Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Catalysts For Upside In Uranium

Summary

Uranium has been cheap for years, but the market has been waiting for a catalyst.

Rising in oil prices in yen terms are putting pressure on Japan to reactivate plants.

Pressure is coming on supply side as well just as new plants come online.

Fundamentally, the bull case for uranium is that Uranium prices have been depressed due to post-Fukushima negative sentiment towards nuclear power despite rising demand in emerging markets. Uranium miners have been trading near lows as cheaper crude oil prices subdued immediate pressure for energy importers to switch to alternatives. Nonetheless, the fundamental developments for uranium prices have been very positive and likely are the catalyst for a turnaround in uranium prices.

Uranium prices since Fukushima source: Cameco

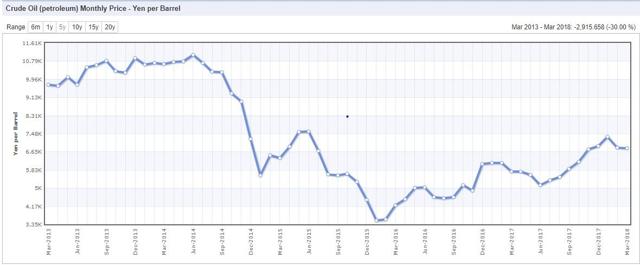

The first catalyst is the accelerated restart of nuclear power plants in Japan. As of April 1, only five of Japan’s forty-two nuclear power plants have been reactivated. Due to the shale bust and fading “Abenomics” hopes keeping the yen from falling below 125 vs the dollar, oil prices plummeted 68% from the date of the accident in Yen terms from 2011-2016. As a result, there has been economic pressure to import energy and keep nuclear power plants closed. However, with a broad recovery in oil markets since then and rising rates internationally, oil in yen terms has likely bottomed.

Oil in Yen since 2013: source IndexMundi

Since Japan does not produce any fossil fuels domestically, their reliance on imports of oil and natural gas from abroad makes reactivating nuclear power plants look imperative. Consumers will start to feel the impact of the shutdown and increased foreign oil dependence from higher utility bills in absence of restoring nuclear power sources. In addition to economic pressure, the political climate is becoming more favorable as the leading governor opposing any nuclear plant reactivations had to resign his post due to a sex scandal. Abe’s weakening poll numbers will not benefit from rising energy costs either. As a result, Japan plans on reactivating at least two more plants this summer, and seventeen more have applied torestart. Assuming no oil bust in the near term the rest of the power plants will likely be modernized and reactivated over the next five years.

Outside of Japan, nuclear power demand is growing. The US and France are not adding plants but still are maintaining existing nuclear plants and modernizing them to prevent future accidents. Meanwhile, in emerging markets 57 new nuclear plants are currently under construction.

Germany will also start to face pressure to reactivate its nuclear plants as well. Shutting them down has contributed to Germany having the highest electric power costs among developed economies. For a country that relies on heavy manufacturing with large energy demands, high power costs hurt the country’s exports relative competitiveness to the US (who has a fraction of the energy costs due to abundant natural gas) and China (who outcompetes Germany on wages).

Germany has a 65% non-fossil fuel target for its energy grid by 2030. Germany and many other nations looking to end dependence on fossil fuels will have a very difficult time achieving such goals without involving nuclear power. The cost profile of solar and wind energy (assuming no NIMBY problems) has come down somewhat, but not enough for a major country to rely on them as the dominant power source. This is especially the case in northern-European countries who are leading this charge despite less than favorable levels of sunlight for solar farms.