Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Is Azarga Uranium the next new ISR uranium producer in the U.S.?

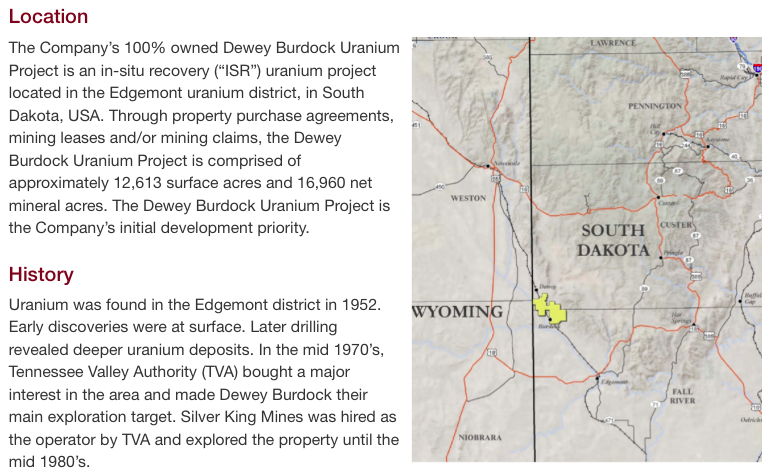

On December 13th, Azarga Uranium Corp. (TSX: AZZ) / (OTCQB: AZZUF) announced that the Atomic Safety & Licensing Board (“ASLB“) resolved the final remaining contention for the Company’s flagship Dewey Burdock (“DB“) In-Situ Recovery (“ISR“) uranium project Nuclear Regulatory Commission (“NRC”) License. {all figures below in US$}

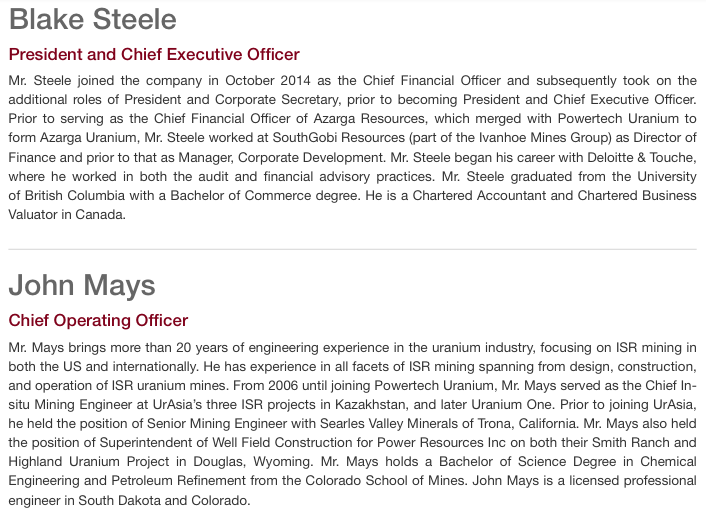

Blake Steele, President & CEO commented,

“We are extremely pleased with the ASLB’s decision, which removes the last contention from the Company’s flagship Dewey Burdock Project NRC License. Resolution of the last remaining contention comes more than four years after the ASLB issued its Partial Initial Decision for the Dewey Burdock Project and marks a monumental achievement for the Company. The ASLB proceeding is now terminated and the Dewey Burdock Project NRC License is contention free for the first time since this proceeding commenced. This decision represents a key risk reduction event and a significant step towards realizing the full value of the Dewey Burdock Project.”

Later in the press release CEO Steele added,

“As announced on 4 December 2019, the results of the Preliminary Economic Assessment (“PEA”) for the Dewey Burdock Project cemented it as one of the preeminent undeveloped in-situ recovery uranium projects in the United States. The estimated cost profile and modest initial capital expenditures leave the Dewey Burdock Project well positioned to capitalize on the anticipated recovery in the uranium price. The robust PEA economics along with the ASLB decision continue to pave the way towards construction and further de-risk the Dewey Burdock Project.”

With the NRC License in good standing and contention free, the Company remains focused on working with the Environmental Protection Agency (“EPA“) to obtain the final Class III & Class V underground injection control permits in the near-term. Importantly, in August 2019, the EPA issued revised draft permits. The comment period for the revised draft EPA permits is closed.

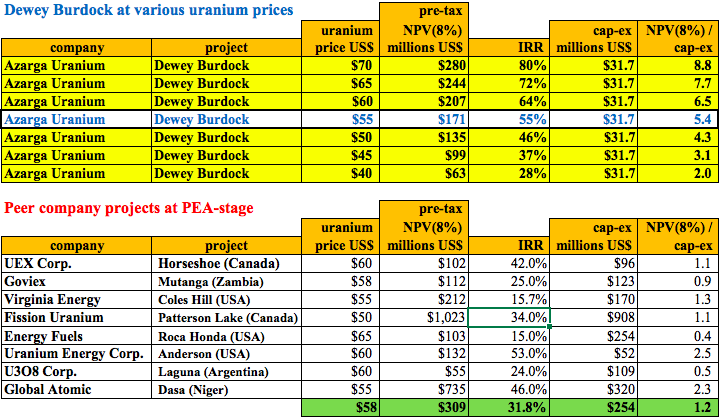

This spectacular news came shortly after the findings of the eagerly anticipated, revised & updated, Preliminary Economic Assessment (“PEA“) on the DB project. DB is truly world-class, with a pre-tax NPV(8%) of $171 million at an assumed long-term uranium price of $55/lb. That’s an IRR of 55%. Cap-ex is $31.7 million. At $60/lb., the NPV is $207 million and the IRR is 64%. I’m quoting pre-tax figures to better compare the DB project to others {see chart below}.

The base-case scenario in Azarga’s new PEA compares very favorably to the listed peers. DB is a project that could be in production in within 3 years. That’s sooner than almost any PEA-stage mining project anywhere in the world. The average uranium price & IRR among peers is $58/lb. & 31.8%. DB’s IRR is substantially higher, double in fact, 64% (@ $60/lb.).

The far right column in the chart is labeled NPV(8%) / cap-ex. This is a ratio of pre-tax Net Present Value (discounted at 8%) divided by initial cap-ex on the PEA-stage project. Initial cap-ex does not include longer-term sustaining capital items. By this metric, DB stands out once again. The higher the ratio, the more bang for a project’s cap-ex buck.

Not only does DB enjoy a far superior ratio of NPV/cap-ex, its absolute amount of initial cap-ex required at $31.7 million is lower than all but one peer. This is incredibly important in a market where obtaining project financing has been very difficult. Another noteworthy observation is that DB is in the U.S., a place I believe will be a better place to operate a mine than Argentina, Zambia or Niger.

Important catalysts to watch for….

1) Finalize DB EPA permits, 2) DB State permits – applications have been completed, recommended for approval by South Dakota DENR staff, 3) Off-take / project financing – revisit these discussions in the context of an improving uranium market, 4) Dewey Terrace (adjacent to DB, on Wyoming side of border) — continue analysis of historical data to identify additional uranium mineralization, 5) Gas Hills – hydrological studies show permeability & surface conditions suitable for ISR mining — evaluate ISR development options, review data for areas of additional uranium mineralization.

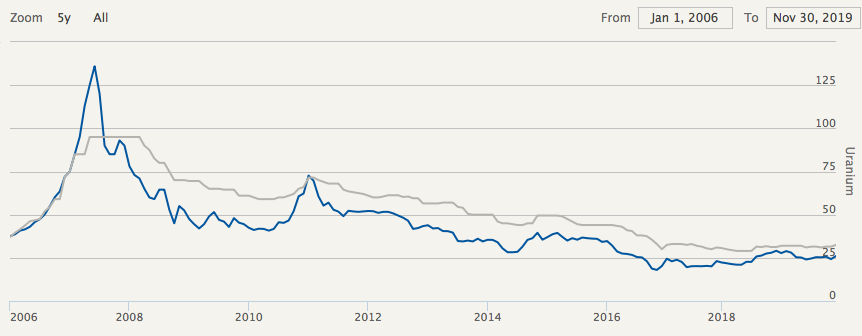

So far in this article I’ve pointed to a strong ISR project, as defined by a new, revised & updated PEA. Unlike many PEA-stage mining projects, this one could be in production in ~3 years. That’s very important because it seems fairly likely that the uranium price will be meaningfully higher by then. Importantly, the long-term contract price today, as reported by Cameco, is $32.5/lb.

We’re only $10/lb. away from a price where Azarga could comfortably sign a 5-yr. contract for a portion of nameplate capacity and enter production. But a price that well over 50% of peers would not, or could not, accept. Readers should consider that of the $31.7 million of capital that needs to be raised, $20-$25 million could probably be raised in debt. Of the remainder, some of that could potentially be satisfied with an upfront payment on an off-take agreement with a utility company or commodity trader.

In addition to off-take payments & debt funding, Azarga could sell a minority interest in the DB project to cover the remaining cap-ex requirements. In other words, the company probably could, if it wanted to, reach production with fairly minimal additional equity capital. However, management might feel the need to dilute shareholders if financing terms of debt and/or off-take agreements are not that attractive.

How much upside from satellite deposits?

Readers might have noticed that I’m very bullish on the Dewey Burdock project. But there’s more to it than immediately meets the eye. The PEA describes only a subset of what the overall operation could turn out to be. By that I mean that satellite deposits, if found to be amenable to ISR and of reasonable size, could either extend the mine life of the project or possibly increase annual production.

Make no mistake, there may never be a satellite deposit that fits the requirements of the DB project. Still, the potential upside is nice to have. Satellite deposits often represent low or even very low-cost additions to mine supply that can be quite profitable to exploit.

Although Dewey Burdock is the flagship project and the primary development focus, Azarga owns or controls nine other uranium projects & prospects in South Dakota, Wyoming, Utah & Colorado. Some of these properties have NI 43-101 delineated resources.

Adjusted for inflation, (not reflected in above chart) the contract uranium price peaked at about $118/lb. and averaged roughly $65/lb. for that period. Some pundits believe that $60+ will return by 2022 or 2023. If so, it would be perfect timing for the Dewey Burdock project.