Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Deficit should keep palladium price on the boil

Prices for March palladium went 1.18% up in late afternoon on Friday as the metal was trading at $2,634 an ounce on the Comex market in New York.

Earlier in the week, palladium futures for March delivery climbed 7.8% at $2,497.60 an ounce on the New York Mercantile Exchange on Wednesday and prices kept rising after the market closed, touching $2,504.50, the highest in 30 years.

Tight supplies for palladium have continued to feed its price rally. A report from chemicals company Johnson Matthey estimated that the supply deficit for the metal widened to nearly 1.2 million ounces last year and is expected to deepen this year, as stricter emissions legislation in China and Europe will drive up vehicle palladium loadings.

Rhodium is also expected to deepen its deficit. The metal was traded at $13,100 per ounce on Friday.

Scotiabank reports that even with the coronavirus crisis continuing to weigh on the “Detroit of China” (Hubei) and while the quantity of demand being either lost or delayed remains uncertain, overall palladium and rhodium demand will not change.

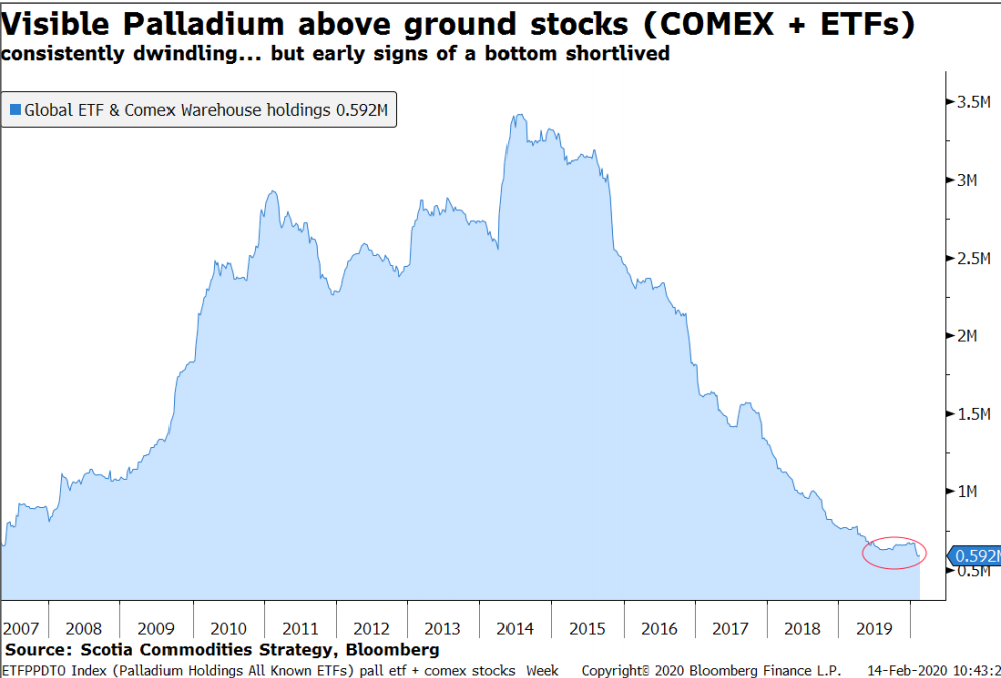

According to Scotiabank, synchronized repricing in rhodium and palladium and the lack of viable substitution marks a new cycle – an era of higher prices versus the previous decade, but also with higher volatility. The bank also reports that palladium above ground known stocks have reached decade lows.

“There is nothing on the horizon to change the direction of these shortages,” Neal Froneman, the chief executive officer of Sibanye-Stillwater said at a presentation about the company’s results in 2019 on Wednesday, referring to palladium and rhodium.