Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Aben Resources reports 3 of (up to) 24 drill holes; stock sells off hard on heavy volume. Justified?

Aben Resources (TSX-V: ABN) (OTCQB: ABNAF) (Frankfurt: E2L2) recently announced results from the first shipment of drill core from its 2019 drill program at the Forrest Kerr gold project in the Golden Triangle (“GT“) British Columbia, Canada. Results from three of ten completed drill holes were reported. Nothing too exciting in the assays, the best intercept was 61.7 m of 0.46 g/t gold. {August corp. presentation}

The market spoke, and it spoke loudly. The press release was not well received. But why such a negative response? Shares plummeted to $0.135, down 27%, before ending Wednesday at $0.155, and dropping a penny on Thursday to $0.145.

Trading volume of 3 million shares was the heaviest of the year. I would have expected something like this if the Company was out of cash, with no more results pending.

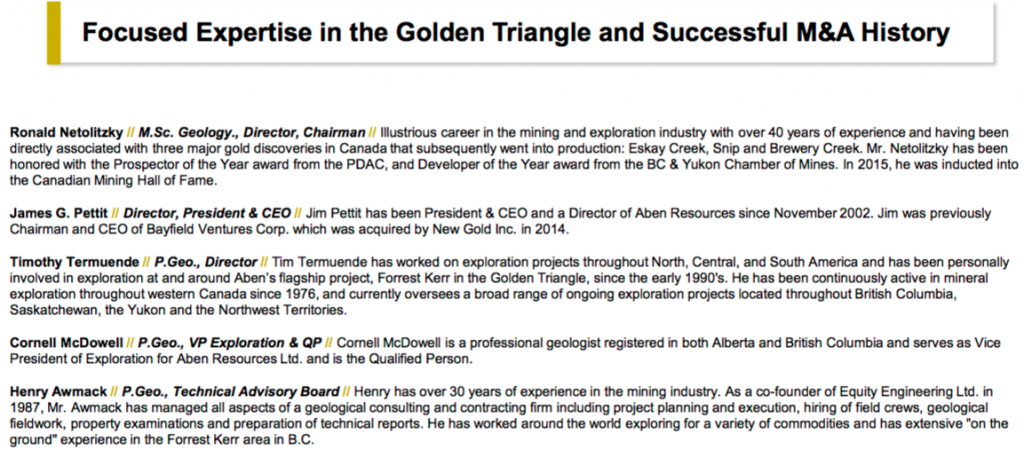

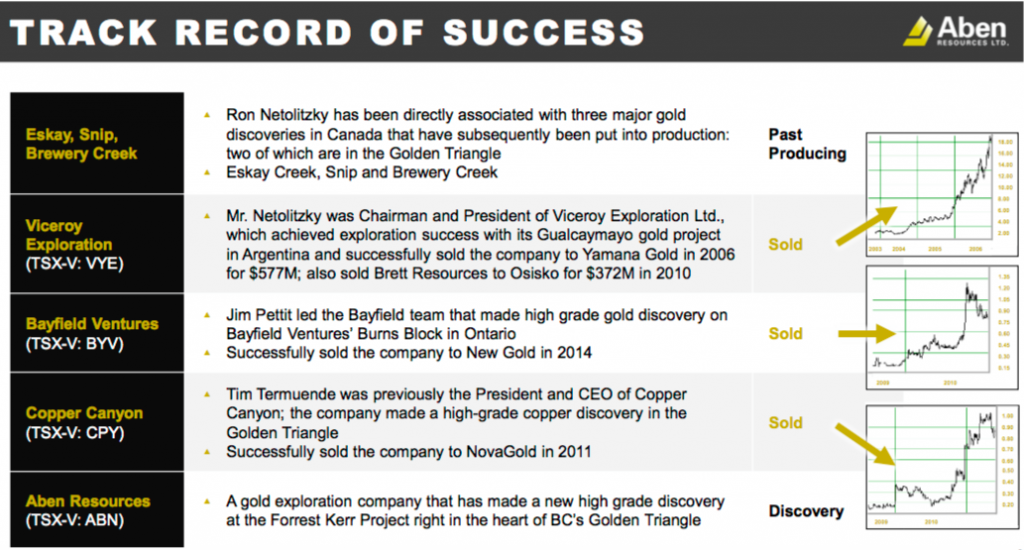

However, that’s simply not the case, Aben remains well funded. Eric Sprott is the largest shareholder. Note: {in the remainder of this piece I suggest that Aben’s share price [could, might, possibly, potentially] rebound from $0.145. However, I don’t know when or if this will happen, or how much of a rebound is likely}.

First and foremost, we need to see one or more strong drill holes reported in Sept., Oct. or Nov. This remains quite possible because the zones being drilled are still open along strike and at depth.

ALL drill holes are important in understanding the geology, to better target zones of mineralization. The GT is known to have complex geology, as is the case with a lot of deposits in the district. Even assays that are not that exciting help explain geology & structure, improving Aben’s chances of success.

What if there’s nothing left to find?

Management believes there’s likely to be more high-grade gold on the property. Gold zones identified so far came from a powerful mineralizing event. The team is up in the GT this week planning the next batch of drill holes, and they remain optimistic for the remainder of this season.

Management pointed out that last year’s blockbuster hole FK18-10 (multiple high-grade zones, incl. 62.4 g/t gold over 6 m within 38.7 g/t gold over 10 m) was targeted based on a high-grade surface sample. Aben has several new target areas supported by high-grade surface showings that will be drilled over the next several weeks. Strong, intercepts from any of these new areas would be deemed a new discovery.

A lot of angst, disgruntlement & fear over just 3 assays?!?

Along with a few disappointing drill holes was the arguably more important news that management is doubling down on its drill program. Aben is expanding the budget and intends to continue drilling into September. The team is drilling another 12-14 holes at Forrest Kerr and should end the season with about $2 million in the bank.

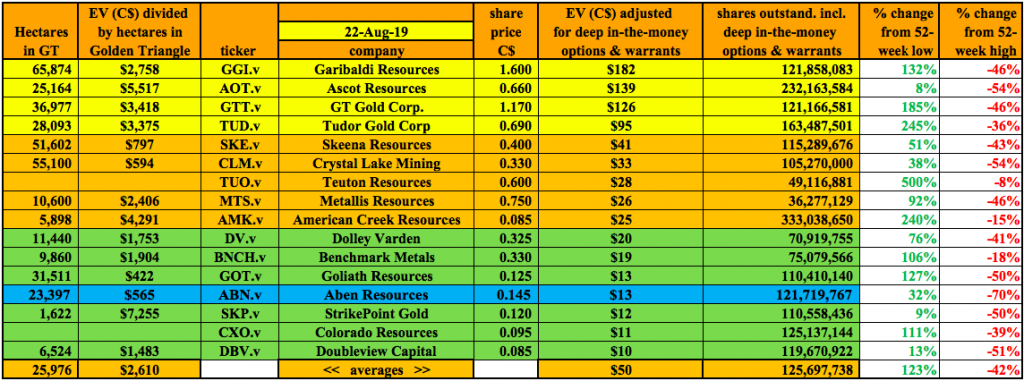

On just three assays of up to 24 expected from the Golden Triangle this season, Aben is down 24% from $0.19 to $0.145. It has fallen out of the top 10 GT juniors, as ranked by Enterprise Value (“EV“) [market cap + debt – cash], now sitting at #13 with an EV of $13 million.

The company’s share price is down 70% from its 52-week high. That’s the worst decline among the top 20 GT juniors. Is the considerable share price weakness justified?

While the press release was not great, it wasn’t all bad either ….

The following are two streamlined quotes from the press release that describe the drill program at Forrest Kerr. There’s a fair amount of technical data in the press release for readers interested in that. I’m keeping it simple in this article.

“The goal of this year’s drill program is to test a specific area of the North Boundary Zone and the area around the historic “Noranda hole” and a corresponding new zone south of the Noranda hole. These three assays are from widely spaced holes, peripheral to the main zone of mineralization. Each encountered variable & intermittent polymetallic mineralization.“

Obviously, the goal of this year’s drill program has not been defeated by the first three drill holes! In fact, the team believes the goal is alive and well, thus a more than doubling of the number of holes from 10 (completed) to a total of up to 24. Presumably, management would not do this unless they had good reasons.

“Mineralization corresponds to multiple & widespread fault & shear zone structures. The mineralized structures correlate very well with magnetic highs delineated by an airborne survey flown in May 2019. Drilling on this part of Forrest Kerr has only tested a small portion of the potentially mineralized structures defined by the magnetic survey.“

Only a small portion of potentially mineralized structures defined by a magnetic survey have been tested. Again, the goal remains intact, to drill test very specific zones with potential for high-grade mineralization.

Gold price up nearly US$300/oz. since this time last year!

Readers should not forget the critical importance of today’s gold price of approximately C$2,000/oz. In US$, gold is at a 64-month high!

Last year, Golden Triangle juniors were working with a US$1,200-$1,250/oz. gold price backdrop. Anything above US$1,400/oz. is awesome in my opinion. Last year’s lower gold price did not prevent some spectacular gains from select GT players. For example, who can forget GT Gold (TSX-V: GTT),