Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

China Is on a Big Gold-Buying Spree

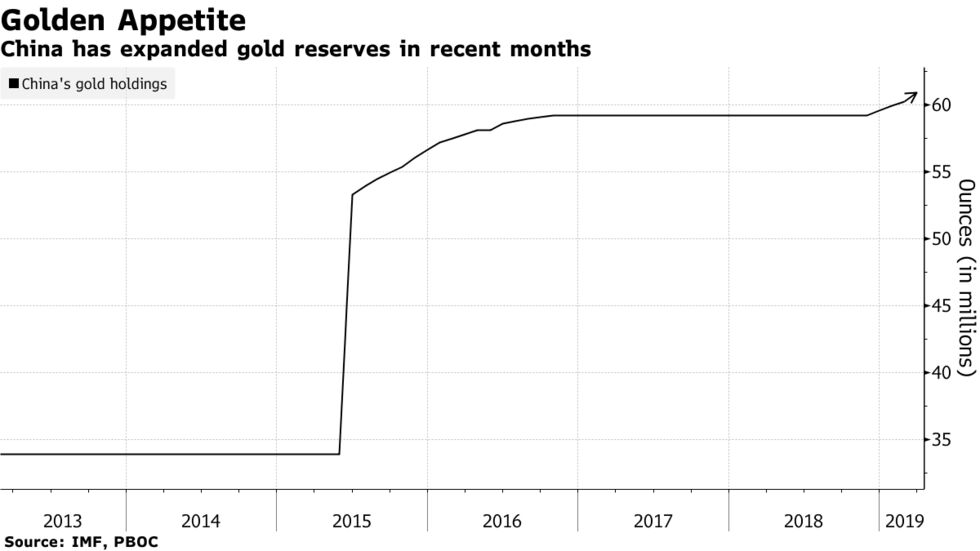

China’s on a bullion-buying spree as Asia’s top economy expanded its gold reserves for a fourth straight month, adding to investors’ optimism that central banks from around the world will press on with a drive to build up holdings. Prices advanced back toward $1,300 an ounce.

The People’s Bank of China raised reserves to 60.62 million ounces in March from 60.26 million a month earlier, according to data on its website on Sunday. In tonnage terms, last month’s inflow was 11.2 tons, following the addition of 9.95 tons in February, 11.8 tons in January and 9.95 tons in December.

China, the world’s top gold producer and consumer, is facing signs of a slowing economy, even as progress is being made in trade negotiations with the U.S. The latest data from the PBOC indicate that the country has resumed adding gold to its reserves at a steady pace, much like the period from mid-2015 to October 2016, when the country boosted holdings almost every month. Should China continue to accumulate bullion at the current rate over 2019, it may end the year as the top buyer after Russia, which added 274 tons in 2018.

Last year’s bullion buying by emerging-market central banks was the most robust in a long time as countries diversified reserves, Ed Morse, Citigroup Inc.’s global head of commodities research, said in a Bloomberg TV interview on Monday. The bank’s positive on gold, targeting $1,400 by year-end.

Spot gold fell for a second month in March even after the Federal Reserve signaled it would pause rate hikes, which led to a surge in equities instead. Still, the longer-term outlook is more bullish as central-bank demand should help support prices, with inflows running as high as last year, according to Goldman Sachs Group Inc., which expects a rally to $1,450 an ounce over 12 months. Bullion for immediate delivery was at $1,297 on Monday.