Categories:

Energy

Topics:

General Energy

Diversification Is Key to Energy Value: Frank Holmes and Brian Hicks of U.S. Global Investors

Calling the energy space underowned and a great value, Frank Holmes and Brian Hicks of U.S. Global Investors view shale oil plays as integral to an energy renaissance. Still, to hedge their bets, the two experts recommend diversification across the entire natural resources sector, including agriculture and food. In this interview with The Energy Report, they list opportunities in upstream oil and gas production, refining stocks, master limited partnerships and potash.

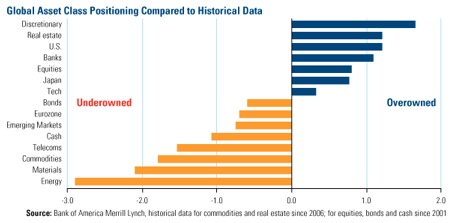

Calling the energy space underowned and a great value, Frank Holmes and Brian Hicks of U.S. Global Investors view shale oil plays as integral to an energy renaissance. Still, to hedge their bets, the two experts recommend diversification across the entire natural resources sector, including agriculture and food. In this interview with The Energy Report, they list opportunities in upstream oil and gas production, refining stocks, master limited partnerships and potash.The Energy Report: Frank, you wrote a contrarian manifesto of sorts at the beginning of May titled "A Case for Owning Commodities When No One Else Is." It showed that energy is the most underowned class by a long shot. That situation was last seen at the end of 2008, just before a major rally in natural resource stocks. Is history repeating itself?

Frank Holmes: To a certain degree, yes. The big difference is that America, thanks to the new introduction of fracking technology, is in a different position than the rest of the world. This is positive for America's trade deficits and its costs of manufacturing.

The population of the rest of the world continues to grow. China and India account for about 40% of the world's population growth. Both countries import energy. There is not enough water in China for it to benefit from fracking.

Brian Hicks: Water is a very large constraint in fracking, along with other geologic factors. Over the last several years, the game changer has been the development of shale plays here in the U.S. We now import less oil than China because of the amount of shale oil we have.

FH: The U.S. has had huge success in drilling and exploring for natural gas, followed by all this gas coming onstream. The inverse of that was when drilling rigs slowed down because gas prices were falling. The rig count went to an all-time low.

"Very few North American natural gas plays are economic at a price below $4/Mcf."

People do not realize that looking for energy is like being a gerbil on a wheel—you have to drill continuously to replace production. When drilling slowed down to a fraction of what it had been, gas prices went up. What are they now, Brian?

BH: They fell as low as $1/thousand cubic feet ($1/Mcf). Now we are in the $4/Mcf range. We had a clear overshoot to the downside. Now we are back to a more normal level.

We are in the shoulder months for natural gas. If we see a warm summer, the gas price could easily approach $5/Mcf. Right now, people are in a wait-and-see mode.

The natural gas market looks constructive. There is more commercial usage. The rig count is down. If we start to see more demand on the horizon, natural gas prices could go back to $5/Mcf pretty quickly.

TER: Do you agree with the Porter Stansberrys of the world, who say the U.S. will be a gas exporter within the next few years, or do you lean toward the Bill Powers' school of thought, that wells will be decimated a lot faster than anticipated and there is no supply glut?

BH: I do not think we have a supply glut. We have had a severe oversupply for the last few years, but that has started to change. The change is reflected in rebounding equity prices and a more normal price range for natural gas. In terms of government policy, natural gas is considered a winner, with coal losing market share.

"We have seen a pretty good lift in upstream oil and gas producers here in the U.S."

Very few North American plays are economic at a price below $4/Mcf. To incentivize more capital investment in natural gas drilling and build a stronger rig count, we need to see prices sustained above $4, closer to $4.50–5. If gas falls below $4/Mcf and stays in that range, the rig count will continue to erode and supply will diminish.

This year's somewhat longer winter shored up the overall inventory picture, which is more or less back to normal. If we have typical summer weather, we could enter the heating season with inventories slightly below average.

The new wells being drilled—the shale natural gas plays—come on at very high rates and decline very quickly. For some plays, questions remain as to where their flow rates will bottom out. Despite the strong supply response of this new technology, there are still question marks as to what the normalized rates will be.

TER: Almost 19% of your Global Resources Fund is in energy stocks: 9.98% in oil and gas and 8.8% in energy infrastructure. Which is the biggest growth area: exploration, production, transportation or services?

BH: We have seen a pretty good lift in upstream oil and gas producers here in the U.S. Internationally, a number of stocks are trading at compelling valuations that could go higher. On the service side, we have seen a good bounce year-to-date.

"The expansion of the U.S. crude oil supply has prompted a massive need for pipeline infrastructure."

Refining stocks is an area we see as an inverse derivative play of new production in shale oil plays. The refiners are the beneficiaries of all of the crude coming on-line. They can source cheaper feedstock and produce refined diesel product at lower costs than their global peers. The U.S. is exporting large quantities of refined product. The margins of refining companies have expanded, and they are generating a lot of free cash, paying dividends and buying back stock. Thematically, we have enjoyed the refining space at the larger cap level because of that competitive advantage.

We also see that competitive advantage reflected in chemicals, another source of strength. Even more broadly, this energy renaissance is helping lower manufacturing costs. It has benefited the overall U.S. economy.

More upside potential remains in services. If the North American rig count expands, I think pressure pumping and drilling stocks will improve. We have invested for a number of years in an offshore theme: infrastructure, supply, manufacturing. A lot of capital is being spent in the offshore space off Brazil and in the Gulf of Mexico. That is another area that looks compelling.

TER: What are some examples of stocks in your portfolio that have done well in each of those areas?

BH: Starting in the refining space, HollyFrontier Corp. (HFC:NYSE) had a very good 2012, as didMarathon Petroleum Corp. (MPC:NYSE). Both benefited from strong midcontinent refining margins.

In upstream oil and gas production, we own Pioneer Natural Resources Co. (PXD:NYSE), which has a lot of opportunities in the Permian Basin. It expanded its overall resource by doing some lateral drilling, and is seeing big success there.

In the services area, I mentioned the offshore theme. Hornbeck Offshore Services (HOS:NYSE) has started to gain traction with increased drilling activity in the Gulf of Mexico. It is an offshore supply boat company. You are starting to see significant earnings power generated in the Gulf of Mexico because of increased day rates and more activity after the Macondo oil spill.

TER: You have four master limited partnerships (MLPs) in your fund. What role do they play in balancing your risk exposure?

BH: Our energy infrastructure allocation comprises mostly MLPs. You might think of higher dividend-paying, higher-yielding stocks as lower growth, but that is not the case with these MLPs.

The expansion of the U.S. crude oil supply has prompted a massive need for pipeline infrastructure. In the South Texas Eagle Ford shale play, we see tangible signs of pipeline takeaway infrastructure. We like investments that pay us a dividend every quarter—some between 5–7%—and that are growing at double-digit rates because of the build out taking place in MLPs. We think that could continue for some time.

With MLPs, you get the added benefit of a strong inflation-adjusted yield that will increase along with prices for the underlying commodity, and at a faster rate than consumer price index inflation.

TER: What are some of the best performers in the MLP space?

BH: Kinder Morgan Energy Partners L.P. (KMP:NYSE) has been a strong performer for us. We have owned Plains All American Pipeline L.P. (PAA:NYSE), but sold that after a big move.

Enterprise Products Partners L.P. (EPD:NYSE) is a major name in the space. Williams Partners L.P. (WPZ:NYSE) has done well for us also.

TER: You also invest in fertilizer, in the form of potash. Why are you bullish on agriculture? What is the best way to invest in that space?

BH: We are very bullish on agriculture and food from a long-term, thematic standpoint.

The overall theme is rising income levels in emerging markets, which increases demand for protein, whether from cattle or chicken. More protein requires more feed, so you can see demand for corn strengthening. Global population growth and per-capita income growth are also driving the demand for more food.

We have chosen to play that in two ways with companies that package and produce food and protein, such as Tyson Foods Inc. (TSN:NYSE) and Smithfield Foods Inc. (SFD:NYSE).

You also have the fertilizer stocks such as PotashCorp. (POT:TSX; POT:NYSE); CF Industries Holdings Inc. (CF:NYSE), which produces nitrogen, also used in fertilizer; and The Mosaic Co. (MOS:NYSE). Those stocks have done very well over the years, and should continue to do well given the macro theme.

TER: Is that your advice for contrarians looking to profit in the energy sector—diversification?

BH: This is an unprecedented time with respect to macro policy, considering the economic conditions in Europe, the expansion of the money supply in the developing world and central banks increasing their balance sheets. There are lots of crosscurrents. We have chosen to negotiate those crosscurrents by being diversified. Our resources fund is balanced across the spectrum of natural resources.

Within the energy sector, we have an allocation in all segments of the energy value train: refining, MLPs, upstream oil and gas production, domestic and international stocks. Having our hand in all of these areas helps us navigate volatility and capitalize on mispriced stocks wherever we find them.

We try not to make large, concentrated bets in any one particular area. This strategy makes sense whether you are an institutional investor or an individual investor. We look for sustainable, long-term themes—companies that can generate cash flow in bullish commodity environments or in a commodity environment that is not quite so bullish. In other words, we look for lower-cost producers with solid management teams.

TER: Frank and Brian, thank you for your time and your insights.

FH: Thank you.

BH: It's been a pleasure.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors Inc., which manages a diversified family of mutual funds and hedge funds specializing in natural resources, emerging markets and infrastructure. The company's funds have earned many awards and honors during Holmes' tenure, including more than two dozen Lipper Fund Awards and certificates. He is also an adviser to the International Crisis Group, which works to resolve global conflict, and the William J. Clinton Foundation on sustainable development in nations with resource-based economies. Holmes co-authored "The Goldwatcher: Demystifying Gold Investing" (2008). Holmes is a former president and chairman of the Toronto Society of the Investment Dealers Association, and served on the Toronto Stock Exchange's Listing Committee. A regular contributor to investor-education websites and a much-sought-after keynote speaker at national and international investment conferences, he is also a regular commentator on the financial television networks and has been profiled by Fortune, Barron's, The Financial Timesand other publications.

Brian Hicks joined U.S. Global Investors Inc. in 2004 as a co-manager of the company's Global Resources Fund (PSPFX). He is responsible for portfolio allocation, stock selection and research coverage for the energy and basic materials sectors. Prior to joining U.S. Global Investors, Hicks was an associate oil and gas analyst for A.G. Edwards Inc. He also worked previously as an institutional equity/options trader and liaison to the foreign equity desk at Charles Schwab & Co., and at Invesco Funds Group Inc. as an industry research and product development analyst. Hicks holds a master's degree in finance and a bachelor's degree in business administration from the University of Colorado.

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Interviews page.

DISCLOSURE:

1) JT Long conducted this interview for The Energy Report and provides services to The Energy Reportas an employee. She or her family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: None. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Brian Hicks: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Frank Holmes: I or my family own shares of the following companies mentioned in this interview: None. I personally am or my family is paid by the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

5) The following securities mentioned were held by the Global Resources Fund as of 3/31/13: HollyFrontier Corp., Marathon Petroleum Corp., Pioneer Natural Resources Co., Hornbeck Offshore Services Inc. Kinder Morgan Energy Partners LP, Enterprise Products Partners LP, Williams Partners LP, Tyson Foods Inc., Smithfield Foods Inc., Potash Corp. of Saskatchewan Inc. (PotashCorp.), CF Industries Holdings Inc. and The Mosaic Co.

6) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

7) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

8) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.