Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

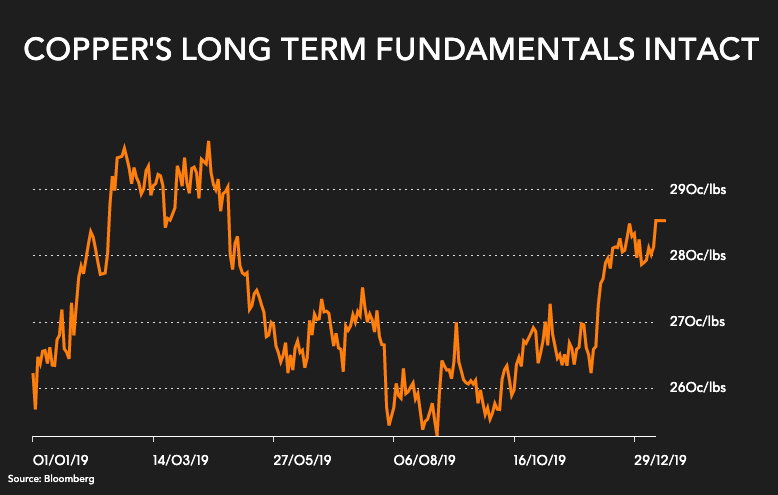

Copper price jumps to 8-month high

On Monday in New York, copper for delivery in March closed the day near $2.8640 a pound ($6,314 a tonne), an 8-month high and up 3% from 2019’s closing level.

The US Treasury on Monday lifted China’s designation as a currency manipulator, paving the way for the signing on Wednesday of a phase-one trade deal with China.

China consumes half the world’s copper, and the dispute with the US has weighed on the market for more than a year. Given its widespread use in industry, construction, transport and power distribution, the metal is sensitive to broader economic conditions.

Bloomberg reports inventories at warehouses tracked by the three international exchanges – New York, Shanghai and London – have shrunk by about 37% since July to just shy of 300,000 tonnes, equivalent to just 1.2% of global consumption.

“Europe and developed Asia have been destocking pretty aggressively over the past six months or so,” Colin Hamilton, an analyst at BMO Capital Markets, told Bloomberg. “You can’t do that forever.”

Chinese imports of copper concentrate shot up last year with January–November volumes reaching 20.1 million tonnes, a gain of just over 10% compared to the first 11 months of 2018 and already above the record set in 2018.