Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

China's Next Big Rare Earth Move

For at least the last two years, I’ve explained that confidence in governments is dying around the world, that central bankers are losing control, that global growth is slowing, that the next financial crisis would come as a result of a bond blowup, and that China would be the largest beneficiary of this crisis as a bond market blowup has the potential to cause institutions to fall, power to shift, and a realignment of the financial pecking order.

It is curious and alarming that all of those themes seem to now be playing out on the global stage simultaneously.

The simultaneous part is important because tossing around one live grenade can easily lead to an unpleasant accident, but tossing around multiple live grenades at the same time almost ensures an unpleasant accident.

You all know I believe volatility is here to stay and that volatility will be a major catalyst that sends gold and commodities into a historic bull market.

There is now a very serious and new potential secondary catalyst: China withdrawing from the WTO.

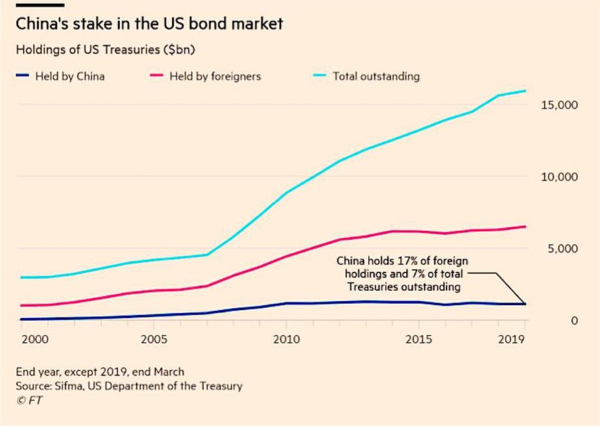

While U.S. bond holdings are a weapon, they are not what will lead China to withdraw from the WTO, but it will be the death blow in the long run.

China has always had leverage with rare earths pricing. It has flexed that leverage by charging much less for rare earths in China than it does for rare earths outside of China, forcing manufacturers (think high-tech, not industrial) to set up shop in China while China picks off the technology, reverse engineers it, and uses it for its own purposes.

It did this in 2012 when the WTO intervened and put a halt to the practice. I remember those days clearly because of the mania surrounding critical metals, specifically rare earths.

What if China decides to withdraw from the WTO? Deciding it is no longer beneficial or even necessary for it to advance its goals.

It’s easy to speculate on the next move. China has a dominant stranglehold on the rare earths market.

The U.S. relies on China for about 80% of its rare earths. It’s why Europe is in such a rush to establish an independent supply chain. It’s why Leading Edge Materials has always been an important company in Europe’s development — even if the market (for now) doesn’t get it.

It’s not hard to imagine a scenario where China pulls out of the WTO and immediately decides to slash rare earth prices within China to 1/5th or 1/10th of the rare earth prices outside of China.

The move would bankrupt outside rare earth competition — remember Molycorp? No? Google what happened to it — and force manufacturing giants (think high-tech, not industrial revolution manufacturing) that require large amounts of rare earths to move operations to China.

I’ve mentioned that it is eerie how all these events that I’ve cautioned about are playing out simultaneously. Remember the Belt and Road initiative I wrote about over a year ago?

That project may very well be the fire to the match that allows China this course of action.