Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Blue Sky Uranium – Right on time to capitalize on higher uranium prices

Sometimes a bear market lasts longer than expected, and this definitely seems to be the case for uranium. Although the spot price is relatively irrelevant in the greater scheme of things, a continuously low spot price has had a negative impact on the long-term contract prices as well. This created a situation where uranium producers aren’t too interested in continuing to produce and sell uranium at loss-making prices.

The uranium market might turn around sooner rather than later, and this could be good news for Blue Sky Uranium (BSK.V), one of the Grosso Group companies. The past few years haven’t been easy for Blue Sky, but it has been able to invest several million dollars on its uranium properties in 2016-2017, and could now become one of the more interesting uranium exploration plays, as it owns one of the few exploration projects in Argentina, a country which imports 100% of its uranium needs in spite of its geological potential to be in the top uranium reserves in the world.

In this report, we will solely focus on the Amarillo Grande flagship project, as it’s the most advanced project in Blue Sky’s portfolio.

The uranium market

We won’t go into great detail here as it’s widely known the two main uranium producers in the world (Kazatomprom and Cameco) have announced production cuts to accelerate a supply and demand equilibrium ahead of the new long-term uranium delivery contract negotiations which will start in 2018.

The move of both companies immediately reduces the expected 2018 supply surplus to zero and actually potentially creates a supply deficit based on the most recent projections. If anything, this increases the pressure on the owners of the nuclear power plants which will now be very eager to secure a sufficient amount of uranium to keep the plants up and running. As a supply deficit seems to be around the corner, the uranium producers are now in the driver’s seat during the contract renegotiations and could evolve from being ‘price takers’ to price setters.

This doesn’t mean we expect the uranium price to reach a triple digit price again but it’s clear the current long term contract price in the $30’s won’t be around for much longer as Big Uranium very likely prefers to shut down (more) mines rather than selling uranium at these prices. Ideally, we would like to see the long-term contract price increasing to $52-58 per pound as most producers would generate relatively healthy margins at those prices, whilst the price remains low enough to avoid new high-cost new production coming online.

Blue Sky’s flagship Amarillo Grande project in Argentina

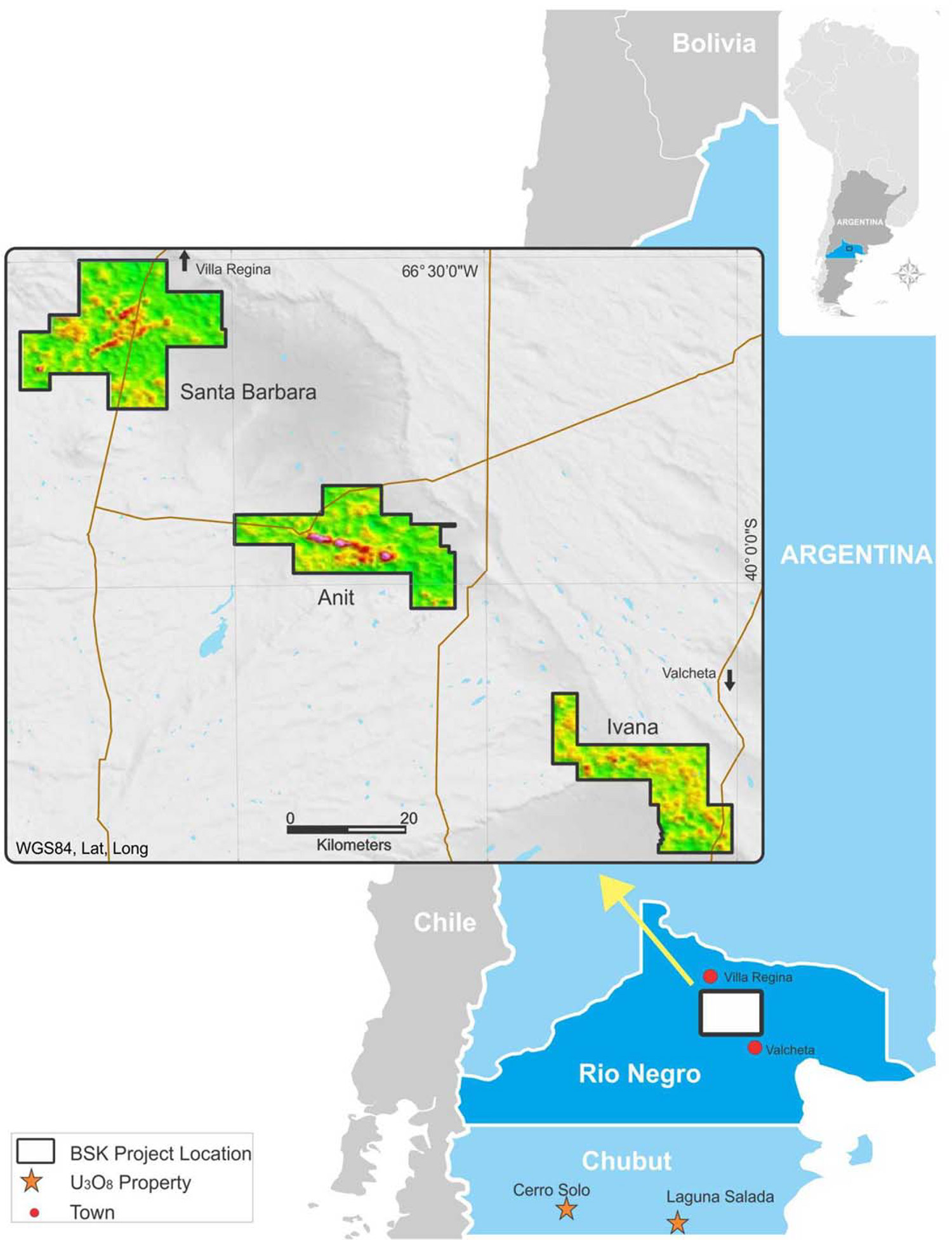

Blue Sky’s flagship project is the Amarillo Grande project in Argentina’s Rio Negro province, which consists of the Anit, Ivana and Santa Barbara zones for a total land package of approximately 287,000 hectares.

Rio Negro has been the subject of uranium exploration before, as approximately 50 years ago, a national commission for atomic energy initiated a first exploration program in the province. Unfortunately, no historical data has been made public by the Argentinean government, and the results of the exploration program in the Sixties and Seventies remain unknown. The properties remained dormant until 2006 and 2008 when Blue Sky Uranium acquired a 100% interest in the Anit and Santa Barbara properties in two separate steps.

Blue Sky Uranium started with a surface sampling program at Santa Barbara which is part of a regional uranium-vanadium system. It was remarkable to see how even surface grabs sampled in excess of 10,000 ppm uranium which is absolutely stunning. This confirmed Blue Sky’s suspicions about a potentially sizeable uranium exploration target right under the shallow overburden.

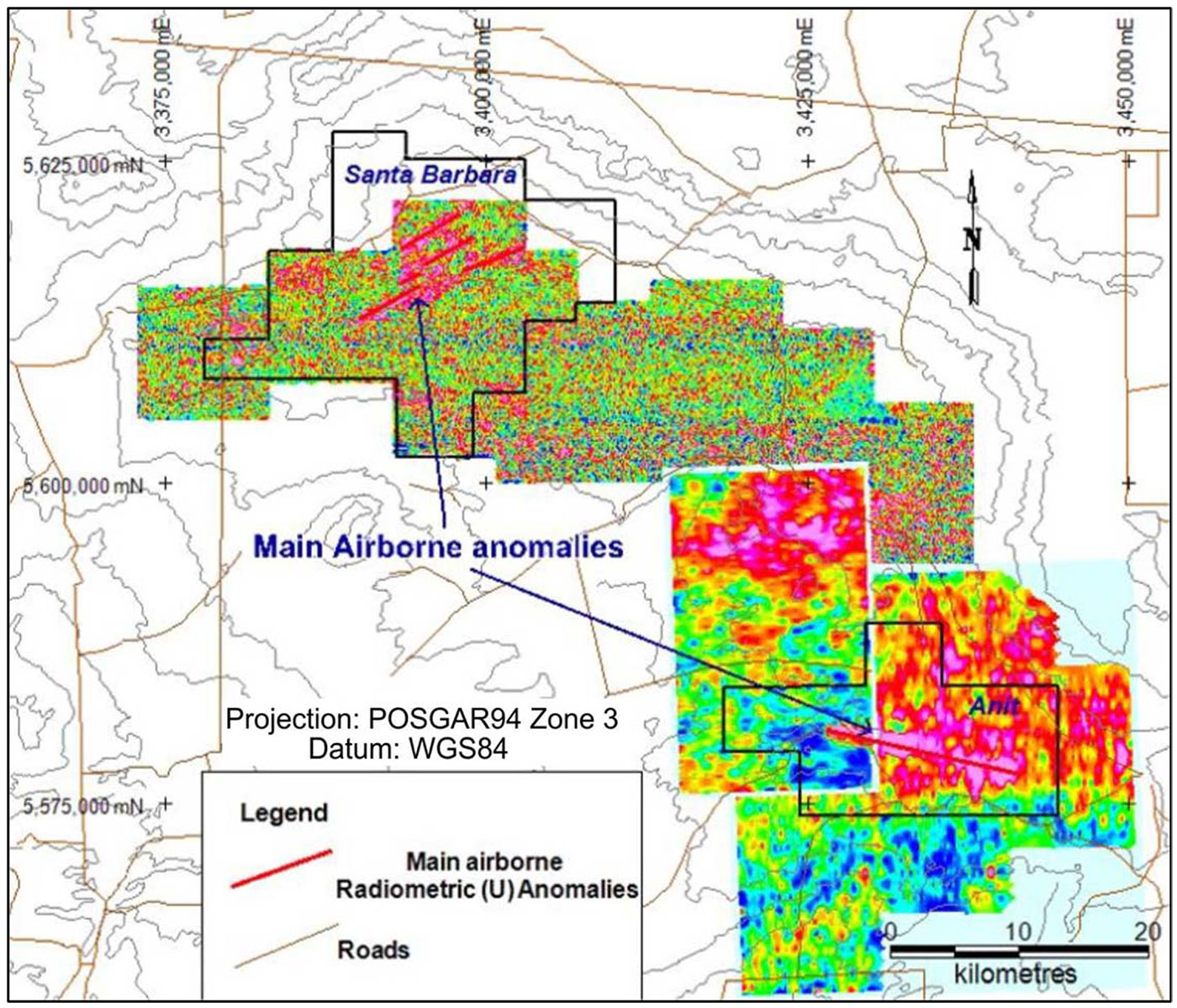

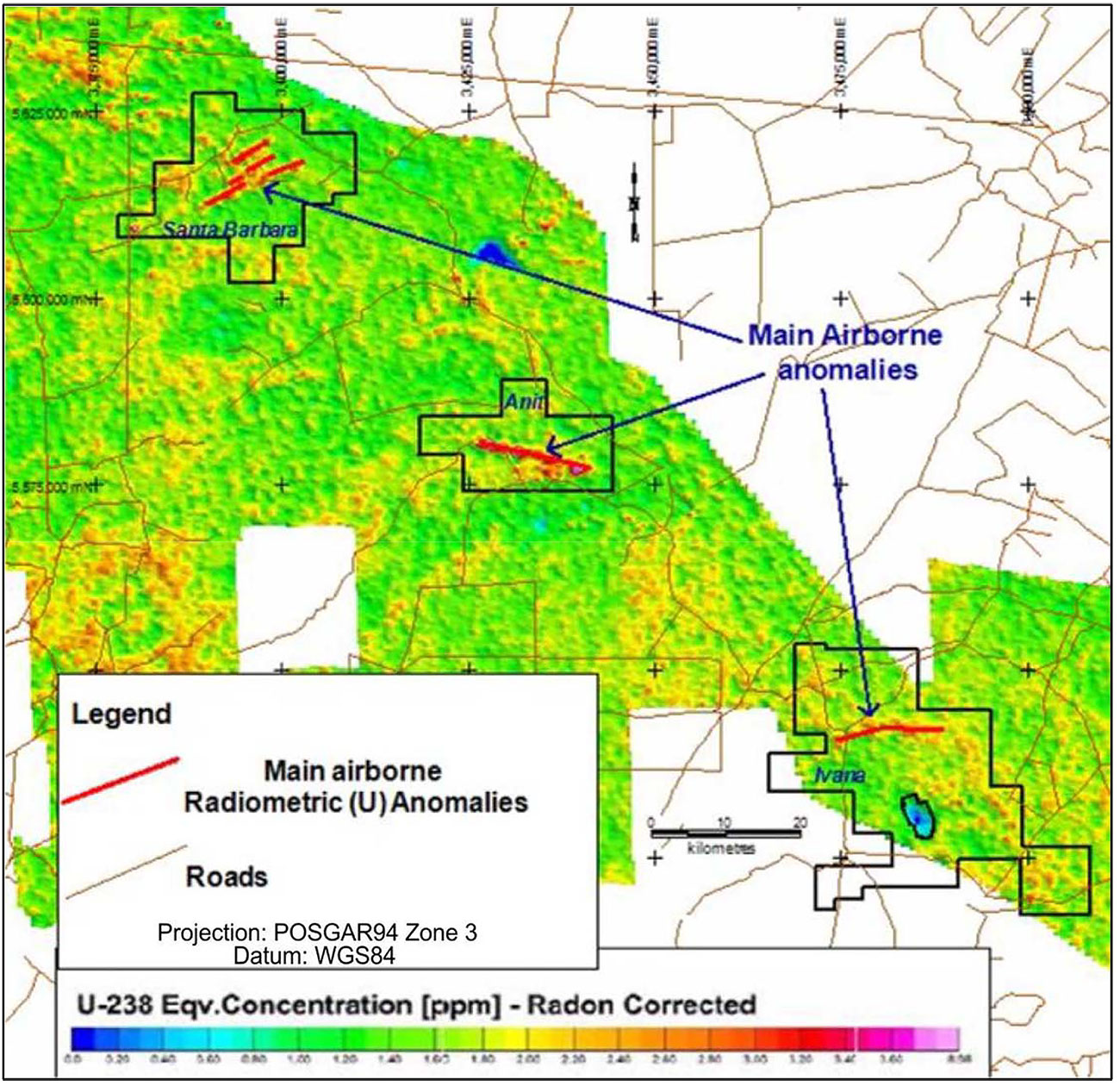

The next step undertaken by Blue Sky (as part of its original earn-in schedule to acquire a 75% stake in the properties), an airborne survey was commissioned (the three properties have been subject to almost 40,000 kilometers of airborne surveys). This was a good approach to follow up on previously identified uranium anomalies on the Anit and Santa Barabara zones. The airborne survey discovered 4 anomalies; one at Anit, and three large ones at Santa Barbara of which the largest was up to 11 kilometers long and 1.5 kilometers wide. If you look at the next map, you don’t even have to be a geophysicist or geologist to see the ‘hot spots’ pop up on the map.

Once the hot spots of uranium anomalies had been pin-pointed on the map, BSK initiated a radon gas soil survey which roughly confirmed the results of the airborne survey which paved the way for Blue Sky to dig some ‘test pits’ on its prospects. This was an excellent way to establish firm proof of the existence of a ‘layer of uranium’ at the airborne and radon gas anomalies. The mineralization was very close to surface, making the shallow pits (the maximum depth of the pits was just 3.5 meters) an excellent tool to determine the high-priority trench and drill targets. The uranium was hosted in a carnotite setting, a uranium sandstone type deposit almost on surface, called a surficial deposit.

Carnotite is a vanadium mineral typical in oxidations zones in arid areas. The uranium – vanadium relationship was variable from 1 to 1 to 1 to 3, with over 1 to 10 relationship in some sectors at Anit.

These exploration results caught the attention of French uranium giant AREVA which partnered up with Blue Sky Uranium. As part of a joint venture agreement which required AREVA to spend US$6-7M on exploration, it could earn an initial 51% interest in the property. Due to the adverse circumstances on the uranium market and its deteriorating financial situation, AREVA dropped the project in 2014 (with Blue Sky Uranium retaining a 100% interest in Amarillo Grande) after having spent US$3M at the project. That’s US$3M Blue Sky didn’t have to spent themselves, and that’s a big deal for a small company like BSK!

Fast forward to 2017, where Blue Sky Uranium completed another (shallow) drill program at Amarillo Grande under the supervision of Guillermo Pensado, who was hired in 2016. Keep in mind the Amarillo project is a so-called surficial deposit. Unlike the underground uranium deposits you might be more familiar with, sandstone type deposits are usually several kilometers long, relatively wide (1-1.5 kilometers) but usually aren’t thicker than just a few meters. And these sandstone type deposits are the main source of uranium production worldwide.

This offers several advantages as the capital expenditures to start mining in a few years will be very low as Blue Sky Uranium would just have to fund the construction of a processing plant. Virtually no pre-stripping activities will be required, and all equipment could easily be sourced from (local) contractors.

Additionally, mining a horizontal layer of mineralization is also very straightforward as you could simply use a continuous miner to ‘scrape the surface’, reducing the operating expenses per tonne. And finally, it makes resource calculations very easy as you just need to calculate the dimensions of the layer of uranium mineralization. 3 kilometers by 1 kilometer by 3 meters and a density of 1.6-1.7 would result in a total size of 15 million tonnes. At an average grade of 500 ppm U3O8 (or 1.1 pound) as an arbitrary number (don’t interpret this as an official guidance), this would result in 16 million pounds of uranium on an in situ basis. And that’s just 3 kilometers of a total strike length of 140 kilometers!

Blue Sky Uranium hasn’t completed a resource calculation just yet, but as it continues to gain a better understanding of the project, we would expect the company to be in a position to release a maiden resource estimate by the end of 2018. According to its official timeline, Blue Sky will initiate a resource calculation at Ivana before Anit whilst both zones will be the subject of additional metallurgical test work as well.

Amarillo Grande Project – Anit Property

Vanadium as icing on the cake?

Let’s also not forget about the vanadium credit. The Amarillo Grande project hosts a typical uranium-vanadium type of mineralization and as the vanadium price has started to increase again, the vanadium which could be recovered from Amarillo Grande could increase the value per tonne.

‘Could be’, indeed, as even though vanadium has been present ever since Blue Sky started to explore Amarillo Grande, it hasn’t really been taken into consideration. As mentioned before, the vanadium content has been considered in general as 1 to 3 times the uranium content. With historically prices below US$5 per pound, those grades didn´t represent something to get really excited about.

Today, we are still considering the potential vanadium credit as ‘icing on the cake’, but are becoming more excited about the zones where higher vanadium levels appear to be present.

After reviewing Blue Sky’s November 2017 project update, it was encouraging to see higher grade zones with grades of up to 3,411ppm V2O5 (or 0.34%) and a map showing a delineated significant area of vanadium mineralization covering a much larger area than the previously defined uranium mineralized zone.

Assuming the general uranium/vanadium ratio observed at this point (the ratio of 1-3 times as much vanadium compared to Uranium we previously mentioned), the vanadium could add more value than we anticipated.

Amarillo Grande Project – Ivana Property

Could Blue Sky Uranium benefit from the project’s location?

Very few people realize approximately 10% of Argentina’s energy needs are being fulfilled by three nuclear power plants, of which the most recent one (Atucha II) only reached 100% of its capacity in 2015. The total capacity of the three working plants is just above 1,600 MW, which results in an expected annual uranium consumption of just less than half a million pounds per year. Note, the 2017 uranium needs might not take the future needs of the Embalse nuclear power plant in consideration. This plant is now offline and will be restarted in 2018 after a thorough refurbishment to keep it going for an additional 30 years.

But as Argentina’s economy continues to grow, the demand for electrical power obviously also increases and ex-president Kirchner was definitely confirming nuclear power plants will provide an important role, and Macri, the country’s current president, appears to continue this policy.

In fact, the country will very likely break ground to build a new reactor at the Atucha compound in 2018 in a joint venture with a Chinese company. This new reactor will have a capacity of 700 MW, which would require approximately 180,000 pounds of uranium per year.

Note that this estimate is based on the consumption of the current reactors, but estimates vary as an official study of the European Commission estimates one needs 12 cubic meters of uranium for a 1000 MW nuclear plant. This would equate to half a million pounds per year, or 350,000 pounds for a 700 MW plant, so the real number will probably be somewhere in between both estimates.

On top of that, a new reactor also needs a certain quantity of uranium as ‘start-up’ load, and for a 700 MW reactor, this would be approximately 560,000 pounds of uranium (again, we only have secondary sources for this number).

But our point is simple. Argentina will use in excess of half a million pounds of uranium per year (with a larger 1000MW reactor to be built from 2022 on) which could push the total uranium need to in excess of 1 million pounds per year.

As mentioned before, Argentina has no domestic uranium production at all, and it imports all of its uranium needs from Canada and Kazakhstan, which per definition increases the supply risk as the country is fully depending on two foreign nations to live up to their promises to keep 10% of the nation’s electrical consumption up and running.

Whilst Blue Sky’s Amarillo Grande project is still in its infancy, the Argentinean government has every reason to be interested to make this project work. It doesn’t need to see a huge open pit mine with a multi-million pound output, but anything between 0.5 and 1 million pounds of uranium would be the sweet spot as 1 million pounds per year would fulfill Argentina’s total uranium needs.

But there’s no reason why Blue Sky Uranium should consider a 1 million pound production plan as its long-term target. Based on our recent discussions with company representatives, we believe Blue Sky is ultimately planning to develop the project into a 2.5-3 million pound per year producer.

The majority of the cash is being spent on the project

It’s always very interesting to have a look at how companies are spending the cash they raise. Some management teams like to see shareholders as personal ATM’s and only care about the monthly paychecks, but other companies, like Blue Sky Uranium effectively spend the money on the ground.

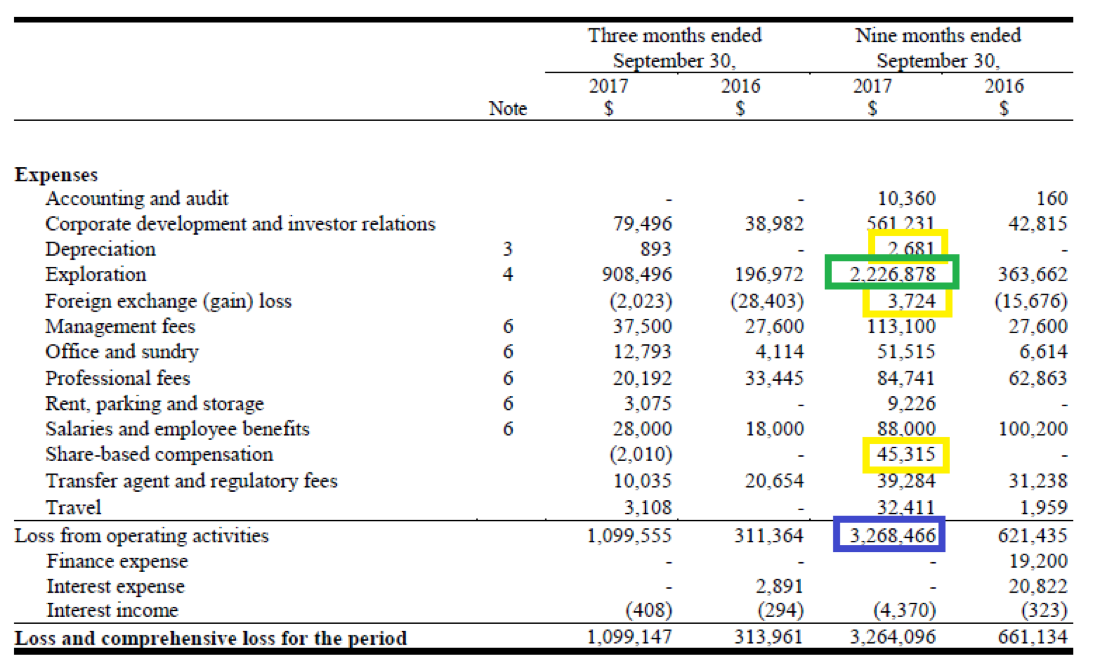

As you can see on the next image, Blue Sky Uranium has expensed C$3.27M in the first nine months of the year, which includes a C$45,000 share-based compensation and $6,000 in other non-cash expenses. This results in a total cash expense of approximately C$3.2M in the first nine months of the year, of which almost C$2.23M was spent on exploration.

That’s a great ratio and an example for its peers. For every dollar the company raised, 69 cents was spent on the projects. That’s a positive sign and it very likely helped the company to close an oversubscribed placement in December, raising C$1.1M at C$0.19 per unit (with each unit consisting of one common share and a full warrant with a strike price of C$0.30).