Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Copper price powers on but doubts are starting to creep in

December copper futures trading on the Comex market in New York powered ahead on Monday after hedge funds pushed bullish bets on the metal to fresh record highs. Copper touched a high of $3.1095 a pound ($6,855 per tonne) up more than 1% from Friday's closing price and the highest since October 2014. Copper is now up 23.4% in 2017.

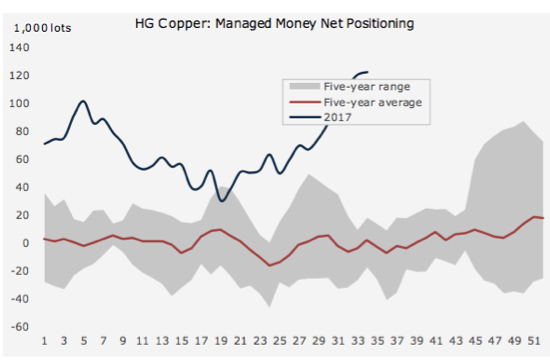

Hedge funds built long positions– bets on higher prices in future – in copper futures and options to a new record high last week according to the CFTC's weekly Commitment of Traders data. So-called managed money investors' net longs now total over 122,000 lots, the equivalent of over 3 billion pounds or nearly 1.4m tonnes worth $9.5 billion at today's prices.

It shatters the previous peaks achieved mid-2014 when the price of the bellwether industrial metal was above $3.20 a pound and represents the equivalent of $12.5 billion swing from 2016 second quarter net short position (bets that copper can be bought back cheaper in future).

With speculative interest in unchartered territory (see graph below) some analysts are expressing doubts about the sustainability of the rally given the fundamentals of the industry – less than stellar demand growth flattered by higher than usual supply disruptions – haven't changed much.

Bloomberg quotes Bernard Dahdah, a metals analyst at Natixis in London, expressing concern over the outsized speculative interest on derivatives markets:

"We think that this is a market that is overreacting to short-term conditions and ignoring several warning signs."

Without support from the physical industry, prices could be set for a swift drop as investor positions are unwound.

“Private investors can leave these markets just as quickly as they get in,” Dahdah said.

Barclays is quoted by CNBC as saying the recent rally (up 13% in little over a month and seven straight weeks of gains) is "puzzling":

They said supply disruptions have increased and the market is in a deficit, with mined production set to decline this year if those disruptions continue. Those factors and the fact that China has defied expectations for a slow down have helped push copper higher.

"Yet something seems off about this recent rally, and we still remain skeptical of its strength and duration," wrote Barclays' Dane Davis. "We think that this is a market that is overreacting to short-term conditions and ignoring several warning signs."

Source: www.tradingfloor.com

Bears in a scrap

The latest rally was sparked by reports at the end of July that China, responsible for some 46% of global consumption of the metal, is planning to ban the importation of scrap copper by the end of next year. China imported more scrap (1.85m tonnes) than refined copper (1.54m) during the first half of 2017. China-bound cargoes of copper concentrate is expected to match 2016's 17m tonnes annual total.