Cordoba Minerals (OTCQX:CDBMF) is a little-known exploration company that discovered a potentially world-class copper-gold deposit in Colombia. The company is underfollowed, the trading volumes are relatively small and also here on Seeking Alpha, the company is followed only by 246 people. This is one of the reasons why Cordoba Minerals has been able to fly under the radar. This all, despite the involvement of Robert Friedland, one of the most successful explorers and mine developers in history, and the great exploration results, including 1% copper and 0.56 g/t gold over 136 meters or 1.26% copper and 0.87 g/t gold over 108 meters.

After some great drill results were released in January, the share price rose by more than 100% quickly. But during the spring months, the share price started to decline along with the whole mining sector. In June, the decline was further supported by a controversial deal that hands out the control over Cordoba Minerals to Robert Friedland's privately owned company High Power Exploration.

As I discuss below, this deal may be interesting for the new shareholders, but it's definitely not good for the old ones. As a result, the share price declined back to the late 2016 levels and the market capitalization of the company is less than $40 million right now.

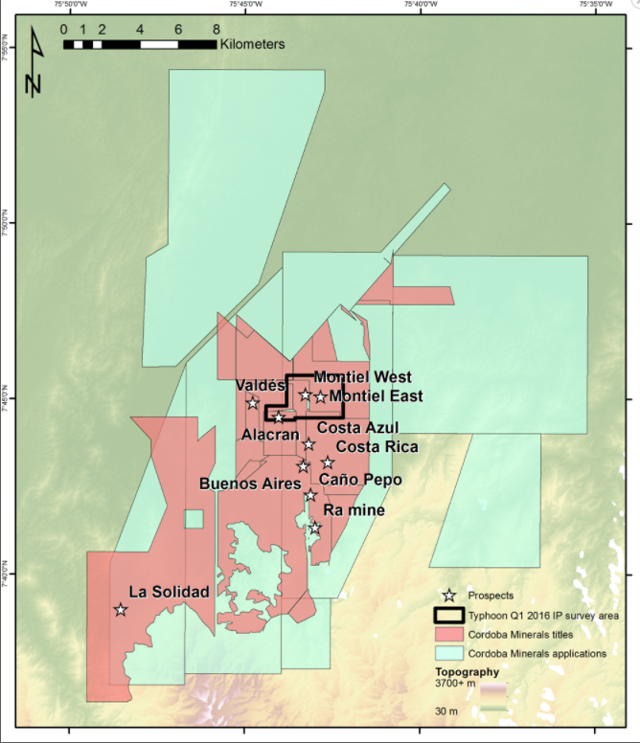

The San Matias Project

The San Matias Project located in northern Colombia covers an area of 260 km2. The area is highly prospective, there are several producing mines in a close vicinity to San Matias (South 32 operated the Cerro Matoso nickel mine, Argos operated the Carbon del Caribe coal mine).

Moreover, Cordoba Minerals applied for further exploration permits. If granted, the extent of the San Matias Project will more than double. On the San Matias property alone, multiple occurrences of copper-gold mineralization were discovered. The extensive exploration activities resulted in the identification of multiple exploration targets. The most advanced of them is Alacran.

A rich copper-gold mineralization located just below the surface was discovered at Alacran. The deposit was drilled 1.3 kilometers along strike, to a depth of 250 meters. It is still open in all directions and at depth. Some of the most exciting drill holes include: ASA-051 (111 meters grading 1.01% copper and 0.38 g/t gold (or 1.27% of copper equivalent, at the current metals prices of $2.6/lb copper and $1,220/toz gold), starting 6 meters below surface), ACD-005 (29 meters grading 2.72% copper and 1.16 g/t gold, or 3.51% of copper equivalent, from 18 meters below surface), ACD-009 (150 meters grading 0.73% copper and 0.49 g/t gold, or 1.07% of copper equivalent, from 31 meters below surface), ACD-033 (108 meters grading 1.26% copper and 0.87 g/t gold, or 1.86% of copper equivalent, from surface), or ACD-032 (66 meters grading 1.2% copper and 0.23 g/t gold, or 1.36% of copper equivalent, from 46 meters below surface).

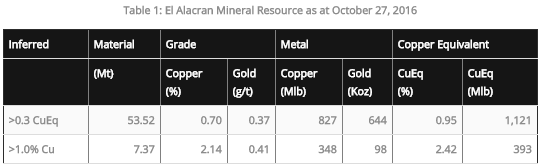

An initial resource estimate, published in early 2017, was able to outline a deposit containing inferred resources of 827 million lb copper and 644,000 toz gold. It is a very solid start, given that it was based only on 20,200 meters of drilling, completed by October 27, 2016. But this is only the beginning. According to Cordoba Minerals, there is potential to significantly expand the deposit.

The initial resource estimate includes an area of approximately 1,300 x 355 meters and it is still open for expansion in multiple directions. Mineralization to a depth of only 220 meters is included, although it is known that it continues further to depth. The recent drilling is focused on expanding the resources. For example, the above-mentioned drill holes ACD-032 and ACD-033 are not included in the initial resource estimate.

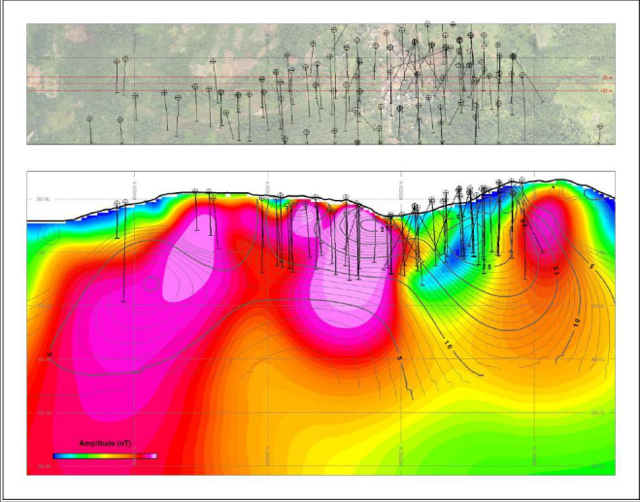

Source: Cordoba Minerals

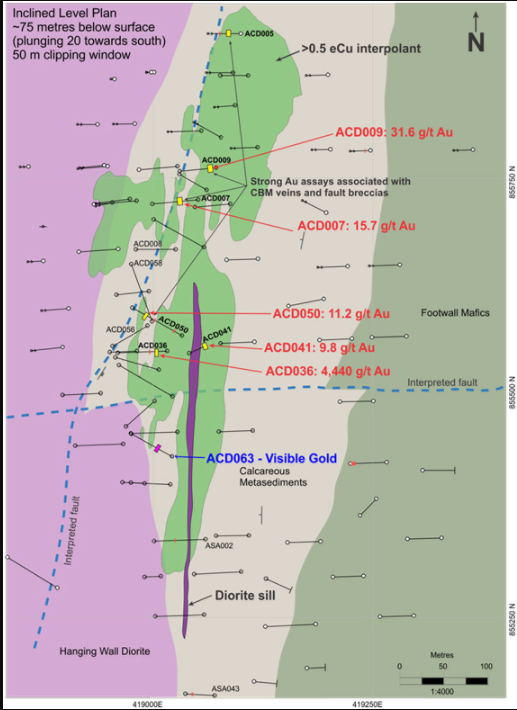

Moreover, Cordoba Minerals and its joint venture partner discovered some ultra high-grade carbonate-base-metal-veins (CBM veins) at Alacran. On January 23, the company announced that drill hole ACD-036 intersected 0.9 meters grading 4,440 g/t gold, 10.25% copper, 24.7% zinc and 347 g/t silver. At the current metal prices, it equals to 4,447.3 g/t of gold equivalent.

A great news is that this vein was intersected only 90 meters below the surface. It means that it will be most probably mined as a part of the Alacran open pit. It is yet unknown how big this vein is or how many of them are down there. But this type of mineralization can boost the economics of the future Alacran mine notably. And there is also a huge anomaly in the southern part of Alacran, that hasn't been fully tested yet.

Besides Alacran, there are other exploration targets on the San Matias property. Some of them have been already drill-tested and the results were anything but mediocre. At Montiel, multiple very promising drill holes were drilled.

For example DDH-004 intersected 101.1 meters grading 1% copper and 0.65 g/t gold, or 1.44% of copper equivalent, SMDDH-009 intersected 123.2 meters grading 0.74% copper and 0.6 g/t gold, or 1.15% of copper equivalent and SMDDH-012 intersected 118.4 meters grading 0.71% copper and 0.56 g/t gold, or 0.65% of gold equivalent, or 1.09% of copper equivalent. Similar to Alacran, the mineralization starts right at the surface, or only several meters below it.

At Costa Azul, drill hole CADDH-003 intersected 86.6 meters grading 0.62% copper and 0.51 g/t gold, or 0.97% of copper equivalent and CADDH-001intersected 45.8 meters grading 0.61% copper and 0.6 g/t gold, or 1.02% of copper equivalent. And once again, the mineralization starts right at the surface.

The current drill program is focused on testing the extent of the extremely high-grade CBM veins at Alacran and the eastern extension of the Alacran deposit, in the area where ACD-033 intersected 108 meters grading 1.26% copper and 0.87 g/t gold, or 1.86% of copper equivalent. The drill results released in May show multiple intersections of shorter intervals with higher copper and/or gold grades. Although no other of the drill cores presented numbers comparable to ACD-036, the gold grades are significantly higher compared to the typical Alacran intersections.

Moreover, drill hole ACD-063 intersected visible gold (the exact numbers for this hole haven't been published yet). According to the company, the elevated gold grades are related to the diorite sill that is approximately 500 meters long (map below), which means that there is a lot of potential for further higher grade interceptions.

Source: Cordoba Minerals

Source: Cordoba Minerals

According to Mario Stifano, the CEO of Cordoba Minerals:

We look forward to restarting our aggressive drilling program at our highly prospective San Matias Copper-Gold Project, which will focus on expanding the size and scope of mineralization at Alacran, as well as testing other high priority targets at San Matias that have previously yielded large widths of high-grade copper-gold mineralization.

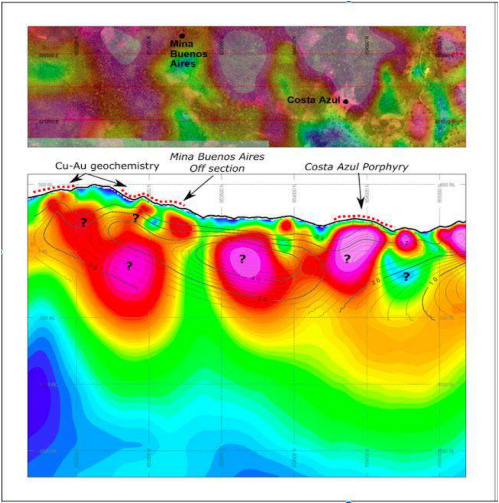

Stifano's words indicate that further drilling should be expected also at Montiel and Costa Azul. Montiel lies approximately 2 kilometers to the northeast of Alacran and Costa Azul lies approximately 2 kilometers to the southeast of Alacran. The drill results at all of the three targets show very similar intervals, grades, and proximity to surface. If the three deposits happen to be connected, we are definitely talking about a world-class copper-gold discovery.

Source: Cordoba Minerals

According to the latest corporate presentation, also the 3 kilometers' long Costa Azul - Buenos Aires porphyry trend (map above) and a large La Capitana target to the south of Alacran should be drill-tested this year.

The HPX Colombia Ventures deal

As I mentioned in the introduction, Cordoba's share price has been negatively affected by the proposed consolidation deal between Cordoba Minerals and High Power Exploration (HPX). The whole story started back in 2015. On May 8, Cordoba Minerals announced a strategic partnership with HPX, a private company indirectly controlled by Robert Friedland. As a part of the deal, HPX purchased 7.3 million shares and 7.3 million warrants of Cordoba Minerals. Moreover, Cordoba Minerals and HPX created a joint venture to develop the San Matias copper-gold project:

The Agreement also provides for HPX and the Company to enter into a separate joint venture agreement (the "JV Agreement") which calls for HPX to fund an initial C$2,500,000 of exploration work over an 18 month period ("Initial Option Period") on the San Matias Project, to be funded by proceeds from the Private Placement and the exercise of the Warrants. HPX will be the operator of the exploration program. The Agreement provides additional earn-in phases (Phase 1, 2 and 3), whereby HPX can earn up to 65% of Cordoba's indirect subsidiary Minerales Cordoba SAS (the "JV Company") which holds the San Matias Project by spending an additional C$16,500,000 in exploration with a minimum of $6 million in Phase 1 for a 25% interest and $10.5 million in Phase 2 for a 51% interest and funding a National Instrument 43-101 compliant feasibility study on the Project during Phase 3 for a 65% interest over a maximum 102 month period following the Initial Option Period.

The deal was great for Cordoba Minerals, a small company with a great project, but insufficient funds. HPX committed to fund the exploration and other related costs, up to the feasibility study, in exchange for 65% of the project. Moreover, Robert Friedland's HPX was meant to be the operator of the exploration program, which further supported the exploration potential, given Friedland's exceptional history (Voisey's Bay, Oyu Tolgoi, Kamoa-Kakula). All Cordoba's shareholders had to do was to sit tight and wait for the value of their 35% stake to grow.