Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Cobalt Miners News For The Month Of September 2017

Summary

Cobalt spot price news - Cobalt spot prices very slightly lower.

Cobalt market news - "China to ban sale of fossil fuel cars in electric vehicle push."

Cobalt miner news - CleanTeQ "binding offtake agreement signed with Beijing Easpring."

Welcome to the September 2017 cobalt miner news. For some background on the cobalt miners, please check out my earlier articles:

- May 2016 - "Cobalt Miners Set To Boom"

- December 2016 - "A Look At The Junior Cobalt Miners"

- December 2016 - "Top 5 Cobalt Miners To Consider"

- March 2017 - "Top 3 Cobalt Miners To Accumulate"

Cobalt price news

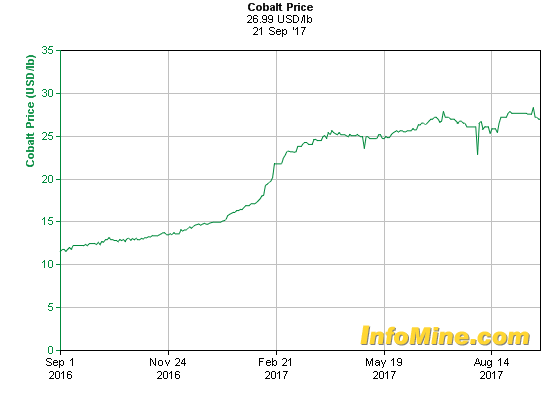

As of Sept. 21, the cobalt spot price was US$26.99, having fallen very slightly from US$27.22 this time last month.

Cobalt spot prices - 1-year chart

(Source: InfoMine.com)

Cobalt demand and supply

On Sept. 7, Bloomberg Technology reported: "Picking electric car winners is BlackRock's key mining challenge. BlackRock’s Hambro sees large demand growth for EV materials. “The biggest theme over the next 10 or 15 years of investing is going to be getting right the transition away from the combustion vehicle towards EVs,” Evy Hambro, who manages BlackRock Inc.’s World Mining Fund, said in a Bloomberg TV interview on Thursday."

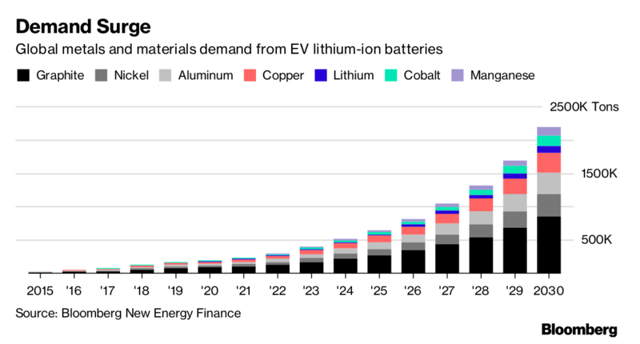

EV metals demand surge coming

Source: Bloomberg New Energy Finance

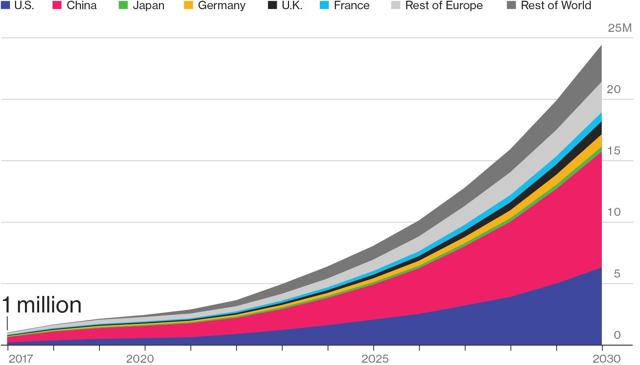

On Sept. 7, Bloomberg Businessweek reported: "We are going to need more lithium." Of course, we will need a lot more cobalt also. Of interest were the two charts below.

EV annual sales forecast to 2030

Source: Bloomberg New Energy Finance

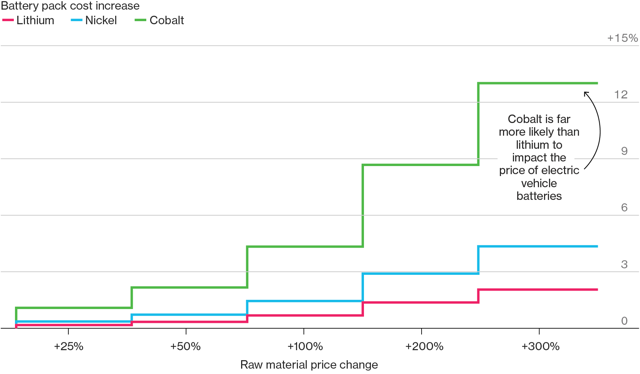

Cobalt prices have the largest impact on battery pack prices

Source: Bloomberg New Energy Finance

On Sept. 11, Bloomberg reported, "China to ban sale of fossil fuel cars in electric vehicle push. Regulators working on timetable for the ban, official says. China joins U.K., France to phase out combustion-engine cars. Xin Guobin, the vice minister of industry and information technology, said the government is working with other regulators on a timetable to end production and sales. The move will have a profound impact on the environment and growth of China’s auto industry, Xin said at an auto forum in Tianjin on Saturday."

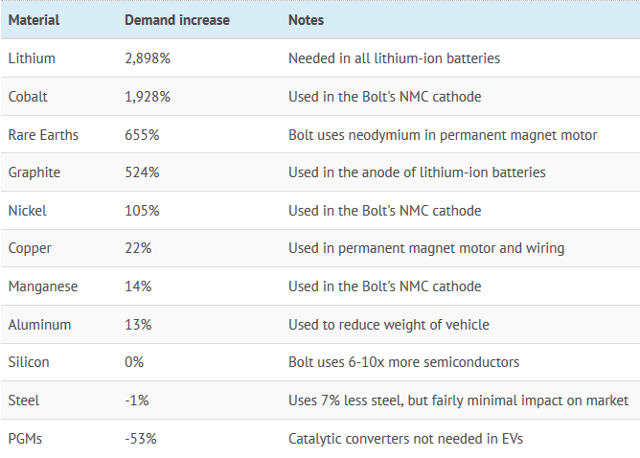

On Sept. 15, the Visual Capitalist released, "The massive impact of EVs on commodities in one chart." Below is a great summary table.

Impact on commodities in a 100% EV world

Source: Visual Capitalist

Note: The above table is based on the Chevy Bolt tear down. Tesla's (NASDAQ:TSLA) batteries have more nickel and less cobalt.

In a recent Bernstein report, they stated (no link): "In our view, therefore, we are likely to see a sustained period of cobalt prices in excess of the last peak in 2008 (US$107,000/t), in order to facilitate the necessary exploration for, and development of, incremental cobalt projects that will be required to satisfy this latest, and most significant, demand-pull in the history of the cobalt industry." For reference, US$107,000/t is ~US$49/lb, and cobalt is now ~US$27.50.

CRU stated earlier in 2017 it "expects 900 T (tonnes) cobalt deficit this year." Investing News state that Macquarie Bank forecasts "a deficit of 885 tonnes is expected next year (2018), with deficits of 3,205 tonnes and 5,340 tonnes expected in 2019 and 2020, respectively." My cobalt production table (work in progress)

| Cobalt miner (tpa) | 2016 | 2017 (forecast) |

| Chinese (Jinchuan, Huayou Cobalt, Jiangsu Cobalt) | 46,966 | 47,000 |

| China Molybdenum (OTC:CMCLF) | 15,909 | |

| Freeport-McMoRan (NYSE:FCX) | 10,944 | ~2,000 |

| Glencore (OTCPK:GLCNF) (Minara, Mopani, Mutanda) | 28,300 | 30,000 |

| Katanga Mining (OTCPK:KATFF) (plans ~11,000tpa in 2018, and ~22,000tpa by 2019 if demand is there) | ||

| Sherritt International (OTCPK:SHERF) | 6,967 | ? |

| Umicore SA (OTCPK:UMICF) | 6,328 | 6,500 |

| Vale (NYSE:VALE) | 5,799 | |

| ERG - ENRC (Chambishi) (plus an additional ~14,000tpa from ~2019) | ?4,317 | ?4,317 |

| Sumitomo (27.5 % Ambatovy Nickel, Madagascar) | 4,418 | 4,500 |

| ICCI | 3,902 | 4,000 |

| Zambia | 3,874 | 4,000 |

| Norilsk Nickel (OTCPK:NILSY) | 3,234 | ~5,500 |

| Others - S.Africa (1,230) | 1,230 | 5,000 |

| TOTAL | ~123,000 | ~130,000 |

NB: Bloomberg Intelligence reported 2016 total cobalt production to be 123,000 tonnes, CRU says 117,000 tonnes. My estimate is 130,000tpa for 2017. Exane BNP Paribas forecasts ~200,000mt market by 2022, and 300,000mt by 2025.

Source: Cobalt News and my own research/estimates

Cobalt market news

On Aug. 30, Investing News reported:

"Asian firm cutting costs by using more nickel in EV batteries. South Korea’s SK Innovation (KRX:096770) has started making mid-and large-sized lithium-ion batteries composed of 80 percent nickel, 10 percent cobalt and 10 percent manganese. That’s compared to the typical lithium-ion battery ratio of 60 percent nickel, 20 percent cobalt and 20 percent manganese. Battery and auto manufacturers need to sign multi-year deals to secure supplies of raw materials including cobalt and lithium. The Volkswagen tender specifies the chemistry for the battery will initially be six parts nickel, two parts cobalt and two parts manganese or 6:2:2, but that it could at some stage switch to 8:1:1. Analysts estimate each battery uses between 8-12 kg of cobalt. That would mean VW will need 24-36 million kg (24-36,000 tonnes) a year for three million EVs, which at current prices would total $1.6-$2.4 billion."

Trying to buy 36,000 tonnes pa of cobalt in a cobalt deficit market will be near impossible.

On Sept. 22, Reuters reported:

"Exclusive: VW moves to secure cobalt supplies in shift to electric cars. Germany’s Volkswagen is moving to secure long-term supplies of cobalt, a vital component of rechargeable batteries, as the group accelerates its ambitious shift to electric cars. Battery and auto manufacturers need to sign multi-year deals to secure supplies of raw materials including cobalt and lithium. Cobalt industry sources told Reuters that VW, the world’s largest automaker, has asked producers to submit proposals on supplying the material for up to 10 years from 2019. Analysts estimate each battery uses between 8-12 kg of cobalt. That would mean VW will need 24-36 million kg a year for three million EVs, which at current prices would total $1.6-$2.4 billion."

Cobalt company news

China Molybdenum (HKSE:3993) (SHE:603993)

No news for the month.

Freeport-McMoRan Inc.

On Aug. 31, 4-traders/Accesswire reported:

"Freeport-McMoRan's and Indonesian government agree to framework for agreement regarding mining rights for Indonesian operations. The Government has given FCX the option to immediately apply for a 10-year permit to continue operations at Grasberg beyond 2021 with the option of a second extension of another 10 years to be proposed before the expiry of first extension in 2031. PT-FI has agreed to build a new smelter in Indonesia within next five years. The most important and defining point agreed by FCX was that it would reduce its stake in PT-FI to 49% so that Indonesian entity(s) would own the controlling and majority stake of 51% in PT-FI. This follows Indonesia's new local ownership rules introduced in January 2017. However, the Company has clarified that the divestment would be structured in such a way that FCX will continue to have operational control and governance of PT-FI. FCX is looking to realize a "fair market value" for its divestment, however, the Government could be looking at a lower valuation."

Glencore (HK:805)

On Aug. 30, Bloomberg reported, "Glencore reaches Zambia power deal after President steps in. Copperbelt Energy Corp. will restore power to Glencore’s Mopani Copper Mines and the two will conclude an agreement over a period of six weeks."

On Sept. 8, Glencore announced they will decrease their stake in Russia's Rosneft.

Katanga Mining

On Aug. 29, Katanga Mining announced:

"Katanga Mining provides update on independent directors' review and restatement of certain financial statements. Katanga reports that the independent directors' review is ongoing and that it continues to work diligently and devote all necessary resources to file its 2017 second quarter financial statements and related disclosures and its restated historical financial statements and related disclosures as soon as practicable. Despite such efforts, the Company now expects to complete the review and make such filings on or before October 15, 2017."

You can also read my original article from Jan. 1, 2017, "Katanga Mining is a potential turnaround story." Followers of mine who bought back then with me at CAD 0.13 have made a tidy 523% gain in 9 months.

Sherritt International

On Sept. 28, Sherritt announced, "Sherritt provides update on the impact of Hurricane Irma on operations. Although our production activities were interrupted by Hurricane Irma, the disruption was relatively insignificant thanks to the considerable preparation and planning efforts we undertook with our Cuban partners."

Umicore SA (Brussels:UMI)

On Sept. 19, Umicore announced: "Acquisition of own shares." The company has bought back a total of 356,011 shares in 2017.

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:SMMYY)

On Aug. 8, Sumitomo Metal Mining announced, "Sumitomo Metal Mining Co., Ltd. (“SMM”) has decided to withdraw from the (Solomon Island) nickel exploration project." That paves the way for Axiom Mining [ASX:AVQ] (OTC:AXNNF) to re-apply to mine the very promising nickel project.

On Aug. 8, Sumitomo Metal Mining announced their "consolidated financial results for the first quarter ended June." Included in the report was "forecast for consolidated operating results for the fiscal year ending March 31, 2018. Second quarter (cumulative) profit per share: ¥67.08. Full-year profit per share: ¥114.21."

MMC Norilsk Nickel

On Aug. 31, 4-traders announced, "Kola MMC to upgrade its transportation and logistics scheme on the back of increased output."

Possible short-/mid-term producers

eCobalt Solutions (TSX:ECS) (OTCQB:ECSIF)

No news for the month; however, the FS results are expected to be out by end September.

Investors can read the latest company presentation here. Long term followers of mine may recall my first discussion in December 2015 of eCobalt when they were at 8 cents and known as Formation Metals, in my article, "Key Stocks To Create Your Own 'Green Home And Vehicle' Portfolio."

Upcoming catalysts include:

- September 2017 - Feasibility Study (FS) results

- 2017-2018 - Project financing

- Q3 2018 - Construction to commence

- Q3 or Q4 2019 - Production to commence

Fortune Minerals [TSX:FT] (OTCQX:FTMDF)

On Sept. 9, Engineering News wrote, "Improving prices prompt Fortune to aim for bigger, more economic Nico development. “With cobalt metal trading in the $30/lb range right now, and our main product, cobalt sulphate, having been up to $35/lb, we have taken the opportunity to re-evaluate the operation. We are working on restating the resource and are rethinking the mine plan, since the higher grades found in the deposit allow us to tailor production to market demand,” ((NYSE:CEO)) Goad stated." He also explained that the updated Feasibility Study will be delayed until later in 2017 at least.

On Sept. 19, Fortune Minerals released, "Fortune Minerals reports all-season road milestone. The Government of the Northwest Territories has selected three consortiums of large Canadian and International firms to advance to the Request for Proposal ("RFP") stage, subject to progress of the environmental assessment ((NASDAQ:EA))."

Investors can read more about Fortune Minerals in my article here, and the company's September presentation here.

Upcoming catalysts include:

- Q3 2017 - Updated feasibility study capital and operating costs

- 2017 - Off-take or equity partners; project financing

First Cobalt [TSXV:FCC] (OTCQB:FTSSF)

On Sept. 18, First Cobalt announced, "First Cobalt exits Congo to focus on Canada."

First Cobalt Corp. (TSX-V: FCC, OTC: FTSSF) (the “Company”) has elected not to complete the strategic alliance over seven cobalt exploration properties in the Democratic Republic of the Congo, previously disclosed on May 1, 2017.

The Company will focus its efforts in 2017 on the Canadian Cobalt Camp. The previously announced mergers with Cobalt One Ltd. and CobalTech Mining Inc. will be completed later this year, resulting in a combined land position of more than 10,000 hectares in the Cobalt Camp containing approximately 50 past producers and mine workings. The high number of advanced exploration targets ready for immediate work in the Cobalt Camp greatly offsets the potential in the DRC properties at this time. The Company may evaluate cobalt opportunities elsewhere in the future, where the exploration project potential aligns with the Company’s overall strategy to offer investors leveraged access to the growing cobalt market.

Disappointing news but the positive is reduced risk.

Ardea Resources (OTC:ARRRF)

On Sept. 15, Ardea Resources announced:

"Heavily oversubscribed placement raises $5.54M. The new shares will be issued at a price of 72.5 cents per share being the same issue price as under the Company’s recently completed share purchase plan. The Company will have over $12m cash upon settlement of the placement. Funds raised will be used to accelerate KNP Cobalt Zone drill programs (previously scheduled for 2018) which will expedite completion of the KNP PFS and bring forward the KNP DFS. The Company will also use funds raised to employ additional technical staff and drill-out its non-core gold and base metal projects (e.g. Mt Zephyr) to evaluate potential further work, JV or spin out opportunities."

Upcoming catalysts include:

- H2 2017: Metallurgical results for KNP and Lewis Ponds

- Q1 2018: PFS results - KNP cobalt project and Lewis Ponds project

- Late 2019: FS results - KNP cobalt project

Investors can view their presentations here.