Categories:

Base Metals

/

Energy

/

General Market Commentary

Topics:

General Base Metals

/

General Energy

/

General Market Commentary

Electric-Car Revolution Shakes Up the Biggest Metals Markets

-

Producers of copper, cobalt, aluminum to benefit from changes

-

Steel, lead, platinum companies may need to adapt operations

The revolution in electric vehicles set to upturn industries from energy to infrastructure is also creating winners and losers within the world’s biggest metals markets.

While some of the largest diversified miners like Glencore Plc argue fossil fuels such as coal and oil still play a crucial role supplying energy needs, they’ll also benefit the most from a move to electric cars, requiring more cobalt, lithium, copper, aluminum and nickel.

The outlook for greener transportation got a boost this year as the U.K. joined France and Norway in saying it would ban fossil-fuel car sales in coming decades. That’s as Volvo AB announced plans to abandon the combustion engine and Tesla Inc. unveiled its latest, cheaper Model 3. Such vehicles will outsell their petroleum-driven equivalents within two decades, Bloomberg New Energy Finance estimates.

"For some of the metals, it’s a complete game changer," said Simona Gambarini, a commodities economist at Capital Economics Ltd. in London. "We’ve already seen a big impact on some metals like cobalt and lithium, which have soared over the past couple of years."

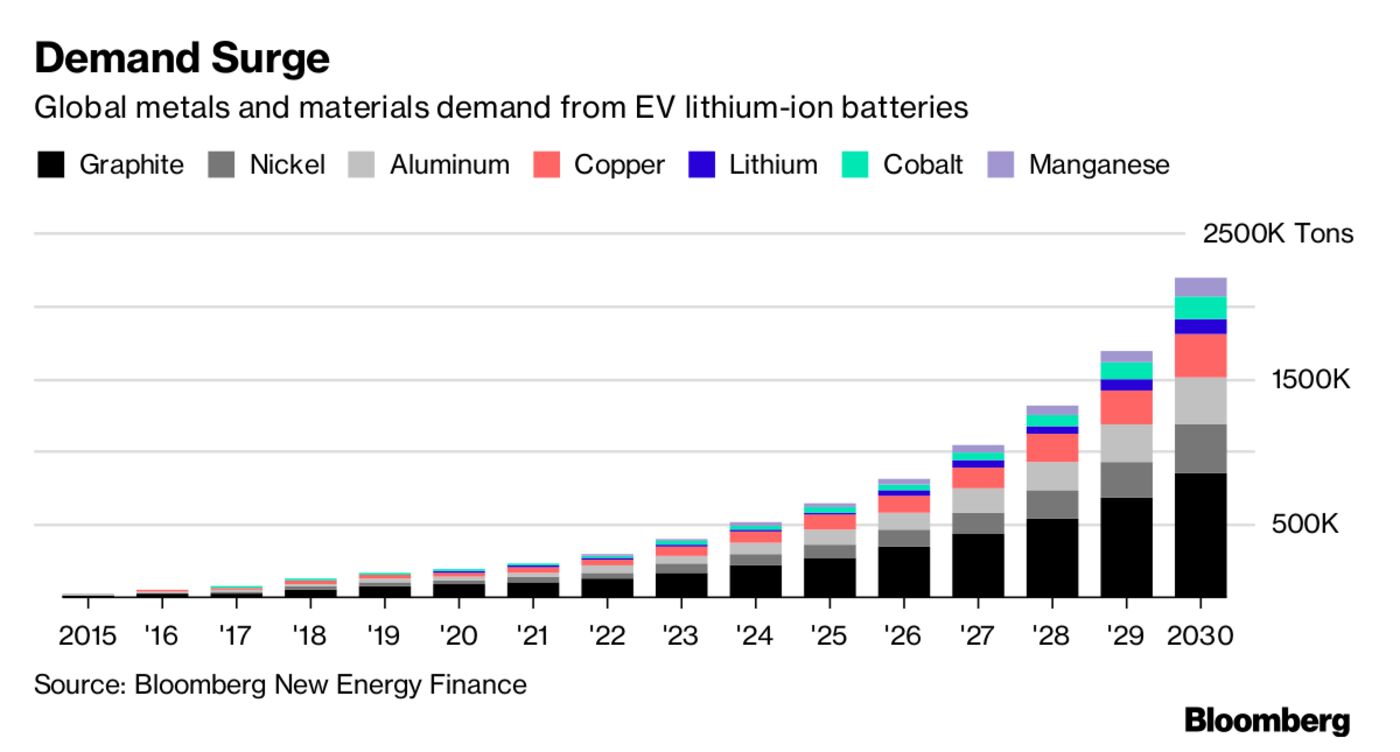

Electric cars contain about three times more copper than a regular vehicle, according to Glencore. Even more is needed for charging stations, with Exane BNP Paribas seeing such infrastructure adding about 5 percent to demand by 2025. Lithium, cobalt, graphite and manganese used in batteries will also see additional demand.

Copper and Cobalt

Glencore will get a boost as rising electric-vehicle sales lend support to copper prices, as well as from its position as the world’s largest cobalt producer, according to Jefferies Group LLC. Freeport-McMoRan Inc. and First Quantum Minerals Ltd. are also top picks for long-term investors looking to benefit from the trend, the brokerage said in a note Tuesday.

Markets are responding. Cobalt has surged 70 percent on the London Metal Exchange this year, after jumping 37 percent in 2016. Lithium prices have extended gains in recent years. Copper is also up 14 percent in 2017 on signs of resurgent economic growth, particularly in China. Glencore shares have risen 20 percent in London, outpacing rivals including Rio Tinto Group, BHP Billiton Ltd. and Anglo American Plc.

On the flipside, lead producers such as Recylex SA and Campine SA may need to adapt operations to the new era. The main end-use for lead is in starter batteries for petrol and diesel engines. Electric vehicles, by contrast, are powered by lithium-ion units.

“It’s a serious risk for lead demand, unless you find different applications to make up for the decline,” said Michael Widmer, head of metals market research at Bank of America Merrill Lynch in London.