Categories:

Base Metals

Topics:

General Base Metals

Watch For Small-Cap Graphite Stocks In 2012 … Your Starting Point

So This Is What Graphite Looks

One great thing about running AGORACOM is the necessity/ability to keep a 30,000 foot view on what is happening and trending in the small-cap space. Getting the best view often requires cutting through the canned promotions and really noticing the under currents that are building on their own. Over the last 2-3 months, I’ve noticed an under current really growing in small-cap graphite companies … enough so that I am now taking a very close look at them and the space.

GRAPHITE MARKET OVERVIEW

I gleaned the following great overview from a Lomiko Metals press releasethis morning, announcing it had signed an agreement to acquire a 100-per-cent interest in the Quatre Milles Graphite Property located in southwestern Quebec:

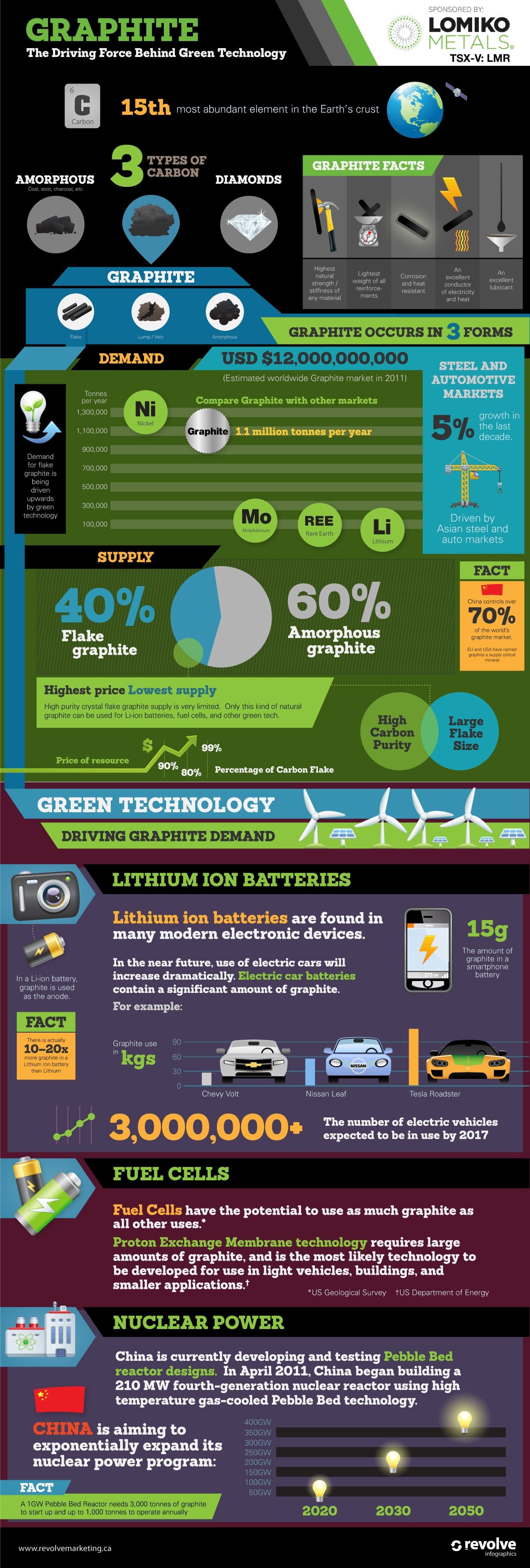

Global consumption of natural graphite has increased from approximately 600,000 tonnes in 2000 to roughly 1.2 million tonnes in 2011. Demand for graphite has been increasing by approximately 5 per cent per year since 2000 due to the continuing modernization of China, India and other emerging economies, resulting in strong demand from traditional end uses such as the steel and automotive industries. Graphite also has many important new applications such as lithium-ion batteries, fuel cells, and nuclear and solar power that have the potential to create significant incremental demand growth. There is roughly 10-20 times more graphite in a lithium-ion battery than there is lithium. Demand for graphite is expected to rise as electric vehicles and lithium battery technology are adopted.

Natural graphite comes in several forms: flake, amorphous and lump. Of the 1.2 million tonnes of graphite produced annually, approximately 40 per cent is of the most desirable flake type. China, which produces about 70 per cent of the world’s graphite, is seeing production and export growth leveling, and export taxes and a licensing system have been instituted. A recent European Commission study regarding the criticality of 41 different materials to the European economy included graphite among the 14 materials high in both economic importance and supply risk (Critical Raw Materials for the EU, July 2010).

Graphite prices have been increasing in recent months and over the last couple of years prices for large flake, high purity graphite (+80 mesh, 94-97%C) have more than doubled. Other public companies developing graphite projects in Canada include Northern Graphite Corp. with its Bissett Creek project in Ontario and Focus Metals Inc. with its Lac Knife project in Quebec. High-growth, high-value graphite applications require large-flake and high-purity graphite which is the prime exploration and development target at the Quatre Milles Property.

Paul Gill, CEO of Lomiko Metals, was also nice enough to share this infographic with me this morning:

SMALL-CAP GRAPHITE PLAYERS

Ryan Fletcher, Director OF Zimtu Capital Corp., sent me the following overview of market players this morning as part of a press release announcing Orocan Resources commenced drilling on 3 graphite properties in Southern Ontario (I added in the Lomiko information at the end myself to give a complete list of companies I know. If you know more, make sure to let me know via comments below)

1. Focus Metals Inc. (FMS.V)

Shares Outstanding: 83,641,175

Price: $0.82

Market Cap: $68 Million

Last Financing: $20 Million bought at C$1.00 (Cormark)

2. Northern Graphite (NGC.V)

Shares Outstanding: 37,415,167

Price: $0.86

Market Cap: $32 Million

Last Financing: $4 Million IPO at C$0.50

3. Tasex Capital Corp. – CPC Undergoing QT (TAX.P)

Shares Outstanding (Post IPO): 35,100,000

IPO Price: $0.50

Post Raise Market Cap: $17.5 Million

Current Financing: $5.2 Million IPO at C$0.50

4. Orocan Resources (OR.V)

Shares Outstanding: 15,614,625

Current Price: $0.315

Market Cap: $4.9 Million

5. Lomiko Metals (LMR.V)

Shares Outstanding: 55,518,445

Current Price: $0.04

Market Cap: $2.2 Million

NEXT STEPS

It goes without saying that none of the information above is intended to be any kind of recommendation or endorsement. I’m starting my hard DD right now and, if you have any interest in this space, I recommend you do your own due diligence on these companies, as well as the entire graphite space.

Regards,

George