Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Gold price builds momentum as hedge funds add 36% to bullish bets

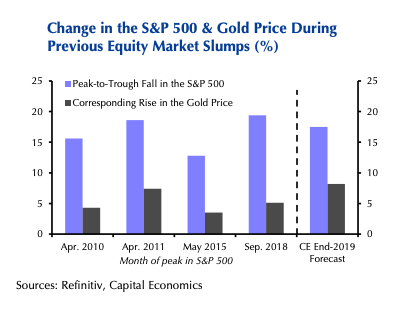

Gold built on last week's gains on Monday rising more than 1% in heavy volume as investors seek a safe haven amid a widening trade war unleashed by US President Donald Trump.

Gold for delivery in August, the most active futures contract, reached a high of $1,325.30 an ounce, the highest 10 weeks with over 26m ounces changing hands in New York by midday.

Trump's plan to impose a 5% tariff on all Mexican goods, Chinese adding tariffs on $60 billion worth of US goods over the weekend coupled with Beijing's threat to blacklist foreign companies in retaliation to punitive US levies are rattling markets and hurting the dollar.

Gold is seen as a store of value in turbulent times and the price of the metal usually moves in the opposite direction of the US currency. Gold is also finding investors' favour as bond yields in the US fall and a rate cut in the world's largest economy moves from possibility to probability.

Holdings in the world's largest physically-backed gold exchange traded fund – SPDR Gold Shares or GLD – rose to 743.2 tonnes or 23.9m ounces valued at just under $31.5 billion last week. Holdings across the dozens of listed gold ETFs rose to 70.6m ounces.

At the same time the Commitment of Traders report for the week ending 28 May saw large-scale speculators like hedge funds increase their net long positions in gold by 36% to over 100 tonnes. That's still well below February's bullish positioning north of 300 tonnes however.