COPPER, GOLD, SILVER IN PERU

TSX-V: HAN | OTC: HANNF

Advancing Multiple District-Scale Copper-Gold-Silver Assets in Mineral-Rich Peru

Canada-based Hannan Metals Ltd. (TSX-V: HAN)(OTC: HANNF) is a Peruvian-focused mineral exploration firm focused on the advancement of two basin-scale copper-gold-silver projects in Peru’s mineral-rich, yet vastly underexplored central eastern mining belt.

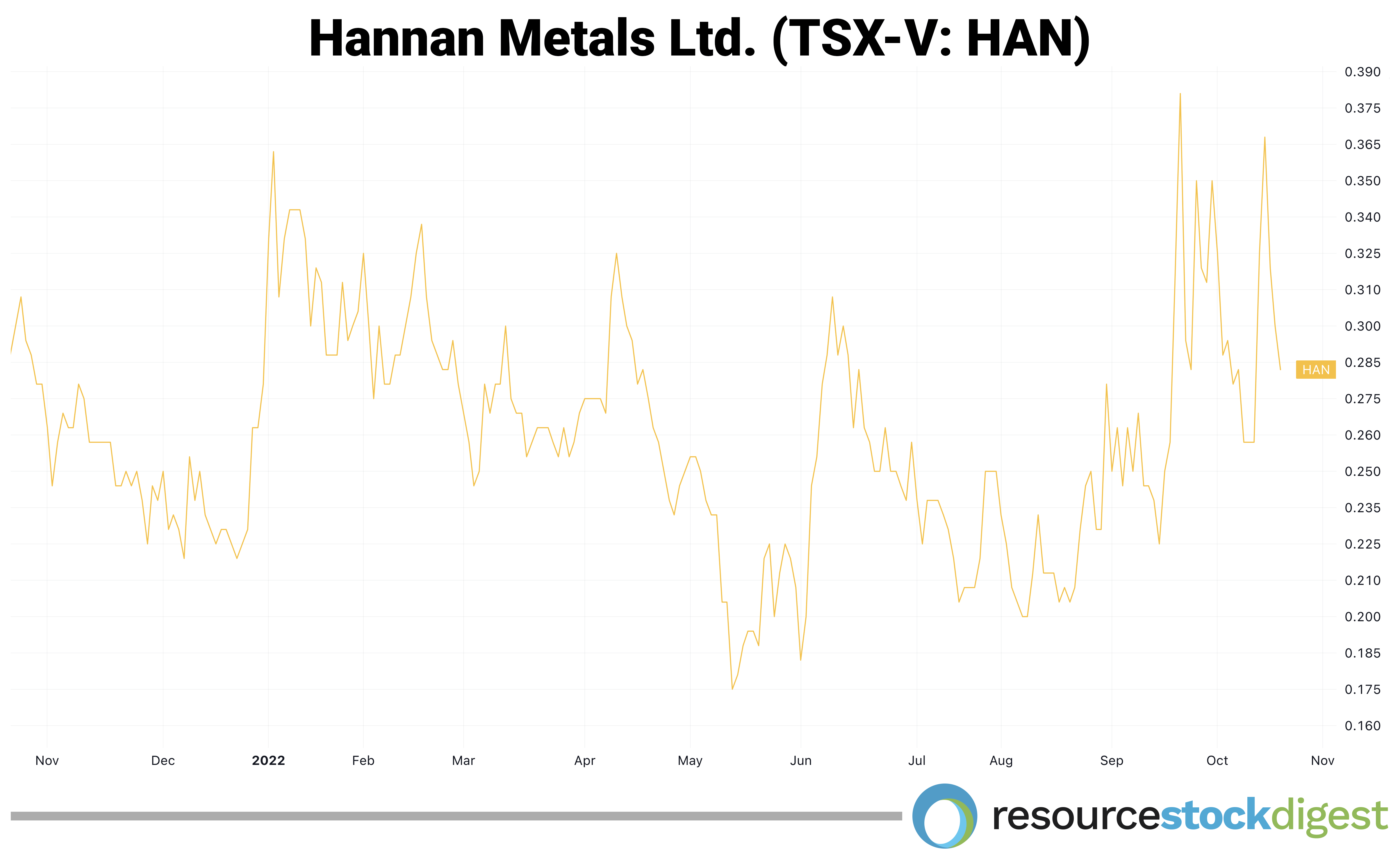

Trading undiscovered below C$0.35 per share — at a minuscule market cap of just ~C$30 million — Hannan Metals has established a Top-Ten in-country tenure position in Peru at a staggering 2,100 sq km (~800 sq mi).

That’s about two-thirds the size of the state of Rhode Island!

While still early-stage, Hannan’s first-mover advantage in this emerging mineral belt is already beginning to attract industry-wide attention — and strategic investment — from some of the global mining sector’s biggest players.

Teck Resources (NASDAQ: TECK) — has come in with a C$2.6 million strategic investment in Hannan. Clearly, Canada’s largest mining firm wants to be an integral part of Hannan’s immense potential upside in the region.

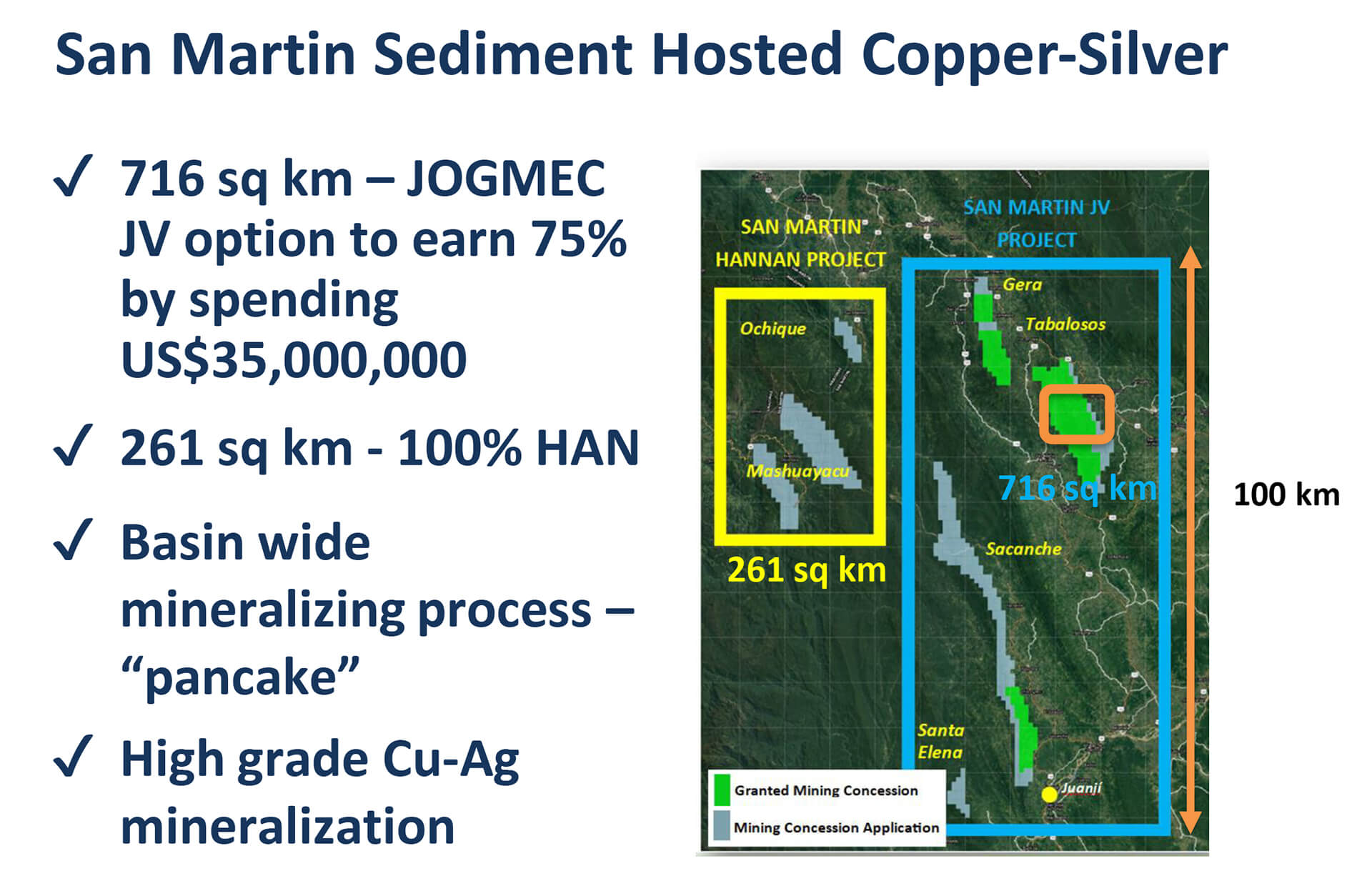

And hailing from the complete opposite side of the globe, Japan’s main mining arm — JOGMEC (Japan Oil, Gas and Metals National Corporation) — has entered into a US$35 million strategic joint venture with Hannan on its San Martin Copper-Silver Project.

Make no mistake about it… something BIG is brewing in this fast-emerging South American precious and base metals district with tiny, undiscovered Hannan Metals squarely at the helm.

With the massive scale involved — and with the key green-energy metals commodity-mix (copper, gold, silver) in-play — there’s no doubt that the broader mining industry will soon have their eyes fixated on Hannan as the junior begins putting the first drill holes in the ground.

And therein lies the immense ground-floor, pre-drilling opportunity at-hand for investors seeking exposure to what could soon prove to be the next district-scale copper-gold-silver area play to emerge in the Americas.

Here’s a quick introduction of the two co-flagships:

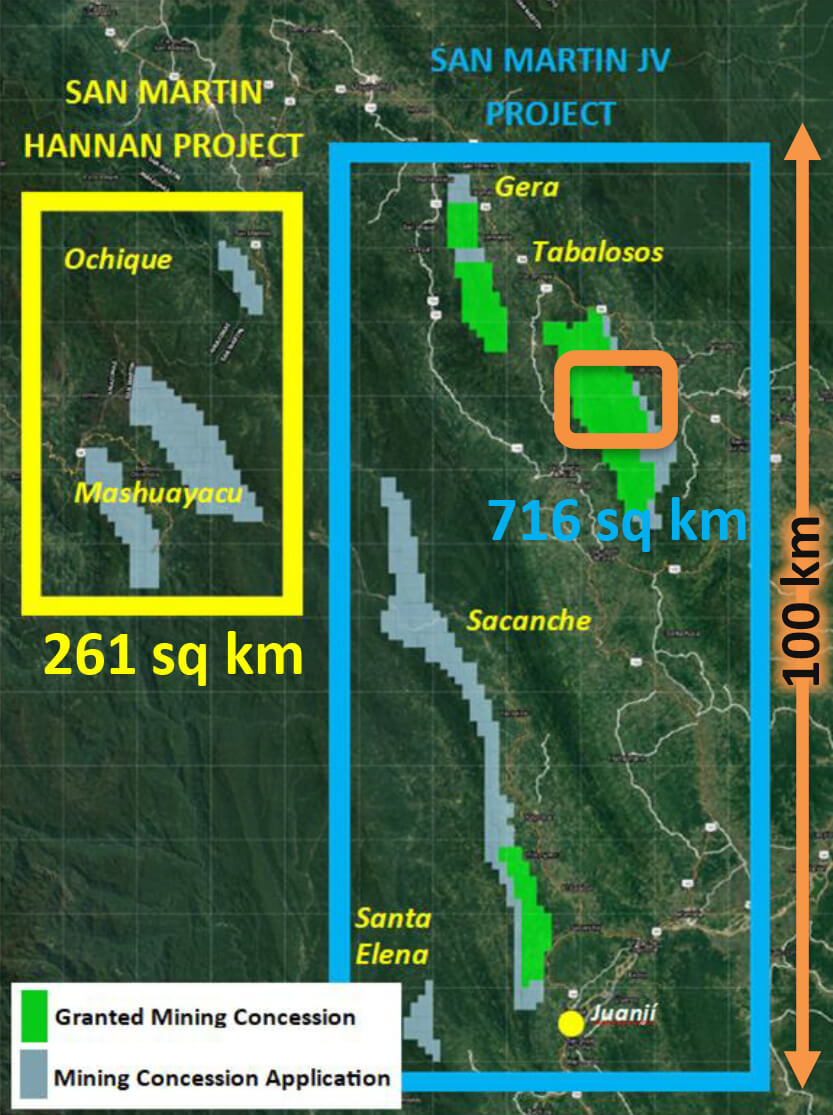

San Martin Copper-Silver Project (JV with JOGMEC) represents mining concessions covering 120 km of combined strike, encompassing a newly-identified basin-scale, high-grade copper-silver sediment-hosted system situated along the foreland region of the eastern Andes Mountains.

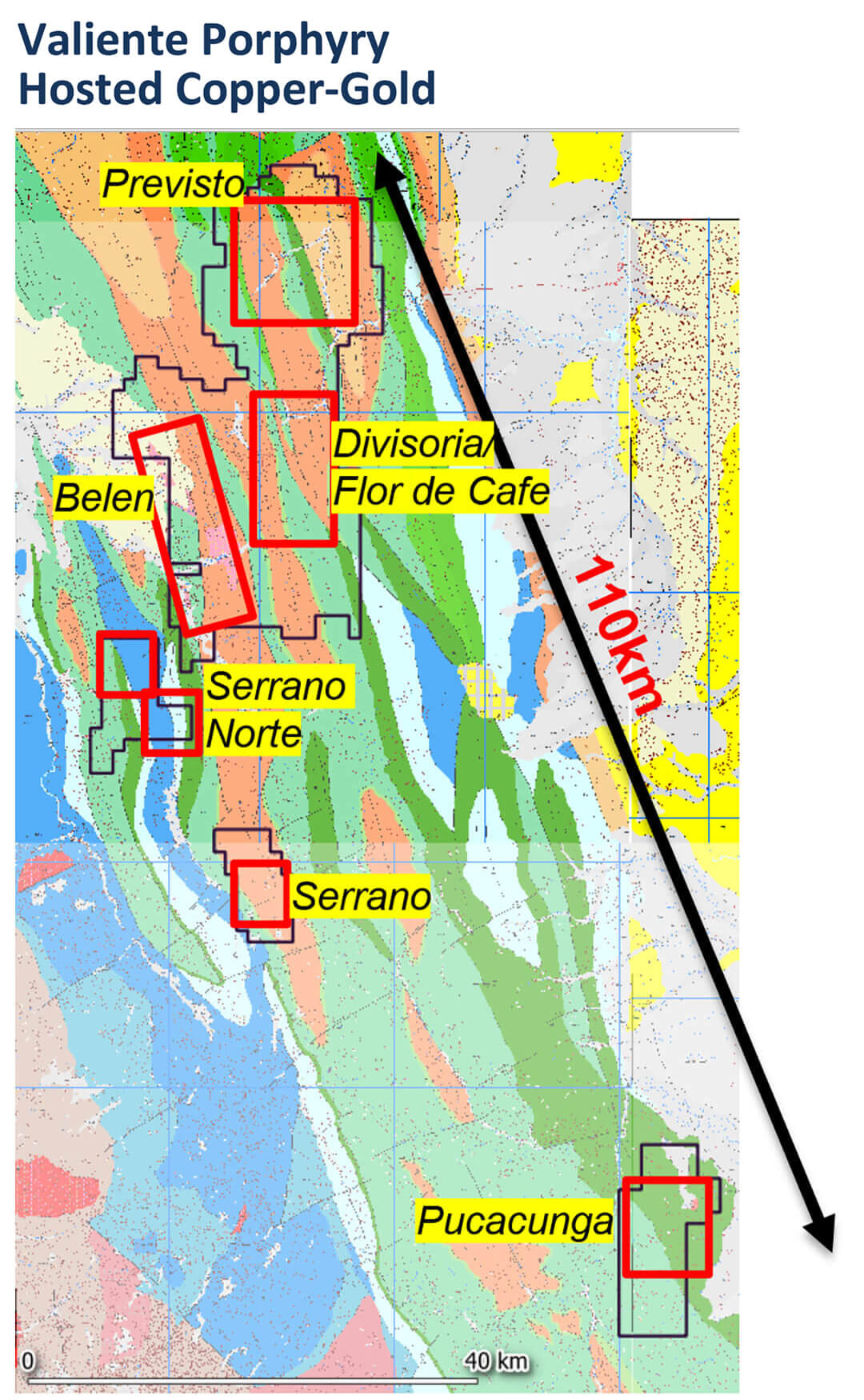

Valiente Copper-Gold Project (100%-owned) represents mining concessions defining a previously unknown porphyry and epithermal mineralized belt within a 140 km by 50 km area — situated 250 km south of the San Martin property — characterized by the identification of 7 intrusion-related porphyry/skarn targets.

In the mineral exploration world, it’s simply not possible to establish that level of land tenure while simultaneously attracting some of the biggest names in mining — BEFORE a single drill hole is put into the ground — without having the right people at the controls.

And Hannan Metals has that in spades with an incredibly experienced and serially successful mining team led by professional geologist and Australia-native Mr. Michael Hudson whom you’ll be hearing from first-hand in our exclusive interview coming right up.

Hannan Metals Ltd.

Michael is highly-respected in the industry, and his successes over the last 30 years are a big part of why Hannan has been able to put together such a massive strategic land package while bringing in the likes of Teck and JOGMEC at this early stage of development.

“Teck's investment in Hannan is a demonstrable vote of confidence in the technical merits of the Company’s projects as well as our team. Over the last two years, Hannan has recognized the significant potential for large copper-gold-silver deposits in Peru and has aggressively staked a large and commanding Top-Ten tenure position in-country.

This bold grassroots strategy has attracted some of the largest industry participants to partner with Hannan, with both Teck and JOGMEC now involved at equity and joint venture levels, respectively. With Teck's involvement, we now look forward to accelerating our exploration efforts at the Valiente project, which is located approximately 20 km east from the township of Tingo Maria in central Peru.

Valiente forms a previously unknown Miocene-age mineralized belt within a 140 km by 50 km area, where Hannan's exploration team of six geologists and support team has identified at least seven intrusion related porphyry/epithermal/skarn targets.”

With its dominant 2,100 sq km land position in the foreland region, Hannan Metals offers a true first-mover advantage in a vastly underexplored mineral belt with robust potential for hosting multiple district-scale copper-gold-silver deposits.

Let’s take a closer look at Hannan’s two primary flagship projects.

San Martin Copper-Silver Project

The 656 sq km San Martin project is being advanced by way of a strategic joint venture agreement with Japan’s national mining arm — JOGMEC — Japan Oil, Gas and Metals National Corp.

JOGMEC has the option to earn up to a 75% interest in the project by spending up to US$35 million leading to the production of a Feasibility Study.

San Martin comprises a brand-new basin-scale, high-grade sediment-hosted copper-silver system — spanning an almost unheard of 120 km of combined strike — situated along the foreland region of the eastern Andes Mountains.

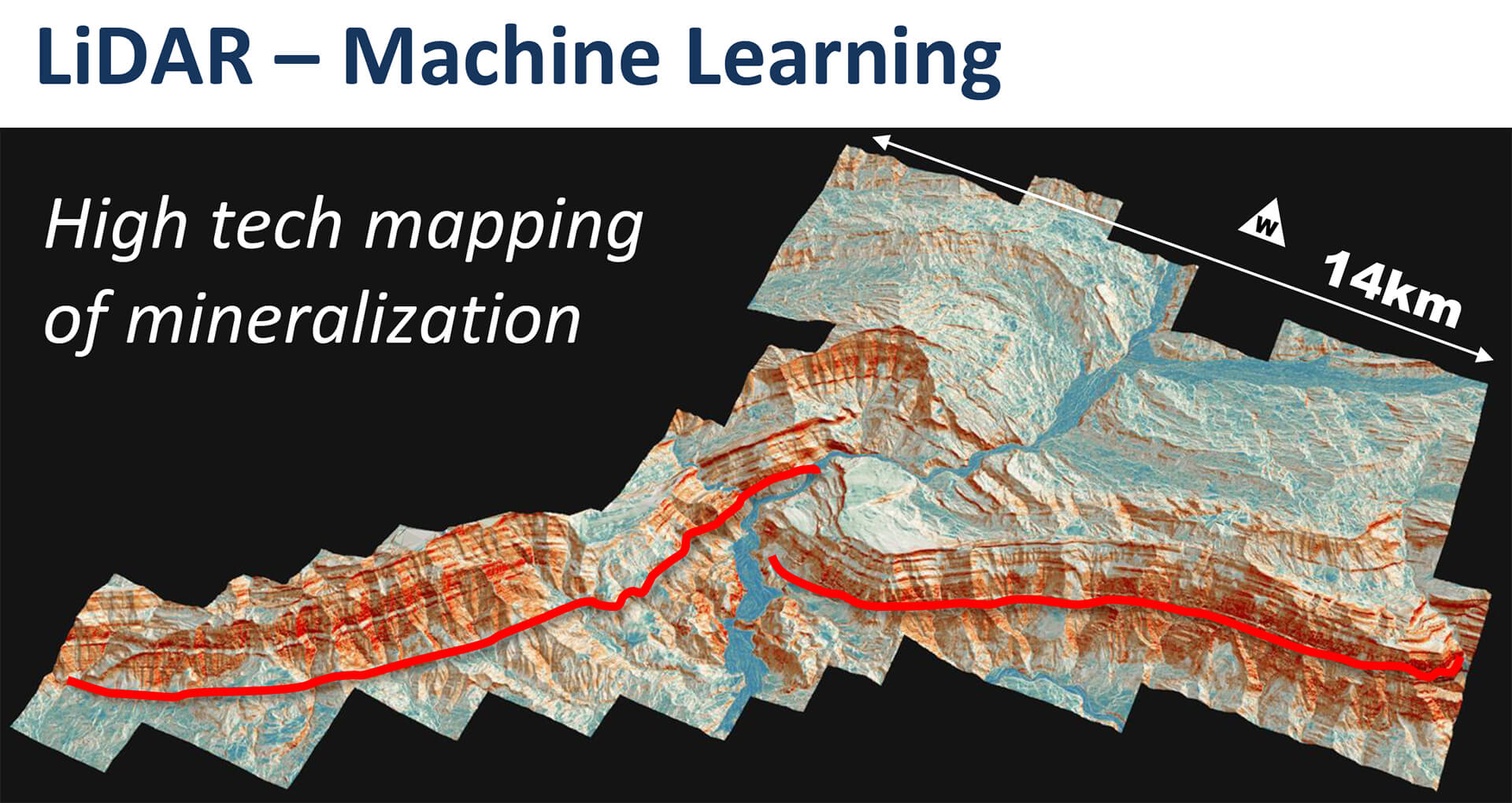

Hannan's detailed geological facies analysis across the project — which includes LiDAR and advanced machine learning — has identified the economic geological implications for high-grade stratabound sediment-hosted copper mineralization that may have significant lateral continuity.

A phase-one drill program is planned for San Martin pending approval of the company’s Environmental Impact Statement (or “DIA” in Peru), which was submitted in Q2 2022.

The proposed program is slated for 3,500 meters of drilling at the Tabalosos East target to test for continuity of the surface mineralization mapped and sampled over a 9 km strike length.

Hannan CEO Michael Hudson commented via press release,

“Comprehensive channel sampling provides further excitement, with average widths and grades continuing to show context with drill numbers found during the discovery of the vast Kupferschiefer copper-silver deposits. We have also extended mineralization via channel sampling a further 3 kilometers south into the Renaco area with some of the highest grades we have seen on the project to date including channeling 0.4 meters @ 10.8% copper and 124 grams per tonne (g/t) silver. With social and geophysical programs planned for February, we highly anticipate moving toward our maiden drill program in this expanding mineral system around the middle of the year.”

Upon approval, the DIA will allow for a total of 40 drill platforms covering an area approximately 9 km long by 3 km wide (2,700 hectares) at Tabalosos East.

Drilling tenders are being sought now with final DIA and other approvals anticipated in early-2023, signaling the green-light for drilling operations to commence.

Valiente Copper-Gold Project:

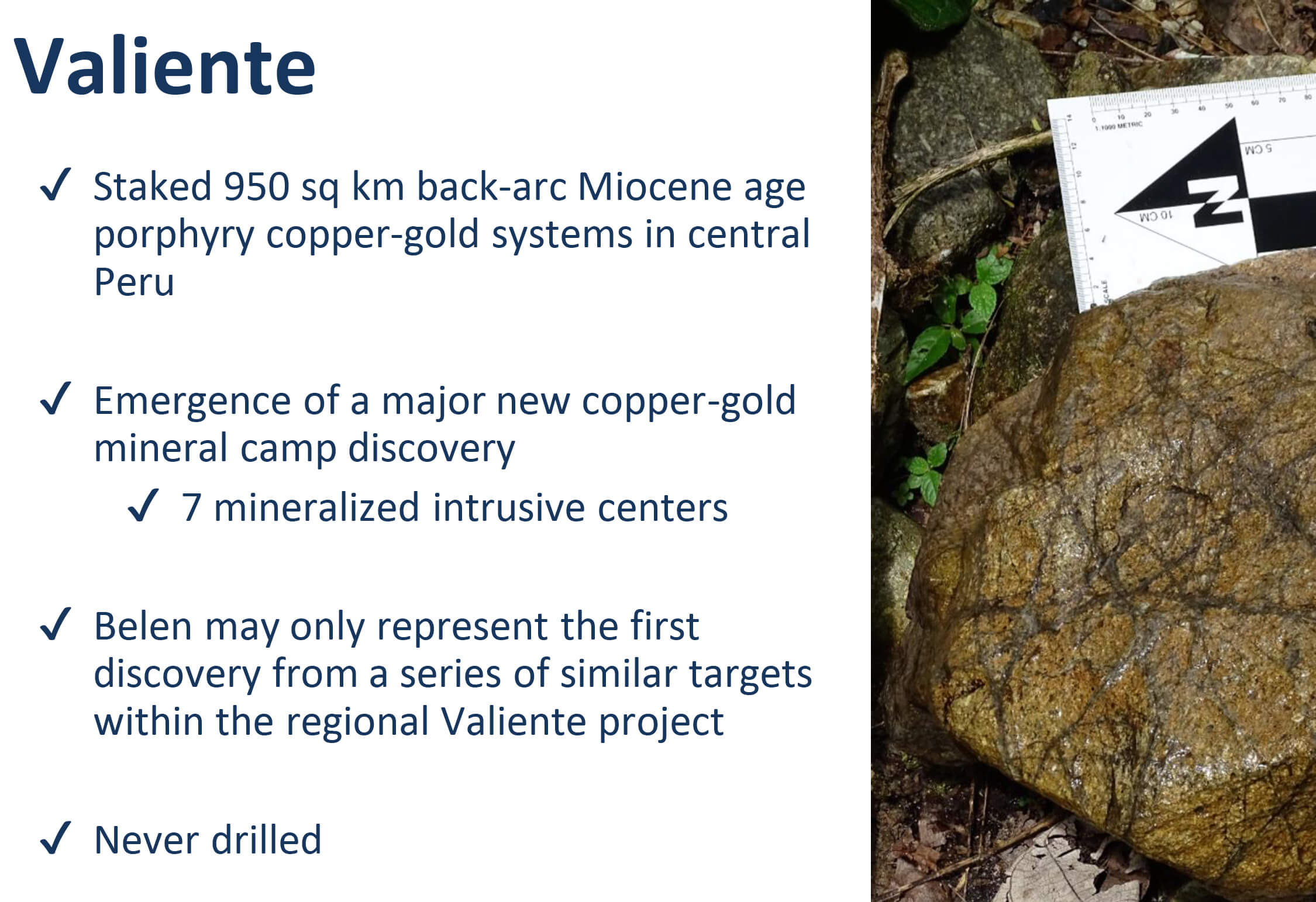

Hannan’s 100%-owned Valiente project — located 19 km east of the township of Tingo Maria in central Peru — defines a previously unknown Miocene-age porphyry-epithermal copper-gold mineralized belt within a massive 140 km by 50 km area.

Situated 250 km south of the company’s San Martin property, the project area spans 1,164 sq km (116,400 hectares) and is prospective for back-arc porphyry copper-gold systems.

Hannan’s first-mover advantage in this Miocene-age district is characterized by an extensive 140 km of combined strike with intense veining and alteration of float and outcrop associated with intrusive clusters.

Those highly-favorable geologic features are coincident with large-scale geochemical stream sediment anomalies that provide a compelling set of exploration criteria for Hannan.

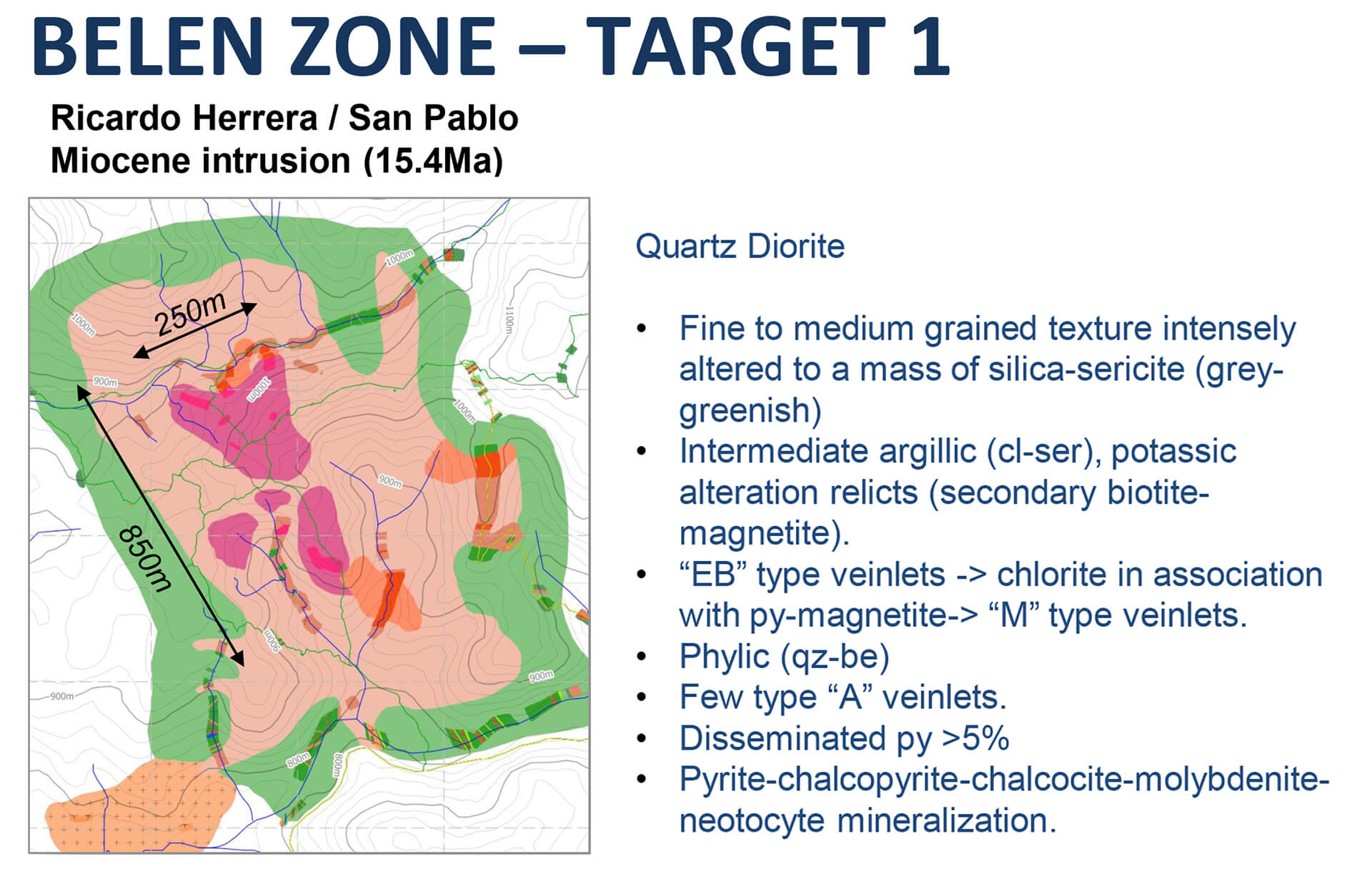

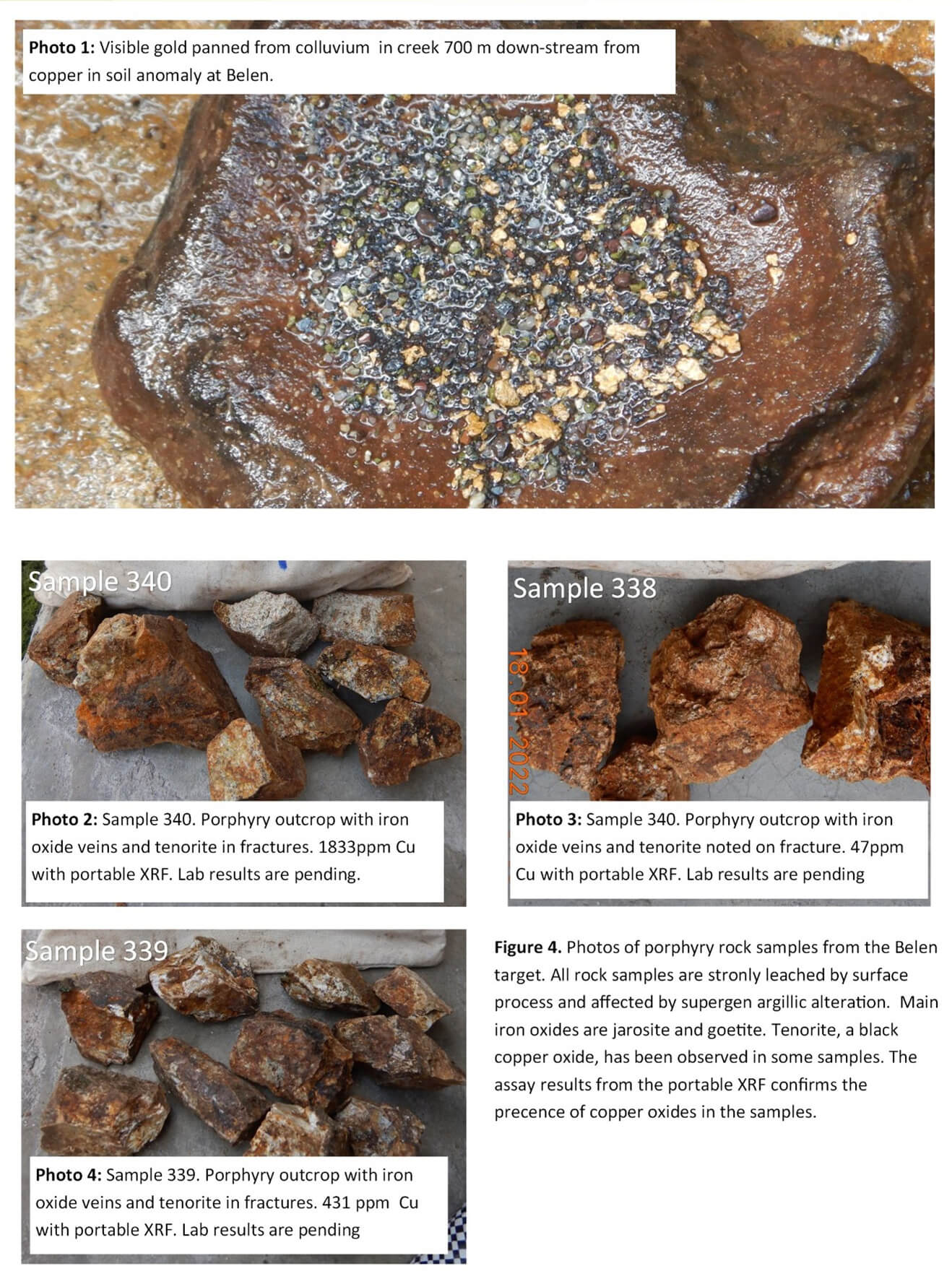

Already, the Hannan team, which includes six geologists and a full support crew onsite, has identified at least seven intrusion-related porphyry/epithermal/skarn targets of which the Belen target is the most advanced.

Hannan CEO Michael Hudson commented via press release,

Hannan CEO Michael Hudson commented via press release,

“At Valiente, we see the emergence of a major new copper-gold mineral camp discovery. After five months, our team has managed to define an array of impressive geological copper-gold targets in an area with little to no prior historic mineral exploration.

Hannan's landholding at Valiente secures the Miocene-age porphyry-epithermal copper-gold mineralized belt with more than 1,000 sq km under 100%-owned tenure, so what we see at Belen may only represent the first discovery from a series of similar targets within the regional Valiente project.

With the wet season now behind us, we look forward to more detailed field work in the coming months, including detailed grid sampling and hand trenching at Belen and the extension of our field programs into surrounding areas.”

That field work is well underway at three primary Belen targets: Ricardo Herrera, Vista Alegre, and Sortilegio:

- Ricardo Herrera: a newly-identified leached copper-gold porphyry with well-developed quartz veining.

- Vista Alegre: a 1.8-km-long gold-bearing epithermal target area characterized by large gold mineralized boulders of quartz-pyrite and iron oxides.

- Sortilegio: an emerging copper-gold porphyry target located 7 km northwest of Ricardo Herrera.

With 1,600-plus samples taken to-date, the program has identified four linked mineral systems, including the first bona fide bedrock find at the Valiente project.

The systems are characterized by outcropping leached copper-gold porphyry with well-developed alteration and quartz veining — each with significant size and tenor within a 8 km by 2 km trend.

To get an overall sense of the sheer scale involved and the nearly unlimited number of high-priority targets at-hand, the Belen Zone represents just 4% of Hannan’s total landholdings at Valiente.

A 4,880 line km aeromagnetic survey has also been completed across the entire ~1,000 sq km Valiente property to zero-in on porphyry targets for follow-up exploration and drilling. Results from that survey are due in Q4 2022.

Additionally, a gold-bearing epithermal target area identified by large gold-mineralized boulders of quartz-pyrite and iron oxides — as well as gold anomalous soil samples — has been discovered 2.5 km northwest of the Southern Porphyry target.

Another newly-discovered porphyry/skarn target at Valiente is Previsto Norte where numerous copper-bearing boulders with varying stages of porphyry intrusions have been observed.

The boulders show strong hydrothermal alteration and B-style quartz-sulphide veining relating to porphyry mineralization.

Values up to 25.6% copper and 28 g/t silver have been assayed.

Gold anomalous boulders are also present with 0.9 g/t gold and 0.12% copper assayed from a strongly leached hydrothermal breccia with porphyritic clasts.

Taken altogether, Hannan Metals is making discoveries at San Martin and Valiente that, individually, should command a higher market cap than what the market is currently assigning to Hannan’s entire basin full of copper, gold, and silver showings.

As noted, Hannan’s market cap currently sits at just ~C$30 million.

It’s early-stage exploration… it’s pre-drilling… and that’s typically the time where foresighted speculators who understand the exploration cycle jump in to take advantage of the relatively quiet moments BEFORE the start of drilling.

Here to paint a clear picture of the milestones achieved to-date and the upward momentum that’s now building toward drilling is none other than Hannan Metals CEO Mr. Michael Hudson.

Exclusive Interview with Hannan Metals CEO Michael Hudson

Our own Gerardo Del Real of Resource Stock Digest caught up with Hannan Metals CEO Michael Hudson at the 2022 Precious Metals Summit in picturesque Beaver Creek Colorado, which took place in mid-September.

The gentlemen sat down for an in-depth discussion on Hannan’s first-mover advantage in Peru’s foreland basins along with next-steps in the advancement of the two flagship properties prior to the start of drilling.

We hope you’ll enjoy the conversation.

Gerardo Del Real: This is Gerardo Del Real with Resource Stock Digest live from the 2022 Beaver Creek Precious Metals Summit. Joining me today is the CEO of what I think is going to be the top-performing stock in 2023 — that's Hannan Metals. This is Mr. Michael Hudson. Mike, it's great to see you in person. How are you?

Michael Hudson: Gerardo, who would've thunk… we're back together!

Gerardo Del Real: It's great to be back out here in person! First and foremost, how is the sentiment out here for you?

Michael Hudson: Well, I think there's a huge amount of enthusiasm in whatever we do in life when we get together as people face-to-face. So without a doubt, it's the biggest conference here that I've been to. I've been here pretty much at every one of these.

I think I’ve missed one over the last 10 years it's been going now. But correct me if I'm wrong… biggest crowd and a lot of enthusiasm. Markets can do a bit better, but despite the markets, there's a lot of enthusiasm.

Gerardo Del Real: So no pressure… I keep telling everybody that I think Hannan Metals in 2023 will do what Patriot Battery Metals has done in 2022. Mind you, I think Patriot, which we were both early investors in, has a lot of runway still left. So I say no pressure… but there's a little pressure there. You want to tell the people why I'm enthusiastic about Hannan in 2023?

Michael Hudson: Well, to be successful in this business, you need to do a couple of things. You've got to have a very good shareholder or capital structure and a tight one so it will allow you to succeed. That's what Patriot did so well, and that's what Hannan still is. It's got a very steady group of shareholders.

We haven't raised a lot of capital. It's been three years literally since we've raised a lot of capital. We put a million bucks in between then so it's got a good solid shareholder base, a known shareholder base. So that's number one.

Then, look for elephants! We can muck around looking for smaller deposits and, of course, everyone wants to find a big one. The recipe to finding a big one is to go where they are — number one.

So Quebec and lithium has, obviously, turned out to be that and has been that… and for us, porphyry coppers in Peru, where we are, and a new style of mineralization in Peru — sediment-hosted copper — which forms world-class deposits. We’ve found copper mineralization over a hundred kilometers in that style; the sediment-hosted copper.

Gerardo Del Real: Over a hundred kilometers!

Michael Hudson: We have! Clearly, if it works, it's going to be big. That's one style; sediment-hosted copper. And then, we’ve got the porphyry copper-gold targets that we're just really starting to work up, which gives me a lot of joy, actually. Geology and exploration turns my crank! Both styles are highly-impressive, and the porphyries are becoming more and more impressive as we're learning more.

Gerardo Del Real: You mentioned elephants and elephant country. And scale is clearly critical if you're going to make the kind of discovery that is a career-maker or a company-maker… or maybe, in the case of Hannan, many company-makers! Can we talk about the landholdings and how you became a Top-Ten land tenured holder in Peru?

Michael Hudson: Taking a big swing… we identified the opportunity early. We're on the other side of the Andes. It hasn't been looked at a lot over the years. I was there 25 years ago, and I had military escorts and it was a big drug growing area in the world there. It's cleaned up now. That's changed.

A lot more infrastructure has gone in. A lot of people have moved in there so it's more accessible; it's safer. We're really first-movers to a great extent in that area over on the other side of the Andes.

Geologists call it the foreland basins, which hold the sediment-hosted copper. Then, if you're talking about the tectonic setting, it's the back-arc — and that's where the porphyries are forming.

The porphyries are not necessarily meant to be out there, a bit like Bajo de la Alumbrera that was found where it wasn't thought to be; one of the greatest porphyries in South America. It's something to do with these big cross-arc structures. That's what we're working through now.

So yeah, we took a big swing! If you're going to find something big, you want to have a big ground position. So here's little minnow Hannan up with BHP and Rio Tinto and all the majors as a Top-Ten ground holder.

Gerardo Del Real: How many square kilometers are you up to now? It was 2,400 or 2,800 last time I checked.

Michael Hudson: Yeah, it's a little less but we're still Top-Ten. It's at 2,100 square kilometers. It's a big patch of dirt, and we’ve worked out how to explore it pretty efficiently too, getting around. We've been able to stream sediment sample the whole basin. The porphyry targets are over 120 kilometers, and we've got seven porphyries so far.

Our first-mover into the area did the stream sediments and had the large magnetic surveys from the petroleum companies that had just become freely available. So that gave us an ability to stake broadly and widely there.

And then, up a little further north, in a joint venture with the Japanese government [JOGMEC] who are fully funding, I should say, the sediment-hosted work that was easily identifiable because you just walked up the creek and found the copper-green-boulders as you walked up the creeks. That's how we staked that area first up.

Gerardo Del Real: That joint venture with JOGMEC, I believe it's US$35 million, and that's just for a little over a third of your current landholdings. Is that accurate?

Michael Hudson: That's accurate.

Gerardo Del Real: Where's your market cap today?

Michael Hudson: At ~C$25 million.

Gerardo Del Real: So let me get this straight. You have a joint venture worth US$35 million… you have a ~C$25 million market cap… and you still have two-thirds of your landholdings, close to two-thirds, that's 100% controlled by Hannan?!

Michael Hudson: Exactly! And a brand new Miocene, which is very important. The age of the porphyries is Miocene, which equates to the biggest porphyries we see up in the Andes themselves; over 120 kilometers, seven of them sticking out of the ground.

We're just going through and running a big magnetic survey now — half a million dollar survey — to really narrow down that area and pinpoint those porphyries. It's very exciting!

Gerardo Del Real: We mentioned the joint venture with JOGMEC. I know that your phone has been ringing because of the amazing exploration work that you've done thus far and because I think companies want to get positioned for what should be a phenomenal run in 2023.

It's one thing if I say it. It's very different when JOGMEC comes in and puts a stamp and says we want to be a part of that. The phone's been ringing from the majors wanting to come in and shake hands with Mr. Hudson?

Michael Hudson: I spent 10 years in a major, and if a major isn't looking at what's going on around in the junior space, they're not doing their job. We're looking for major-scale targets. As a consequence, of course, there’s a lot of interest in what we're doing because it's a bit different and we're finding a lot of copper that hasn't been found before. So they're doing their job, yes.

Gerardo Del Real: Just to be clear, the commodity mix here is copper, it's gold, and there's some silver there too.

Michael Hudson: Copper-gold in the porphyries. Copper-silver, we get about 2% copper and an ounce [per tonne] silver on average over that hundred kilometers where we've channeled.

Gerardo Del Real: On average, right, a hundred kilometers…

Michael Hudson: On average and within a hundred kilometers, yeah. But where we've sampled, that's the average grades.

Gerardo Del Real: Phenomenal stuff! Excited for 2023. What comes next? When do we get to see the drill-bit turn and see what mother nature gifted you?

Michael Hudson: Well, this is the challenge. The one big challenge is Peru and the timing to drilling. I always point to this area here. The sediment-hosted system had permits placed six months ago, and we're waiting for those permits now to be approved probably early next year. That's the guidance we can give you there. It's going to be that same process in the porphyries.

Now, it's one to two years to permit to drilling. But you'll see us work these porphyries up. We've developed one in great detail where we’ve sampled it, we've mapped it. You'll see that happen to two other porphyries this year. So we'll just get a whole portfolio of these porphyries. It's like a ring of pearls, literally, that we're working up.

Gerardo Del Real: Some phenomenal exploration work. Anything to add to that, Mike?

Michael Hudson: Watch this space!

The Opportunity

As a Top-Ten mineral explorer by area in Peru — at a staggering 2,100 sq km — Hannan Metals presents a true first-mover advantage in Peru’s underexplored foreland mineral basin area by way of two flagship properties: San Martin and Valiente.

Even prior to the start of phase-one drilling, the junior firm has been able to successfully attract and secure a C$2.6 million strategic investment from Canada’s largest mining company — Teck Resources (NASDAQ: TECK) — and establish a key joint venture agreement with JOGMEC — Japan’s main mining arm.

At San Martin — which is the US$35 million joint venture with JOGMEC — the Hannan team is systematically delineating a high-grade, basin-scale, sediment-hosted copper-silver system situated along the foreland region of the eastern Andes Mountains.

Hannan has completed and submitted its Environmental Impact Statement (“DIA”) to allow for low-impact mineral exploration programs including drilling, which the team expects to receive in early-2023.

At Valiente, Hannan is focused on a new Miocene-age porphyry copper-gold belt in the Peruvian back-arc where the team has discovered 7 mineralizing systems spanning an area of 140 km x 50 km.

The primary focus at Valiente is on the near-drill-ready Belen target, which covers a large mineralized zone with two porphyries and an epithermal system in between.

Geologically speaking, analogues include the Spar Lake sediment hosted copper-silver deposit in Montana and the giant Kupferschiefer deposits in eastern Europe where KGHM Polska Miedź operates the largest silver producing mine in the world; more than twice the production of any other operation and also the 6th largest copper miner on Earth.

The average widths and grades delineated to-date through channel sampling at San Martin have context with historic drill numbers found during the discovery of the vast Kupferschiefer copper-silver deposits.

In other words, the scale is there… the near-surface mineralization is there… the potential for world-class discovery is there… and the proper team is in place to get the drills pointed in the right direction.

You heard directly from Hannan CEO Michael Hudson. He says:

“The age of the porphyries is Miocene, which equates to the biggest porphyries we see up in the Andes themselves, over 120 kilometers, seven of them sticking out of the ground. We're just going through and running a big magnetic survey now, half a million dollar survey, to really narrow down that area and pinpoint those porphyries. It's very exciting!”

That means the news flow is about to pick up big time… pointing to the early-stage opportunity at-hand for foresighted investors!

Hannan Metals is also very well-structured with only ~100 million shares outstanding on a fully diluted basis with 16% of those shares held by insiders.

Trading undiscovered below C$0.35 per share, the market cap is truly minuscule at roughly C$30 million.

The permitting process in Peru is long and sometimes arduous… but the upward momentum is indeed building.

It’s explore… explore… explore… leading up to the all-important start of drilling, which is where the real excitement is set to begin for Hannan Metals and HAN/HANNF shareholders.

In other words, now is an opportune time to start taking a closer look at Hannan Metals as the company continues to make near-surface copper-gold-silver discoveries on its two Peruvian flagships.

A great place to start is Hannan’s corporate website where you can learn more about the flagship properties, the team, and sign-up to receive updates directly from the company’s IR department.

Also, click here for more of our ongoing coverage of Hannan Metals, including additional late-breaking interviews with upper management as developments arise.

Hannan Metals Ltd. trades on the Toronto Venture Exchange under the symbol HAN and on the US OTC Bulletin Board Exchange under the symbol HANNF.

— Resource Stock Digest Research

Click here to see more from Hannan Metals Ltd.