Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Citi says US and China will nail deal, aiding commodities

The outlook for commodities is bullish, according to Citigroup Inc., which expects raw materials to be supported by a confluence of positive factors including the agreement of a trade deal between Washington and Beijing, improved demand from China, and a weaker dollar.

The bank’s base case is that the U.S. and China will agree to end their protracted trade fight by the end of June, paving the way for tariffs to be lifted, analysts including Ed Morse said in a report. A deal between the two economies is now “on course” for the end of the second quarter, the bank said.

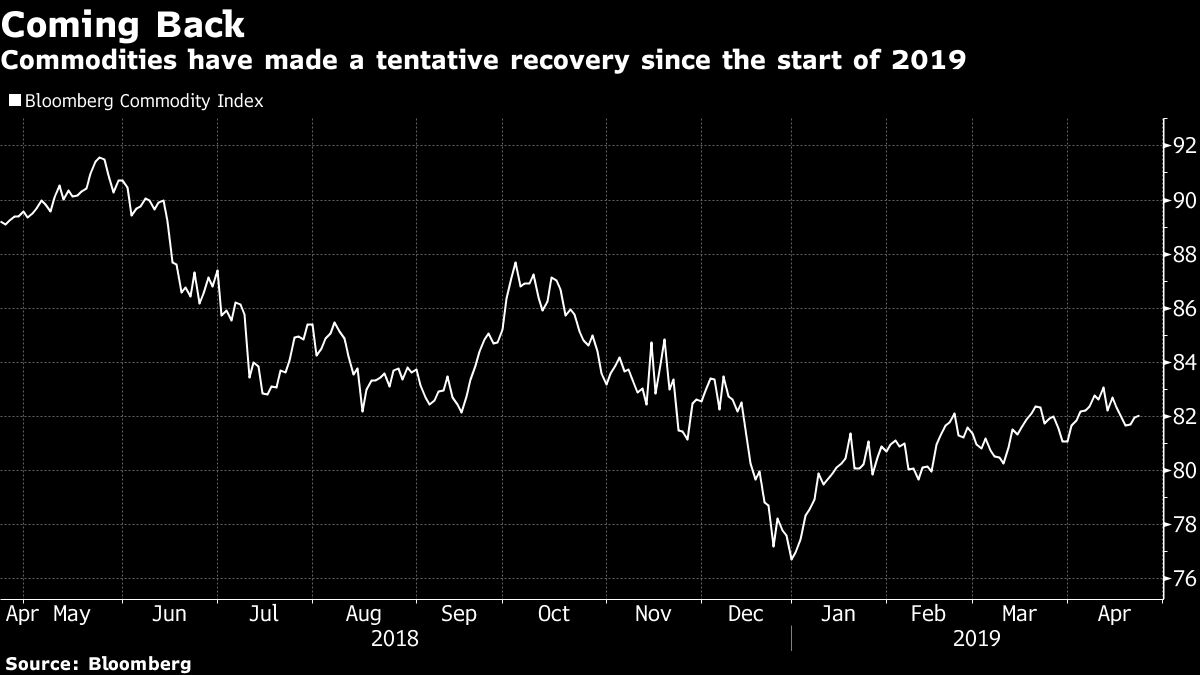

Raw materials have advanced in 2019 aided by gains in energy and metals, with the latest leg up this week driven by the U.S. decision not to extend sanctions waivers for buyers of Iranian crude. At the same time, the U.S. and China have stepped up the pace of diplomacy to try to resolve their trade squabble, with speculation that an agreement may come next month. A resolution would benefit demand for commodities from soybeans to pork.

“Partly as agreed during the trade talks, China is expected to boost purchases of energy and agricultural products from the U.S. in the months and years ahead,” the bank said. The current period will be “be another strong quarter for commodities,” and raw materials are also “looking up” into the third quarter and potentially to year-end, it said.

Global growth is seen at 2.8% this year and 2.9% in 2020, according to the bank, which described that outlook as “still reasonable.” It added: “While a constructive global economic outlook is good for commodities, China being a key engine for global growth would be a further positive.”

A weaker U.S. currency may reinforce the boost. “Citi expects the U.S. dollar to trade flat to slightly lower versus other G-10 and EM currencies in the short term, and should weaken over a six-to-12 month horizon,” it said. That should support demand for dollar-denominated commodities, the bank said.