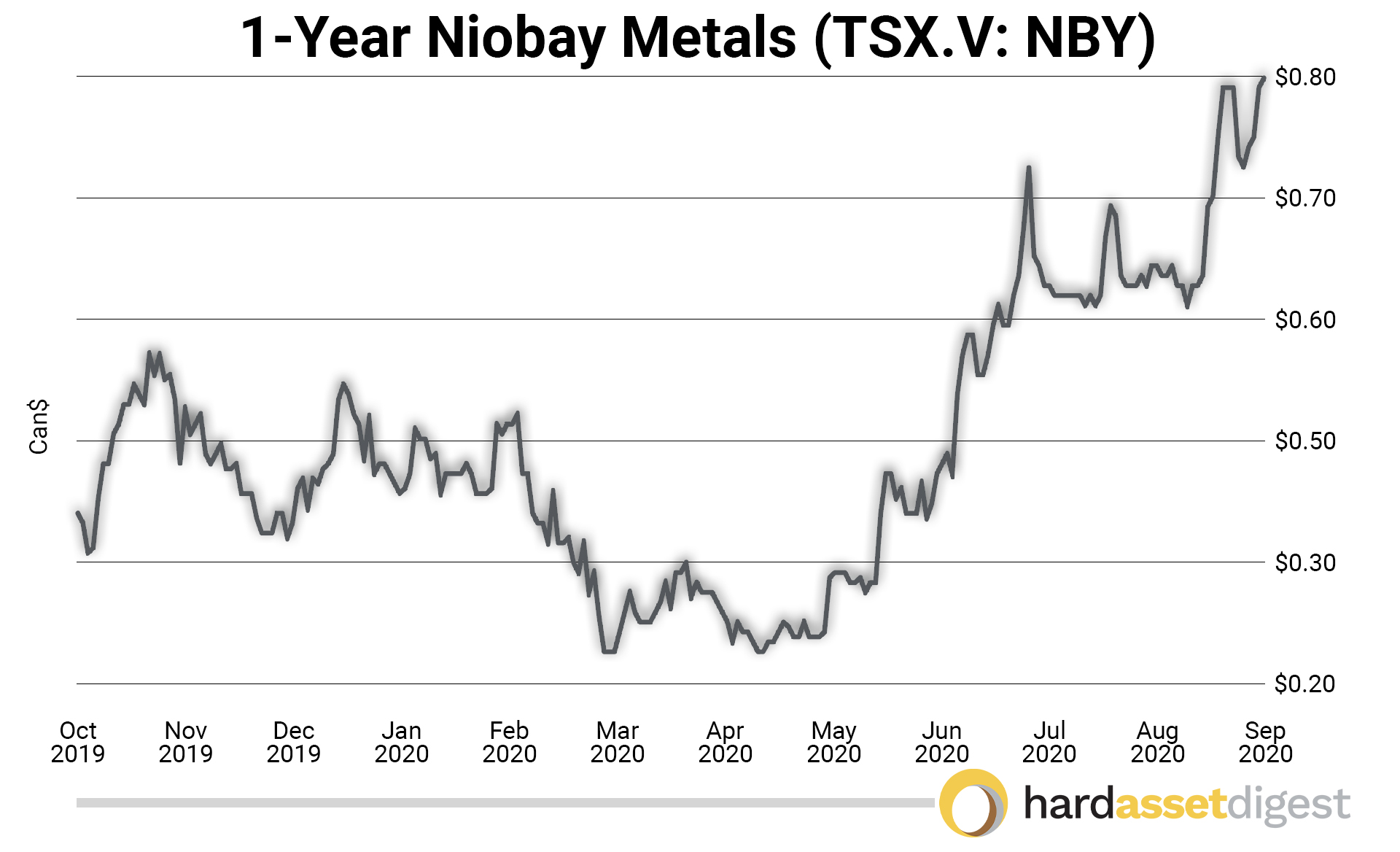

One is Niobay Metals (TSX.V: NBY)(OTC: MDNNF) which is advancing a niobium deposit called James Bay in northern Ontario.

And the other – which I’ll talk about first – is Verde Agritech (TSX: NPK)(OTC: AMHPF) which is developing the market for a potash alternative called glauconite; they call it K Forte.

It’s a silicate that only has about 10%-11% K 2 O. And it actually used to be mined in the United States in the earlier centuries from these greenish deposits and then placed onto fields.

And the beauty of this material is that when you grind it fine and put it on a field, the natural interaction between plant root secretions and microorganisms liberates the potassium that's locked up inside the silicate structure. And these guys figured this out about four or five years ago.

The Verde Agritech team originally attempted to create a heat treated product that would help liberate the potash. Then, they tried to make conventional KCL but the production cost was too high. Then, they discovered by accident in a control plot that simple ground up glauconite worked just as well as the treated version.

Brazil imports 90% of its potassium, so if K Forte ends up being adopted, it could replace half of Brazil's potash import dependency.

And it qualifies as an ESG type of story because the salt nature of conventional potassium chloride really harms the Brazilian soil ——whereas this helps to actually nurture the Brazilian soil and it doesn't kill the microorganisms that are in there.

And so here we have one of the biggest agrarian regions of the world, where, from a domestic source of billions of tons of this material through innovative work by this junior, could end up prolonging the longevity and fertility of Brazil’s soil through the adoption of this breakthrough material.

And Verde Agritech is just in the very early stages of breaking into this market. It's a market development story; they have to convince the farmers that it works. The pricing is based on imported potassium chloride prices. The Brazilian government is behind it because they want self sufficiency, and it ties in with this idea of sustainable supply and supply chains.

At around C$0.60 per share, it’s the kind of story where – when it hits those inflection points where they get the permits to ramp up supply and the Brazilian farming community starts adopting it on a large-scale – you could see a C$10 to C$20 stock coming out of this.

And again, it's an ESG feelgood stock because, if they succeed, there’ll be a greater good component on top of making a whole lot of money.

Turning to Niobay Metals (TSX.V: NBY)(OTC: MDNNF), niobium is an alloy that’s added to steel to make it stronger, which means you don't need as much steel so, therefore, it's lighter; this is called light-weighting.

And this is all part of the drive to reduce the energy footprint of getting things done in this world. The less energy you consume moving something around, the better. Toshiba has been working on a new type of battery that they call a niobium titanium oxide battery.

They're replacing the graphite in the anode of the lithium ion battery with this material. And if this works – and I think they're very close to making a commercialization decision – it would end up substantially ramping up demand for niobium.

Right now, it all goes into steel alloy light-weighting. Most of it comes from a single monster deposit owned by a private company in Brazil. But the world wants diversity of supply; it doesn't want to have all of its niobium coming from a single source.

So the price is low enough to discourage frivolous niobium deposits from coming onstream but also high enough to allow serious deposits such as Niobay’s James Bay deposit to be developed commercially.

The CBMM family realized back in the 60’s that nobody was going to adopt niobium if they were dependent on a single supply source. And so they’re happy to allow these smaller parallel outfits to be developed. Right now, privately held Niobec out of Quebec is the second biggest supplier.

Niobay Metals is going to have a PEA out in a couple of weeks, which will help the market understand the economics of the James Bay project.

And if we get news that Toshiba and its partners like Toyota want to move forward with this special niobium titanium oxide battery — well, that will bring the whole electric vehicle battery narrative into this particular metal.

MF: Two really interesting companies… I’ll definitely be keeping a close eye on both of them!

As we touched upon earlier, John, the resource space as a whole is quite miniscule compared to many other market segments, which means the sector, and junior exploration in particular, is going to require new blood coming in every year.

Do you see the so-called Robinhood generation finding their way into the resource space anytime soon – and is that something we’re going to need for junior resource speculation to stay relevant going forward?

JK: Mike, the Robinhood platform is very popular with Gen-Z’ers and Millennials. You can trade stocks on your smartphone, and commissions are zero.

But, of course, you pay by getting a lousier spread. However, to enable zero commissions, the Robinhood platform only allows you to trade NASDAQ, NYSE, and its former AMEX division listed companies.

I’ve created a page on my website listing all of the resource sector companies that Robinhooders can trade… and most of them are producers.

There’s only a handful of development stage resource companies – such as Almaden Resources (NYSE-AMEX: AAU) and Integra Resources (NYSE-AMEX: ITRG) – that are listed on the NYSE-AMEX that Robinhooders can trade.

So that really limits their ability to come into this space. Mike, the Robinhooders right now appear to be very much focused on momentum type trades and gambling on volatility. They were a key driver in Cannabis stocks because they understood what legalization would imply for that whole market.

So they were heavily into that, but that trend has now peaked; it's no longer a guarantee to make money. Cannabis is now going into the winner take all winding down phase.

Gold is ascending. So they’ll go into these major producer types. But in order to make the really big money, they’ll need to move into proper trading environments — something like interactive brokers where you’re charged a commission yet you’re able to trade directly in all of the exchanges.

And by really big money, I mean those 5 to 10-baggers and beyond that can only come from discovery exploration stories and situations like Almaden overcoming it’s legal problems in Mexico or Midas getting the green light for mine construction in Idaho.

Obviously, the Gen-X’ers are starting to do it. The millennials, who have a more sophisticated understanding of this market, are already dealing through brokers.

Yet, the big problem for the juniors is that these younger generations will eventually need to figure out how the math of an exploration discovery actually works.

If you're looking for a Hemlo-type deposit and you find one, you have to be able to answer certain questions like… What would this deposit be worth at the end of the day? How is the market pricing the bet right now? Are you going to make 5, 10, 100 times your money?

And then, learning to monitor the tea leaves; the data flow. Exploration plays are not momentum plays; they’re much slower time-based plays where information generated by the company changes what the potential outcome looks like.

So as the younger generations end up with less time on their hands… say, from starting a family and not being able to sit there and monitor this day trading stuff… they’ll become interested in plays like this where you place your bet on what you hope will be outsized gains that emerge over longer timelines. Tracking a resource junior’s exploration play is like a game. Especially if you are also active as a social media influencer.

That will be the next wave for the exploration juniors. Will it happen? Will they learn how to think about these discovery exploration plays? Will they be lured in by a rising gold price or rising base metals prices or maybe even critical metals spiking upward as a result of an escalating conflict?

I honestly don't know if this will happen… but it needs to happen for the juniors to get a fresh new audience, and their trading capital, into the space.

All in all, I think it will happen, but certainly not through the Robinhood platform. That platform, by its very nature, will never trade these types of listings on these smaller exchanges.

MF: John, before we wrap things up, would you mind providing my audience with information on how to get in touch with you and how to access the wealth of valuable information your online service provides?

JK: Sure, Mike. What Kaiser Research Online does is essentially two things.

One, it provides an information platform on all of the resource listings on the Australian Stock Exchange, the senior exchanges in the US, and the TSX, TSX-Venture, and CSE exchanges in Canada.

And you can use that search engine as a time saving tool. If you know what you're looking for, you can search and find it and make your own decisions. I'm literally renting tools saving you time.

The other part is, I have picks such as the ones we talked about earlier where I use that same platform to generate my own ideas and then present them to my audience as speculative-value-rated companies. I call them bottom fish when they aren't quite ready for takeoff or where there’s some missing piece.

And, in instances where I see all of the pieces coming together and I really like the story — those I turn into formal picks called favorites.

We have 34 favorites which – when a newcomer signs up – are the ones they should be focusing on right away. And the whole system is designed as a learning platform… as an educational platform. It's not subsidized by any companies and there’s no advertising.

We do not do these deals where we invest in a private placement and then the company does a deal where, for, say, $5K a month, I'll say nice things about them. I don't do anything like that.

We are completely independent, and, as a result, we can talk freely within our Slack workspace that I extend as a privilege to members and just talk about all kinds of things related to this market.

In terms of publishing, it's almost a real-time thing. I'm always trying to publish something. The website gets updated daily; it's in a constant state of updating.

So it's not something like a traditional newsletter that gets sent out once a month or once a week or anything like that. There are comments posted all the time… so it's almost like a real-time tool for research and for covering those favorites.

MF: And what is the cost for a subscription?

JK: The cost is $450 a year for access to everything.

Right now, because people are still a bit reluctant to pay a large amount for something like this, I have a special going for $200 that gives you access until the end of the year. The final three to four months are going to be very turbulent; we could have a significant meltdown in the general markets.

If that happens, it will be like 2008 where the resource juniors and even gold, at least temporarily, will come down with it.

It’s a window where you may see cheap end-of-year prices for companies that got financed and that are advancing their projects. They will be distinct from all of this lifestyle garbage that has polluted this sector for so long… those companies really can't compete in terms of the demands that the market has for real stories, real projects, real backing.

So that $200 gives people access until the end of this year, and then they can decide if they want to subscribe for a full year.

And hopefully, by the end of this year, we’ll know how the election has shaken out and what sort of dynamics will be driving gold and other metals in 2021 and onwards.

MF: John, as always, I really enjoyed the conversation and I’m sure my audience will as well! I appreciate the time and look forward to chatting with you again soon.

JK: Mike, always a pleasure. Take good care.

We have four reports now available highlighting several opportunities for investment in the resource space.

- The Book of Levi: Picks-and-Shovels for the New Gold Bull Market

- Mid-Tier Takeovers for 2020 and Beyond: Two Top Candidates for Premium Takeovers

- The New Standard in Silver

- Exploration Opportunities

Opportunities discussed in those reports and past issues include:

- Golden Goliath (TSX.V: GNG)(OTC: GGTHF)

- FPX Nickel (TSX.V: FPX)(OTC: FPOCF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Niobay Metals (TSX.V: NBY)(OTC: MDNNF)

- Verde Agritech (TSX: NPK)(OTC: AMHPF)

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Sprott Inc. (NYSE: SII)

- Franco-Nevada (NYSE: FNV)

- B2Gold (NYSE: BTG)

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- Blackstone Minerals (ASX: BSX)

- Pan American Silver (NASDAQ: PAAS)

- Hannan Metals (HAN.V)

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)

- Ely Gold Royalties (TSX-V: ELY)(OTC: ELYGF)

- Trilogy Metals (TSX: TMQ)(NYSE: TMQ)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Realgold (private)

- 1903-1926 Gold Commemorative Coins

- Pre-1933 Liberty, Indian, St. Gauden Coins

- Sprott Inc. (TSX: SII)(OTC: SPOXF)

- Alacer Gold (TSX: ASR)(OTC: ALIAF)

- Alamos Gold (TSX: AGI)(NYSE: AGI)

- Silvercrest Metals (TSX: SIL)(NYSE: SILV)

- EMX Royalty Corp. (TSX-V: EMX)(NYSE: EMX)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Revival Gold (TSX-V: RVG)(OTC: RVLGF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)