Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Copper’s Rally Is Longest in a Generation

Copper is on a run that’s set to be the best in almost 30 years.

The metal is on course for the longest winning streak since 1989, topping $7,300 a metric ton in London, on optimism about increased demand, supply disruptions in China and a weaker dollar.

Three-month copper rose as much as 1 percent to $7,312.50 on the London Metal Exchange, the highest since January 2014, and traded at $7,301.50 at 4:31 p.m. in London. The metal is up for a 10th straight day.

“It is the Chinese demand which is driving the copper price crazy,” said Naeem Aslam, the chief market analyst at Think Markets U.K. “We expect this bullish sentiment to continue into 2018 on the basis of the stronger global demand.”

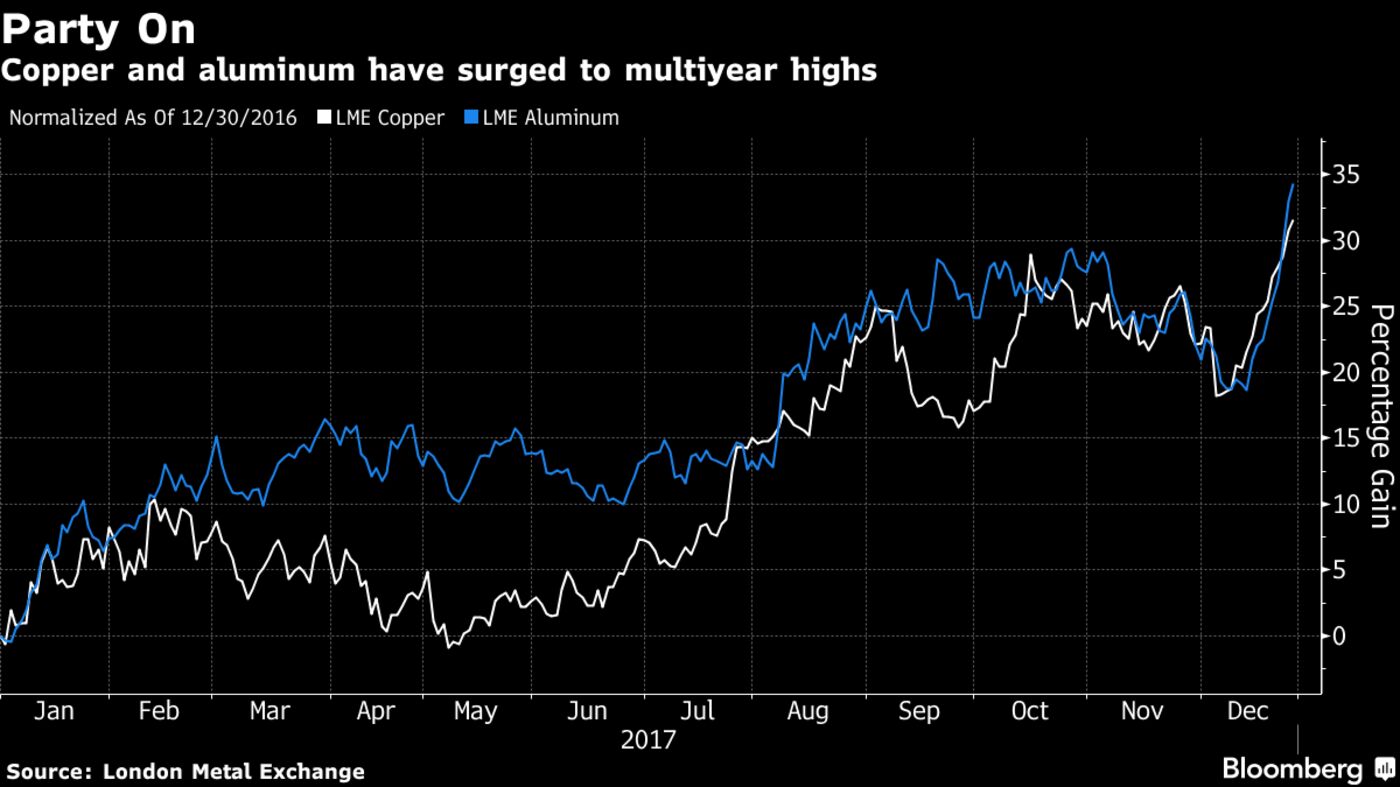

Base metals have posted the biggest returns among raw materials in 2017, with copper, aluminum, zinc and nickel leading gains on the Bloomberg Commodity Index. The advances have been fueled by faster demand and supply disruptions, including plant halts in China as officials press home a battle against pollution. On Thursday, further support came from a weaker U.S. currency as the dollar fell for a second day.

“Dollar weakness, funds returning after the Christmas break are extending the metals rally, adding fuel to bullish sentiment,” Xu Maili, an analyst at Everbright Futures Co., said by phone from Shanghai. The LMEX Index, which tracks the six main metals, posted a ninth gain on Wednesday.

Still, much of the rally has occurred over the holiday period on the back of thin trading volumes, with Saxo Bank A/S cautioning yesterday that moves should be taken with a pinch of salt. The forward curve remains in contango -- a situation when future prices are higher than near-term contracts -- and stockpiles tracked by the LME have been rising this week.