Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Copper Is Trying To Build A Base

Copper is the commodity that is the leader of the nonferrous group of metals that trade on the London Metals Exchange. The LME is a forward market that serves as the hedging center for producers and consumers of the industrial commodities around the world.

The price of copper has suffered under the weight of the trade war between the US and China. China is the demand side of the equation for the copper market, as it is an essential raw material for building infrastructure. The latest GDP data from China showed that the economy grew at 6%, which was the lowest level since 1992. Aside from the trade-related issues, China is shifting from manufacturing to a service economy. The world continued to treat China as an emerging market until US President Trump took the initiative to change the status quo. Aside from having bipartisan support in the US, many other countries around the world favor leveling the playing field on international trade with the Chinese now that they have the world’s second-largest GDP.

Copper will continue to be highly sensitive to the trade war over the coming weeks and months. A change in the leadership of the US would not likely cause a shift in the current policy towards China. Copper is likely to move higher or lower with the issue, but the red metal is attempting to build a base at around the $2.60 per pound level. Southern Copper Corporation shares (SCCO) move higher and lower with the price of the nonferrous metal.

A trading range since September

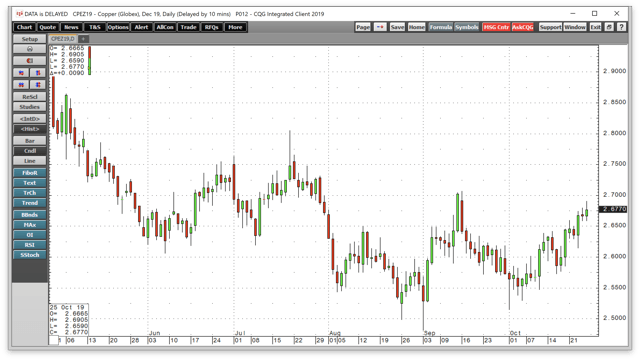

On August 1, US President Donald Trump escalated the trade war by slapping additional tariffs on Chinese goods coming into the US. China quickly retaliated. The President became frustrated with the pace of negotiations and Chinese backtracking during the process. Since copper is a barometer for economic growth around the world and in China, the price of the red metal dropped to a low at $2.5450 per pound in early August. After a recovery to $2.65, the price declined to a lower low at $2.4820 on the active month December contract on September 3. The continuous futures contract fell to $2.4675 per pound, which was the lowest price since December 2016. Since early September, copper has been trading in a range.

Source: CQG

As the daily chart of December futures highlights, since the early September low, the price of copper traded in a range from $2.5150 to $2.7065 per pound. At $2.6770 at the end of last week, the price of the red metal has been trending higher and was closing in on the top end of its trading range.

Technical metrics are not bearish in the medium and long term

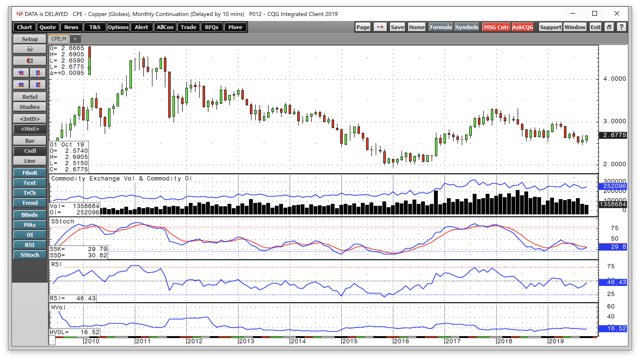

The price of copper has been consolidating since its move to the low in early September.

Source: CQG

The monthly chart shows that the price of copper has been trading sideways but has moved higher over the past two months. Technical metrics indicate that the copper market could be preparing to break to the upside. The total number of open long and short positions in the COMEX futures market has been stable around the 250,000 contract level and was at 252,096 contracts at the end of last week. Price momentum at below the 30 level is in the upper region of oversold territory, while relative strength at 46.45 is a touch below neutral. Monthly historical volatility at 16.53% is below the midpoint level for the copper market compared to the level of price variance over the past decade.

The monthly technical metrics are not bearish for the price of copper and could be setting the stage for a move higher over the coming weeks or months.

Inventories are supportive

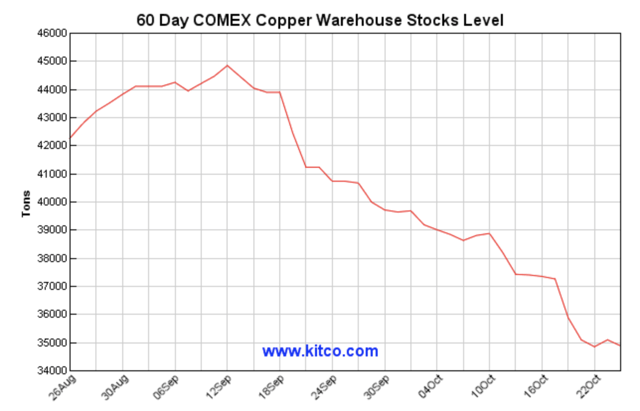

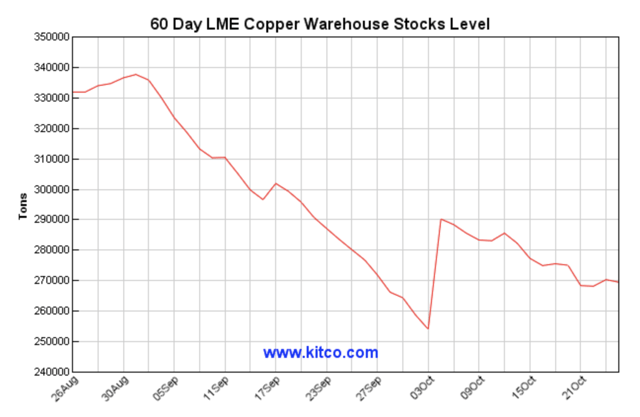

Copper stockpiles on both the London Metals Exchange and COMEX division of the Chicago Mercantile Exchange have been declining.

Source: LME/Kitco

The chart shows that inventories of copper in LME warehouses around the world have dropped from almost 340,000 metric tons in early September to 265,250 tons late last week.

Source: COMEX/Kitco

At the same time, copper inventories on COMEX dropped from almost 45,000 tons in mid-September to under 35,000 tons at the end of last week. The decline in stocks is supportive of the price of copper.

A “Phase One” trade agreement would be a boost

The most recent development in the ongoing saga of trade between the US and China has been discussions over a “phase one” deal that would freeze some tariffs and allow for Chinese purchases of agricultural commodities from the United States. While the Trump administration hailed the progress, the Chinese warned that it is too soon to pop the champagne on a breakthrough when it comes to the trade war. China’s negotiators said they need more time and discussions before signing any agreement.

While there were conflicting signals from both sides, any progress on trade would be a welcome sign for the Chinese economy. Copper would be a beneficiary of a thaw in the trade war, and an eventual deal could ignite the price of the base metal and other industrial commodities on the upside.