Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

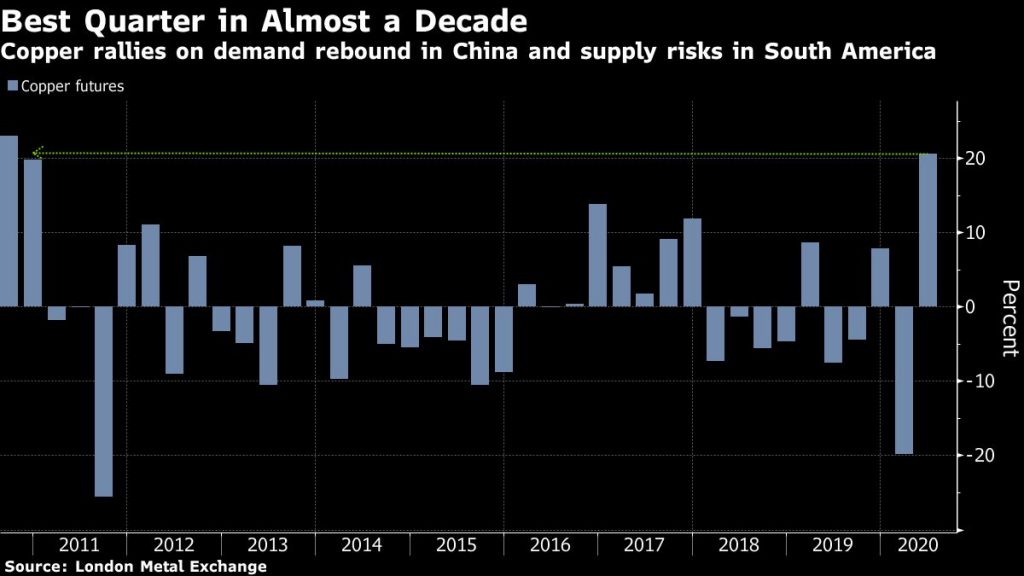

Copper heads for best quarter since 2010 as supply worries mount

Copper is poised for its best quarter since 2010, helped by optimism over a stronger-than-expected demand rebound in top consumer China and mounting supply concerns in South America.

The metal used in everything from automobiles to electronics has surged about 20% this quarter, and climbed above $6,000 a metric ton last week for the first time since the covid-19 outbreak became a global pandemic.

Prices have rallied steadily over the past three months, fueled by sentiment over consumption prospects as first China and then other large economies began to ease lockdowns.

While a new wave of infections adds risk to the demand outlook, the market is getting support from global economic stimulus and concern over mine shutdowns. A report Friday showed hedge funds cut bearish bets on U.S. copper futures and options to the lowest since 2018.

“The basis of the copper rally was three-legged,” said Tai Wong, head of metals derivatives trading at BMO Capital Markets. “The Chinese economic recovery, despite clear warning signs, has surprised strongly versus market expectations; Covid-related supply disruption has been growing rapidly; and traders were fairly short copper and were forced to grudgingly cover throughout the quarter and are now finally small long.”

The metal for three-month delivery rose 0.1% to $5,961.50 a ton at 5:50 p.m. on the London Metal Exchange, its highest closing price in five months.