Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Cobalt Miners News For The Month Of December 2017

Summary

Cobalt spot price news - Cobalt spot prices rise sharply.

Cobalt market news - "Electric vehicle revolution a rare investment opportunity as metals demand spikes." "BMW sees 10-fold jump in its need for battery materials by 2025."

Cobalt miner news - Katanga Mining production recommences with an increased cobalt target to 30ktpa (life of mine).

This idea was discussed in more depth with members of my private investing community, Trend Investing.

Welcome to the December 2017 cobalt miner news. Below is a background on my earlier articles on the cobalt miners.

- May 2016 - "Cobalt Miners Set To Boom"

- December 2016 - "A Look At The Junior Cobalt Miners"

- December 2016 - "Top 5 Cobalt Miners To Consider"

- March 2017 - "Top 3 Cobalt Miners To Accumulate"

- September 2017 - "Top 3 Cobalt Juniors To Consider"

Cobalt price news

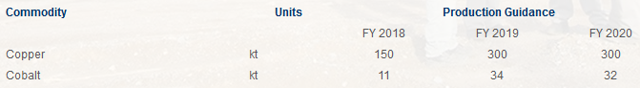

As of December 21, the cobalt spot price was US$34.02, rising very strongly from US$27.67 this time last month.

Cobalt spot prices - 1-year chart

Source: InfoMine.com

Source: InfoMine.com

On November 21 at the Hard Asset Conference Mike Beck stated he sees cobalt prices going much, much higher "in excess of (NYSEARCA:USD) 100/lb" as you can view in his video here (15.20 mark), "Mike Beck: Nickel, Cobalt, and Lithium to Benefit From Generational Demand Shift in Commodities." Current cobalt prices are around USD 34/lb.

On December 4 Platts.com reported, "Cobalt prices seen rising sharply as deficit balloons: BMO. Cobalt prices are likely to rise significantly in the next two years as the industry struggles to meet rising demand from batteries used in electric vehicles, BMO Capital Markets said Monday. It sees the annual average cobalt price peaking at $40.50/lb ($89,290 mt) in 2019, from current levels of about $30/lb and does not rule out the possibility of cobalt prices doubling from current levels in the timeframe."

Cobalt demand and supply

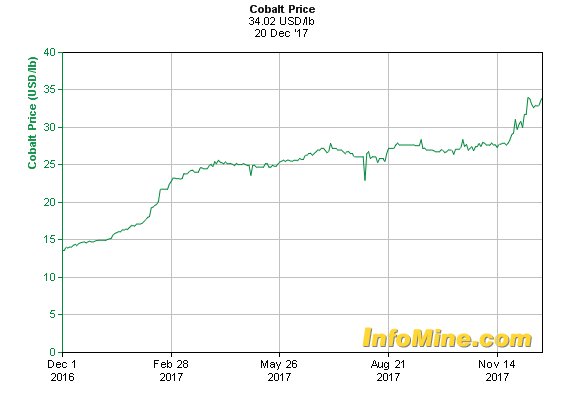

Cobalt demand is forecast to grow strongly due to demand from electric vehicles (EVs); however supply is very constrained, leading to the current cobalt deficit.

Source: Canaccord Genuity Research

Source: Canaccord Genuity Research

CRU stated earlier in 2017 it "expects 900 T (tonnes) cobalt deficit this year." Investing News state that Macquarie Bank forecasts "a deficit of 885 tonnes is expected next year (2018), with deficits of 3,205 tonnes and 5,340 tonnes expected in 2019 and 2020, respectively."

My cobalt production table (work in progress)

| Cobalt miner (tpa) | 2017

(estimate) |

2018 (forecast) |

| Chinese (Jinchuan, Huayou Cobalt, Jiangsu Cobalt) | 47,000 | |

| China Molybdenum (OTC:CMCLF) | 15,909 | |

| Glencore (OTCPK:GLCNF) (Minara, Mopani, Mutanda) | 29,000 | 40,000 |

| Katanga Mining (OTCPK:KATFF) (plans ~11,000tpa in 2018, and ~34,000tpa by 2019 if demand is there) | 0 | 11,000 |

| Sherritt International (OTCPK:SHERF) | ~7,000 | ?reduced |

| Umicore SA (OTCPK:UMICF) | 6,500 | |

| Vale (NYSE:VALE) | ~6,000 | |

| ERG - ENRC (Chambishi) (plus an additional ~14,000tpa from ~2019) | ?4,317 | |

| Sumitomo (27.5 % Ambatovy Nickel, Madagascar) | 4,500 | |

| ICCI | 4,000 | |

| Zambia | 4,000 | |

| Norilsk Nickel [LSX:MNOD] (OTCPK:NILSY) | ~5,500 | |

| Freeport-McMoRan (NYSE:FCX) | ~2,000 | |

| Others - S.Africa (1,230) | 5,000 | |

| TOTAL | ~130,000 | ~140,000 |

NB: My estimate is 140,000tpa cobalt production for 2018 (my demand forecast for 2018 is 146,000tpa). Exane BNP Paribas forecasts ~200,000mt market by 2022, and 300,000mt by 2025. Also note Glencore includes their share of Katanga Mining in their figures. Glencore/Katanga expect to reach 60,000 tpa by end 2019. I will know better the 2018 forecasts by Jan. 2018.

Source: Cobalt News and my own research/estimates

On December 4 Reuters reported, "MINOR METALS-Limited supply, higher demand push cobalt prices up. “The cobalt market is being squeezed, there is a lack of material,” a trader in the U.S. said, adding that strong demand from jet engine makers was partly behind a tighter market. Also behind surge since December 2015, when the price was below $10 a lb, is growing interest in electric vehicles powered by cobalt-containing lithium-ion rechargeable batteries. “It has become a sellers market ... We see prices rising at least until January 2018,” a Luxembourg-based trader said."

On December 12 Bloomberg quoted Glencore Ivan Glasenberg stating: "Still, even with increased supply from Glencore’s mines, there will not be enough cobalt to deliver the number of electric vehicles needed and new battery technology using less or no cobalt will be required, Glasenberg said. Glencore estimates that at least 314,000 tons of additional cobalt production would be required to make 30 percent of new vehicles electric by 2030." Exane BNP Paribas forecasts ~300ktpa cobalt demand by 2025. My model is forecasting 377ktpa by end 2025 (at 20% EV market share), and 682ktpa by end 2030 (at 40% EV market share), using just 8kgs cobalt per electric car.

Cobalt market news

On November 24 Bloomberg Technology reported, "BMW joins race to secure cobalt for electric-vehicle batteries. Carmaker says it’s talking to all suppliers of the chemical. With one eye on accelerating demand for electric vehicles, BMW AG said it’s talking to suppliers of cobalt and other battery materials amid fears that stocks will run short and push already inflated prices higher."

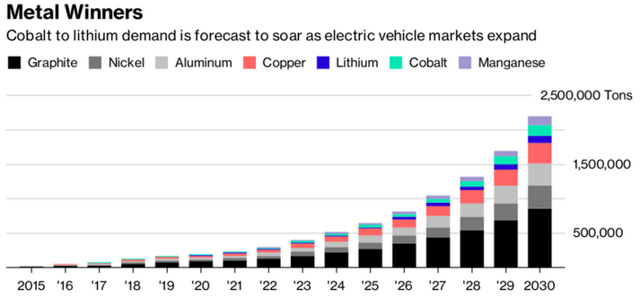

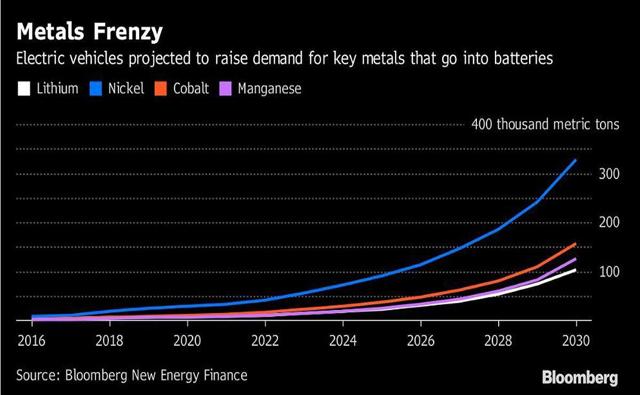

On November 30 Bloomberg Technology reported, "‘Miner's revenge’ is coming with electric cars, Friedland says. Surging demand for metals like copper, nickel and cobalt for use in electric vehicles promises to overturn the balance of power between mining companies and their customers, according to billionaire investor Robert Friedland. Automakers will have to change the way they approach procurement if they want to power their vehicles, said Friedland. “Coming soon to a theater near you: this is the revenge of the miner,” said Friedland. “No miner is willing to sell a high-volatility metal to a car manufacturer at a fixed price.” The graph below from the above article highlights the rapid increase in EV metals demand that is forecast.

EV metals set to boom

Source: BNEF

On December 1 Mining Weekly wrote one of the best article I have read in 2017 - "Electric vehicle revolution a rare investment opportunity as metals demand spikes." From the article:

The rate at which global automotive markets are adopting electric vehicles (EVs) is accelerating at a much faster pace than even some of the keenest market observers estimated at the start of 2017, and is opening up once- in-a-lifetime investment opportunities among the four key ‘energy metals’ – lithium, cobalt, nickel and graphite. Since the beginning of 2017, the market has reached a new peak of lithium-ion battery capacity in the pipeline. An additional 153 GWh has been added to planned capacity build-outs this year alone, taking the total to 372 GWh. “But when you look at where we need to be by 2025 – 750 GWh, of which 645 GWh is for EVs – we are still way short. What the megafactory trend is doing, however, is creating a new production base that did not exist before. This will be the base for the new auto industry, as it is engulfed by electrification”, founder and MD of London-based Benchmark Minerals Intelligence Simon Moores tells Mining Weekly in an interview. “The EV situation is a once-in-100-years occurrence. Right now, the lithium industry is way short of new supply in the pipeline for 2025. There are 24 lithium-ion battery factories announced and at varying degrees of construction." Critical metals expert and House Mountain Partners founder Chris Berry says, “One could easily see more than 500 GWh of capacity by 2025 – over six times larger than today’s capacity. This is why many market watchers are ramping their lithium demand estimates upwards. “I see a tight lithium market to 2020, with a long-term price of around $11 000/t on an LCE basis. Berry believes that breakthroughs in battery chemistry are happening increasingly often, but he does not believe lithium-ion batteries will be unseated soon as the preferred battery for mobility for several more years. Instead, one will continue to see lithium-ion battery prices fall by 8% to 12% a year going forward and energy density increase in the mid- single-digit range, but engineering out or substituting lithium in the battery “just will not happen". “Something special and unprecedented is going to have to happen in the cobalt space to satisfy EV demand by 2022 onwards. Despite developments in chemistry, a lot more cobalt is going to be needed", says Moores.

On December 5 Investing News released a summary of cobalt events in 2017 called "Cobalt Trends 2017: Prices Spike as Supply Concerns Grow." A great read.

On December 7 Asian Metal reported, "BYD: Passenger cars to be equipped with NCM lithium battery in 2018." This means the world top EV seller will now need cobalt and nickel in their batteries, thereby boosting demand for the two metals. BYD previously used lithium iron phosphate, and will continue with that chemistry for their buses and trucks and their taxi car (E6).

On December 7 Investing News wrote, "Cobalt forecast 2018: CEOs optimistic." The consensus from the CEOs for 2018 was "supply worries to push prices higher."

On December 8 Investor Daily reported: "Automation to drive demand for metals in 2018. We now stand at a tipping point for a new generation of commodities driven by intertwining technologies among the themes of energy efficiency, automation and climate change, which are likely to be central for demand. Because metals were used often in the production of batteries or technologies such as self-driving vehicles, lithium, cobalt, copper and silver will enjoy greater demand."

On December 15 Reuters/4-traders reported, "Australia cobalt rush accelerates on electric vehicle demand, DRC troubles. Australia, home to the world's second-biggest cobalt reserves, is seeing a rush of interest in projects still years from production as makers of batteries used in electric vehicles (EVs) seek supplies of the metal from a more costly but less risky source than top miner, the Democratic Republic of Congo. As auto makers seek to develop greener cars, shares in Clean TeQ - owner of one of the largest cobalt deposits in Australia - have trebled this year. Minnows Cobalt Blue, Australian Mines, Artemis Resources and Aeon Metals have also seen shares surge."

On December 15 Bloomberg reported, "BMW sees 10-fold jump in its need for battery materials by 2025. BMW AG’s needs for car-battery raw materials such as cobalt and lithium will surge 10-fold by the middle of the next decade, pushing the German car maker increasingly to forge long-term deals as shortages loom. Purchase contracts with five- to 10-year time frames are close to being completed, the manufacturer’s head of procurement told reporters in Munich Friday. The boom in electric cars could more than quadruple demand for cobalt to in excess of 450,000 tons by 2030 from less than 100,000 tons last year, according to Bloomberg New Energy Finance."

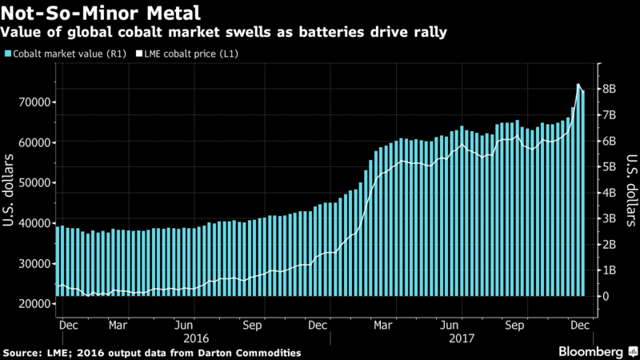

On December 18 Bloomberg wrote, "How batteries sparked a cobalt frenzy and what could happen next. Expanded Glencore mine may keep cobalt market in surplus: CRU. High prices could spur substitution and recycling: BMO." The graph below from the article shows the cobalt rally has clearly been helped by a rising cobalt price, at least until now.

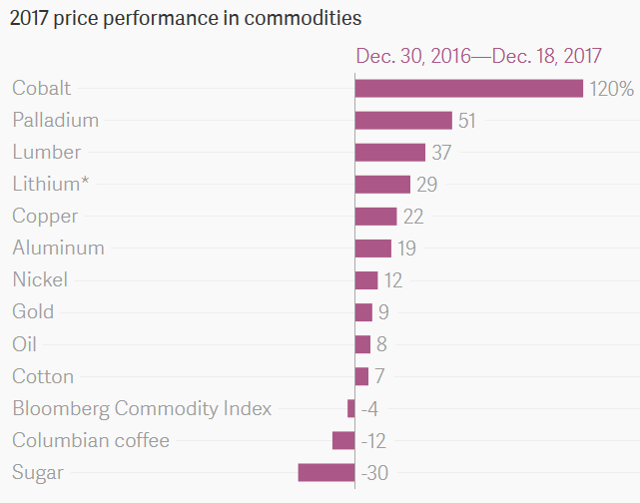

On December 18 Quartz reported, "Electric cars have made this once obscure metal the hottest commodity of 2017. The price of cobalt surged 120%, while the Bloomberg commodity index fell 4%." The graph below says it all.

Sources: Quartz and Benchmark Mineral Intelligence

On December 20 The San Francisco Chronicle reported, "Trump orders boost in production of critical minerals. President Donald Trump on Wednesday ordered the government to boost production of critical minerals used for manufacturing everything from smartphones to wind turbines and cars, raising the prospect of more mining.A new executive order directs federal agencies to find ways to increase exploration, mining and processing of critical minerals and streamline permits for private mining companies. The order directs Interior Secretary Ryan Zinke to develop a strategy to reduce reliance on foreign minerals within six months." Cobalt was one of the listed critical minerals.

On December 20 Scientific American wrote, "Could cobalt choke our electric vehicle future? "The best lithium battery cathodes [negative electrodes] all contain cobalt, and its production is limited", says study lead Elsa Olivetti, a materials scientist and engineer at the Massachusetts Institute of Technology. Cobalt's unique atomic properties let cathodes pack a lot of energy into a small space and help to maintain the cathodes' layered structure. Lithium is unlikely to be a limiting factor in the long run, they found. But even with a very conservative estimate of 10 million EV sales in 2025, the demand for cobalt that year could reach 330,000 metric tons, whereas the available supply at that time would be at most 290,000 metric tons."

Cobalt company news

China Molybdenum [HKSE:3993] [SHE:603993] (OTC:CMCLF)

On December 15 China Molybdenum announced, "Progress on the establishment of the NCCL Natural Resources Investment Fund. The size of the first installment of the Fund shall be US$500.10 million. The Fund intends to closely embrace the national mining strategy and the Belt and Road Initiative and actively participate in investments and mergers & acquisitions in the natural resources fields and the upstream and downstream of the industry chains."

Glencore [HK:805] (OTCPK:GLCNF)

On December 6 Business Day reported, "Glencore increases metal production for EV batteries to stay ahead of its rivals. EV metals account for roughly 50% of Glencore’s core profit, more than double the proportion of its major listed competitors — BHP, Rio Tinto and Anglo American."

On December 12 Bloomberg reported, "Glencore to double cobalt output on electric vehicle demand. Swiss trader could control about 40% of world (cobalt) market by 2019. Glencore in discussions with Apple, Tesla and VW, CEO says. Glencore Plc will double its production of cobalt in the next two years, tightening its grip on the market for the key battery component of electric vehicles. The Swiss commodity giant’s Toronto-listed Katanga Mining Ltd. in the Democratic Republic of Congo will produce as much as 34,000 tons in 2019, Katanga said Monday."

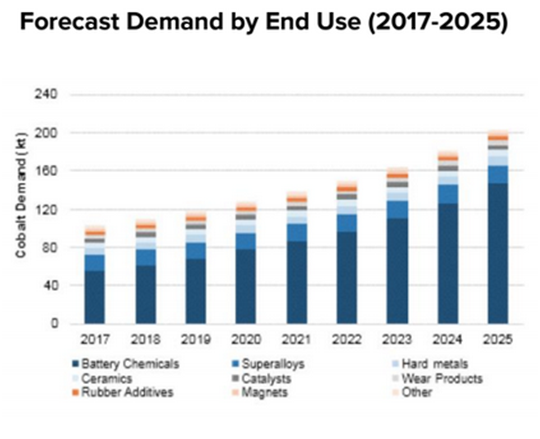

Katanga Mining [TSX:KAT] (OTCPK:KATFF)

On December 11 Katanga Mining announced, "Commissioning of the core of the first train of Whole Ore Leach plant and provides an operational update. Johnny Blizzard, Chief Executive Officer of Katanga, commented: “We are very pleased to have met our anticipated budget and timetable for commissioning the first train of our new plant and are optimistic that the tangible improvements from using a whole ore leach processing circuit will be seen in the near future. We look forward to ramping up to full production capacity of the first train. The construction of the second train of the WOL plant is also on schedule and budget and hot commissioning is still expected to commence in H2 2018. Separately, the Company announces today that its board of directors (“Board”) has approved capital expenditure budgets for the engineering and construction of an upgraded cobalt processing plant (the “Cobalt Debottlenecking Project”) and a sulphuric acid production plant at Kamoto Copper Company (KCC). The Board also approved US$237 million in capital expenditure spread over 2018 and 2019 to construct the sulphuric acid and Sulphur Dioxide production plant at KCC.” Below is a screenshot showing Katanga Mining's production forecasts. Note the increase cobalt guidance to 34ktpa for FY 2019, but life of mine plan is at 30ktpa, making Katanga Mining the world's largest cobalt producer by FY 2019.

You can also read my original article from Jan. 1, 2017, "Katanga Mining is a potential turnaround story." Followers of mine who bought back then with me at CAD 0.13 have made a nice 1,200% gain in 12 months.

Sherritt International [TSX:S] (OTCPK:SHERF)

On December 12 Sherritt announced, "Sherritt closes transaction to restructure Ambatovy joint venture. Consistent with terms previously disclosed, Sherritt has transferred a 28% interest in the Joint Venture (retaining 12%), eliminated $1.3 billion of related debt from its balance sheet, and will continue to serve as operator of the Ambatovy mine, the world’s largest lateritic nickel and cobalt operation, until at least 2024."

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On December 18 Umicore announced, "Umicore held today in Jiangmen (China) the ground-breaking ceremony for its greenfield production site for cathode materials used in Li-Ion rechargeable batteries. It will provide Umicore additional space to significantly increase its production of NMC (nickel-manganese-cobalt) cathode materials for electrified vehicles to meet growing customer demand. Global demand is increasing fast with demand for Umicore’s NMC materials significantly outpacing the market."

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:SMMYY)

On December 19 Sumitomo announced, "Sumitomo Metal Mining Co., Ltd. has taken the decision to commercially recover chromite, which is mainly used as a raw material for stainless steel."

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTCPK:NILSY)

On December 18 4-Traders reported, "PJSC MMC Norilsk Nickel announces the signing of a 5-year USD 2.5 billion facility agreement with the syndicate of international financial institutions. Nornickel's President Vladimir Potanin commented, 'In line with the strategy to optimize its cost of capital our Company has been very active on debt capital markets in 2017. The Company has achieved one of the lowest interest rates of Libor 1M+1.50% per annum."

Investors can also read my recent article, "Time To Buy Norilsk Nickel Before The Nickel Boom Perhaps Starts In 2018."

Freeport-McMoRan Inc. (NYSE:FCX)

No news for the month.

Possible mid-term producers (by ~2020)

eCobalt Solutions [TSX:ECS] (OTCQX:OTCQX:ECSIF)

On December 5 eCobalt announced, "eCobalt to begin trading on OTCQX market in the United States under the symbol “ECSIF” effective today. eCobalt upgraded to OTCQX from the OTCQB Venture Market."

On December 7 eCobalt announced, "eCobalt provides an update on the Idaho Cobalt project optimization." The company is taking "a new direction to produce a clean (low arsenic content) cobalt concentrate product, an upstream precursor material for battery cathode production, that may result in material reduction of capital and operating cost at the Cobalt Production Facility."

On December 14 eCobalt announced, "eCobalt's resource extension drilling hits mineralized zone at ICP."

Investors can read the latest company presentation here.

Upcoming catalysts include:

- 2018 - Project financing

- Q3 2018 - Estimated construction to commence

- Q3 or Q4 2019 - Estimated production to commence

Fortune Minerals [TSX:FT] (OTCQX:FTMDF)

On December 15 Fortune Minerals announced, "Fortune Minerals completes $5M private placement. Fortune is also pleased to report that the Government of the Northwest Territories ("GNWT") recently issued its Request for Proposals ("RFP") for the construction of the Tlicho All-Season Road ("TASR") to the community of Whati."

Upcoming catalysts include:

- Early 2018 - Updated feasibility study capital and operating costs

- 2018 - Off-take or equity partners; project financing

Clean TeQ [ASX:CLQ] [TSX:CLQ] (OTCQX:CTEQF)

On December 14 Clean TeQ announced, "Clean TeQ to commence trading on Toronto Stock Exchange under the ticker CLQ."

Clean TeQ has 132kt contained cobalt at their Sunrise project.

Investors can also read my recent article, "Is A Scandium Boom Next - A Look At The Scandium Miners", and the November company presentation here

Ardea Resources [ASX:ARL] (OTC:ARRRF)

On December 14 Ardea Resources announced, "Extensive scandium complements the cobalt-nickel deposits of Goongarrie South. The two main bodies of scandium mineralisation have been extended: The Pamela Jean/ Patricia Anne measures over 3km strike length. The Elsie Tynan line in the west is now over 2.5km strike length."

Ardea now has 405kt of contained cobalt at their KNP project, with their higher grade KNP cobalt zone having 85,410 tonnes of contained cobalt.

Upcoming catalysts include:

- H2 2017 - Metallurgical results for KNP and Lewis Ponds

- Q1 2018 - PFS results - KNP cobalt project and Lewis Ponds project

- End 2019 - DFS results - KNP cobalt project

Investors can view the company presentations here.

Cobalt Blue [ASX:COB]

On December 4 Cobalt Blue announced, "Railway drilling program confirms grade continuity at depth and along strike. The results demonstrate strong continuity of cobalt mineralisation along both strike and down dip of the previous drilling at Railway. The assays boost the potential for significant enhancement of Mineral Resource supporting the transition from an Inferred to an Indicated Resource, in line with COB’s parallel Pre Feasibility Study (NYSE:PFS). The 2017 drill results are currently being compiled into an upgraded resource estimate, which is scheduled for release in by 1 April 2018."

On December 7, Cobalt Blue posted on their website, "Blue Oceans Equities – Investment Update December 7, 2017". From the report -

"At current cobalt prices of ~US$30/lb, we believe Thackaringa could be worth A$1.2bn!"

Given the current market cap of AUD 90m (EV ~A$80m), that leaves plenty of room for share appreciation.

My interview with their CEO Joe Kaderavek is on Trend Investing here.

Upcoming catalysts include:

April, 2018 - An upgraded resource estimate.

June, 2018 - PFS to be released

First Cobalt [TSXV:FCC] (OTCQB:FTSSF)

On December 14 First Cobalt announced, "First Cobalt reports positive bore hole geophysics results. An electromagnetic program successfully identified a geophysical signature associated with vein-style mineralization intersected in recent drilling as well as an off-hole anomaly, providing a new exploration tool for the Cobalt Camp."

On December 14 First Cobalt announced, "First Cobalt intersects three cobalt veins at Keeley."

On December 14 First Cobalt announced, "First Cobalt closes $30.6 million financing (at CA$ 1.10 per share)."

Investors can view the company presentations here.