Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

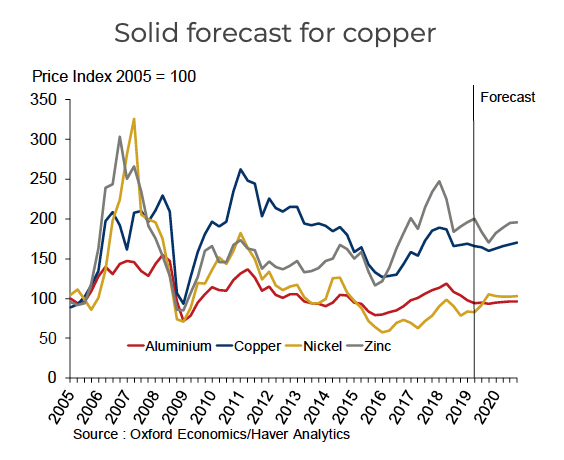

Copper price bears “overlooking decent fundamentals”

The price of copper came under pressure again on Thursday amid worries about a global economic slowdown, particularly in manufacturing, vital to overall demand for the bellwether metal.

In early afternoon trading in New York, copper for delivery in July was at $2.5475 a pound ($5,615 a tonne), not far off levels last seen in 2017.

Trade worries have dogged copper price bulls for the better part of a year, but more recently weak data from China, the US and Germany, the world’s top three consumers of industrial metals, has intensified the sell off.

The US manufacturing purchasing managers index (PMI) fell to below 50 today, the lowest reading since 2009 and the first sign that slowing growth in the sector may be turning into outright contraction of activity.

China, which imports more than half the world’s copper, posted the weakest industrial output growth in 16 years in July (although at 4.8% expansion year-on-year, still the envy of developed economies), while the month before German industrial production registered its biggest annual decline in nine years.

A new report by Oxford Economics argues that the copper market’s “decent fundamentals are getting overlooked amid the gloomy backdrop for financial markets”:

The latest Copper Study Group data flagged up a 1% fall in global copper mine production in the first four months of 2019. Also, copper is constrained by a weak global pipeline of mine projects, and production in Chile was down 1% y/y in both May and June, partly due to strike action.

Spot treatment charges (which fall during periods of tightness) are currently down 37% y/y.

We expect the copper market to be in deficit this year and as a result prices look oversold relative to fundamentals.

In another sign of underlying weakness in demand, global copper inventories have been rising steadily after hitting four-year lows in January. Stocks in London Metal Exchange supervised warehouses around the world jumped by 11% over just the past month.