Categories:

Base Metals

/

Energy

/

General Market Commentary

Topics:

General Base Metals

/

General Energy

/

General Market Commentary

Copper price surges to 32-month high as hedge funds place $20 billion bet

Things are looking up

Copper futures trading on the Comex market in New York raced ahead on Wednesday as global supply disruptions came back into view and large-scale speculators place huge bets on rising prices.

In massive volumes of more than 3 billion pounds by lunchtime copper for delivery in September jumped to a high of 2.9795 a pound ($6,569 per tonne), up more than 3% from Tuesday's close to the highest since end-November 2014.

Copper's 2017 year to date gains in percentage terms now top 18% and the red metal has recovered 54% in value after falling to six-year lows below $2.00 a pound in January last year.

On Wednesday Freeport said flash floods at Grasberg destroyed roads, bridges and water lines and one worker remains unaccounted for

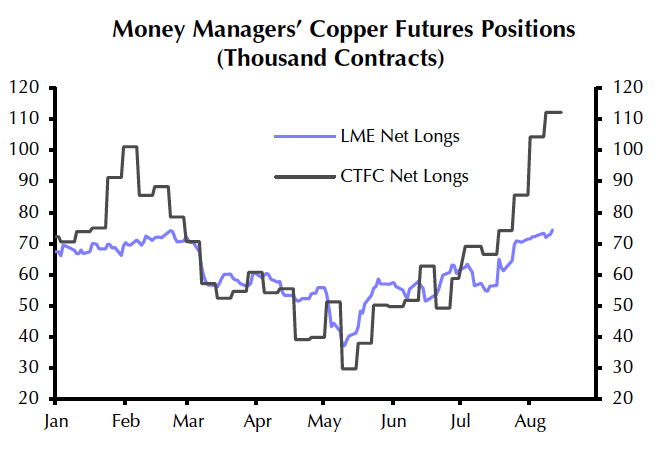

On the copper derivatives market hedge funds built long positions – bets on higher prices in future – to a new record high last week according to the CFTC's weekly Commitment of Traders data. So-called managed money investors' net longs now total over 112,000 lots, the equivalent of 2.8 billion pounds or nearly 1.3m tonnes worth around $8.3 billion at today's prices.

It shatters the previous peaks achieved mid-2014 when the copper price was above $3.20 a pound and represents the equivalent of $11.8 billion swing from 2016 second quarter net short position (bets that copper can be bought back cheaper in future) of 1.2 billion tonnes.

On the London Metal Exchange, hedge funds have also increased their bullish bets in recent weeks and according to LME data released yesterday net longs total over 74,000 lots. LME contracts are for 25 tonnes which translates into more than 1.8m tonnes worth some $12.2 billion on Wednesday.

After a relatively uneventful supply environment in 2016, several outages at some of the world's biggest mines including a 43-day strike at BHP's Escondida mine in Chile which ended in March and ongoing strike action at Freeport McMoRan's Grasberg operations in Indonesia have underpinned prices.

Source: Capital Economics

On Wednesday Freeport said flash floods at Grasberg destroyed roads, bridges and water lines and one worker remains unaccounted for. The impact on operations have not been quantified but a spokesperson for the Indonesian unit said the main processing mill at the extensive complex may also be affected.

Freeport's temporary exporting licence is coming up for renewal in October, a bargaining chip used by Jakarta as it negotiates with the Phoenix-based company about divesting a majority stake in its Indonesian subsidiary.

Zambia, Africa's top copper producer, this week reduced power supply to mines operated by Glencore and First Quantum Minerals in the country over a pricing dispute. While Glencor's Mopani was taken off line, the impact on FQM appears minimal at this stage –

To continue reading please click link http://www.mining.com/copper-price-surges-32-month-high-hedge-funds-place-20-billion-bet/