Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Aluminum Hits Highest Since 2011 With Rusal Supply Seen at Risk

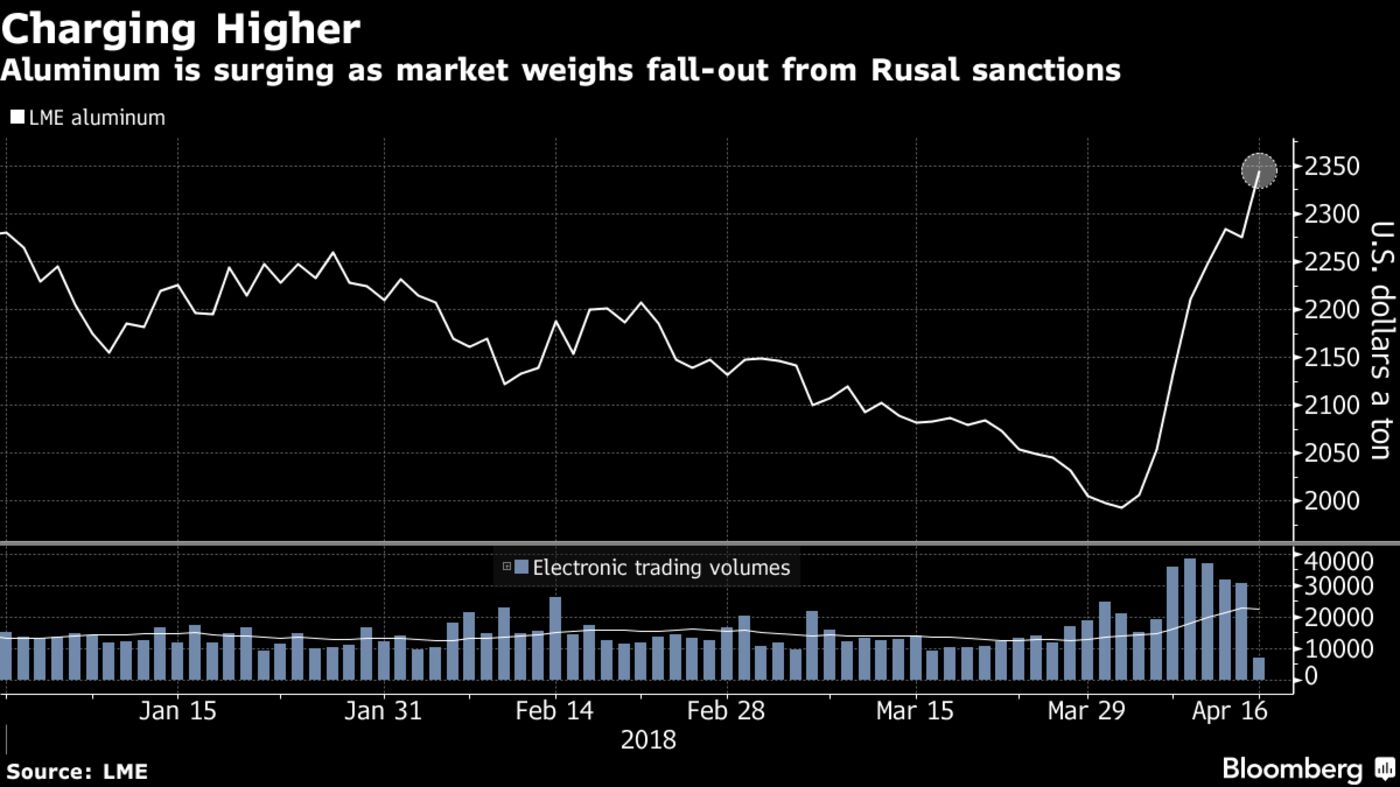

Aluminum extended last week’s record gain, touching the highest in more than six and a half years in London as the market weighed the possibility that United Co. Rusal will be forced to cut production after being shut out of western markets.

The metal advanced 5 percent to settle at $2,399 a ton as of 5:50 p.m. on the London Metal Exchange. That’s the biggest daily jump since November 2011. It earlier touched $2,403, the highest since September 2011. The metal rose 12 percent last week after U.S. sanctions imposed on the Russian aluminum producer sent shock waves through the global metals supply chain.

Counterparties including Rio Tinto Group and Glencore Plc have already declared force majeure on some contracts following the sanctions and attention is now turning to the risk the Rusal will be forced to cut output, exacerbating a shortage seen in markets outside China.

“We have a potential scenario where U.S. and European markets will be shut off to Rusal, and they’ll be forced to redirect units to clients in other markets,” Nicholas Snowdon, a metals analyst at Deutsche Bank AG, said by phone from London. “Doing the maths, that’s going to pose significant challenges, and there’s clear potential that they’ll have to cut production.”

Read more: Aluminum surges through wildest week after sanctions shock

Rusal’s shares dropped 30 percent in Hong Kong after losing more than half their value last week, as traders and analysts weighed the ongoing fallout from the sanctions. Rusal is likely to target sales in alternative markets across the Middle East, Turkey and China to make up for lost exports to western buyers, Morgan Stanley analyst Susan Bates said in an emailed note.