Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

A battle for supremacy in the lithium triangle

Three South American countries have much of the world’s lithium. They take very different approaches to exploiting it

THE Olaroz salt flat sits nearly 4,000 metres (13,000 feet) above sea level at the end of a road that snakes through the Andes mountains. The loudest sound in the featureless expanse is a mechanical one, made by untended pumps. They extract lithium-bearing brine from wells sunk deep below the salt crust and deposit it in evaporation pools. The concentrate will be taken to a nearby plant for processing into lithium carbonate. The operation in Argentina’s Jujuy state, an Argentine-Australian-Japanese joint venture, is one of the country’s two working lithium mines. Last year it produced 11,845 tonnes of lithium carbonate, about 6% of the world’s output. This year Sales de Jujuy plans to make 17,500 tonnes.

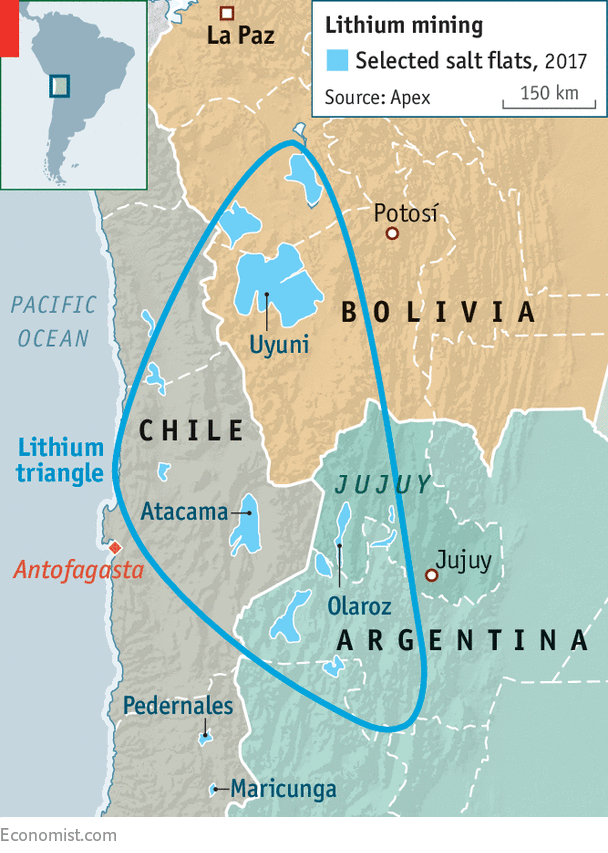

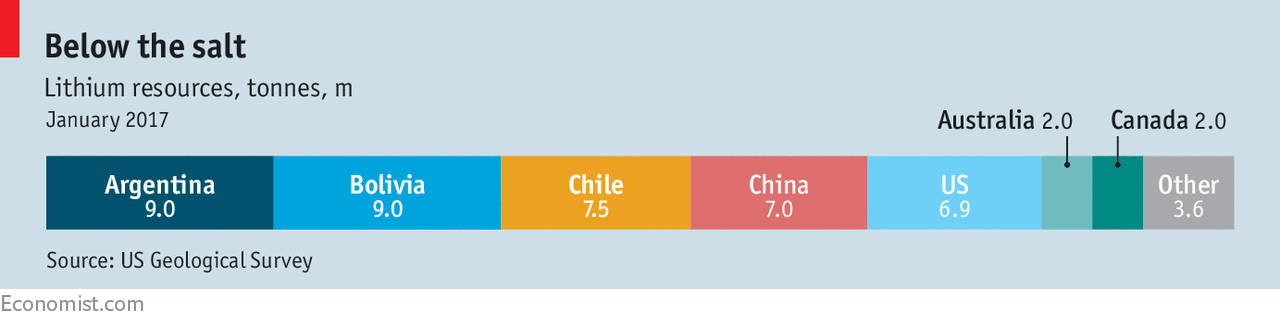

Lithium is a coveted commodity. Lithium-ion batteries store energy that powers mobile phones, electric cars and electricity grids (when attached to wind turbines and photovoltaic cells). Joe Lowry, an expert on the lightest metal, expects demand to nearly triple by 2025. Supply is lagging, which has pushed up the price. Annual contract prices for lithium carbonate and lithium hydroxide doubled in 2017, according to Industrial Minerals, a journal. That is attracting investors to the “lithium triangle” that overlays Argentina, Bolivia and Chile (see map). The region holds 54% of the world’s “lithium resources”, an initial indication of potential supply before assessing proven reserves (see chart).

Latest updates

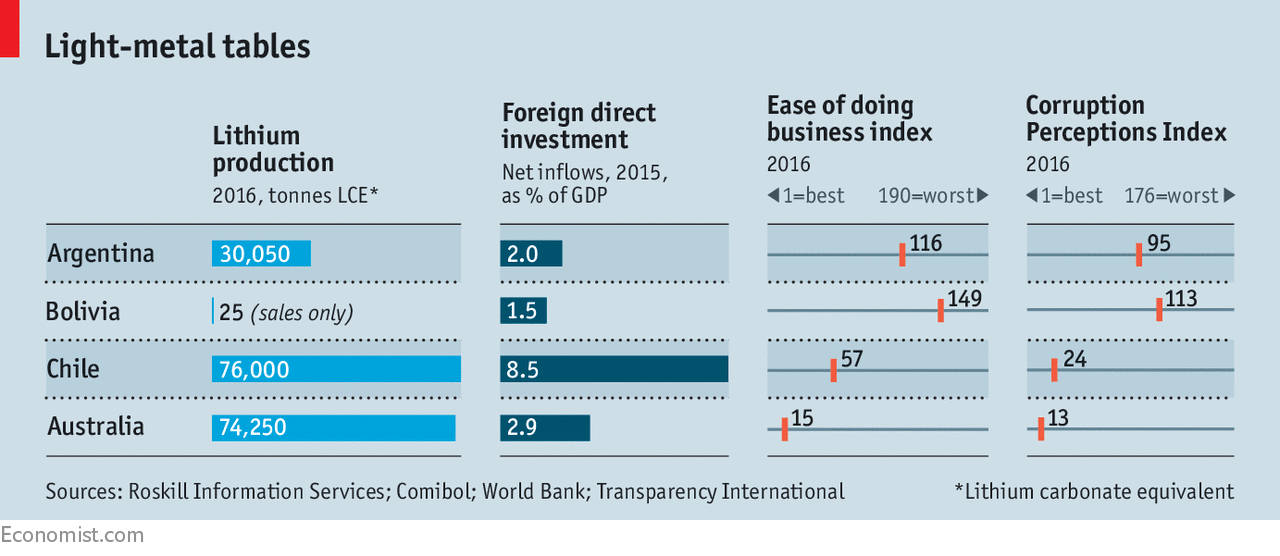

The three countries have not been equally eager to seize the opportunity. Market-friendly Chile has a big head start. Argentina is hastening to make up lost ground, as the activity on the Olaroz salt flat suggests. Bolivia, whose resources are as large as Argentina’s, has barely begun to exploit them. Those differences suggest much about how the South American trio treat enterprise and investment more generally. They face a formidable challenger in Australia, where lithium must be expensively crushed out of rock and shipped to China for processing, but investment conditions are friendlier.

The regional champ

Chile dominated the world lithium markets for decades. The Atacama salt flat has the largest and highest-quality proven reserves. The desert’s blazing sun, scarce rainfall and mineral-rich brines make Chile’s production costs the world’s lowest. Allied to this is the region’s most benign investment climate. Chile is far ahead in rankings of ease of doing business, levels of corruption, and the quality of its bureaucracy and courts (see charts). Its lithium deposits are close to Antofagasta and other Chilean ports; the lithium carbonate that is produced in Jujuy passes through them.

But growth has flattened, allowing Australia to threaten Chile’s position as the world’s top producer. This is mainly because, when it comes to lithium, Chile is less liberal than it is with respect to copper, the country’s biggest export. Fortunately, that problem can be easily fixed.

Laws enacted in the 1970s and 1980s classify lithium as a “strategic” material on the ground that it can be used in future nuclear-fusion power plants. There is little prospect that Chile will soon build one of these, but controls on lithium production remain as a way of protecting the desert’s fragile ecosystem.

Just two companies, Chile’s SQM and Albemarle of the United States, are allowed to extract brine under leases that were signed in the 1980s. In addition, they are subject to quotas on the lithium they can produce from the brine, which also yields other minerals. The government wants to raise production. But the Economic Development Agency (Corfo), which holds the lithium reserves, is now engaged in a legal dispute with SQM, and so has refused to raise its quotas, which the company is likely to use up by 2021.

Chile is looking for other ways to increase output. In January Codelco, the state-owned copper company, invited private firms to invest in the Pedernales and Maricunga salt flats, lithium-rich areas that it controls. This year Corfo struck a new deal with Albemarle, which extends its mining lease to 2044 and gives it an additional quota. Albemarle agreed to sell a quarter of its output at preferential prices to Chile-based firms that propose to make value-added products, starting with cathodes for batteries.

Staying on top

With higher quotas, the Atacama salt flat alone could more than quadruple production to 350,000 tonnes a year without extracting more brine, says Eduardo Bitran, Corfo’s chief executive.

To continue reading please click link http://www.economist.com/news/americas/21723451-three-south-american-countries-have-much-worlds-lithium-they-take-very-different