Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Electric vehicle demand will double nickel price – as soon as 2022

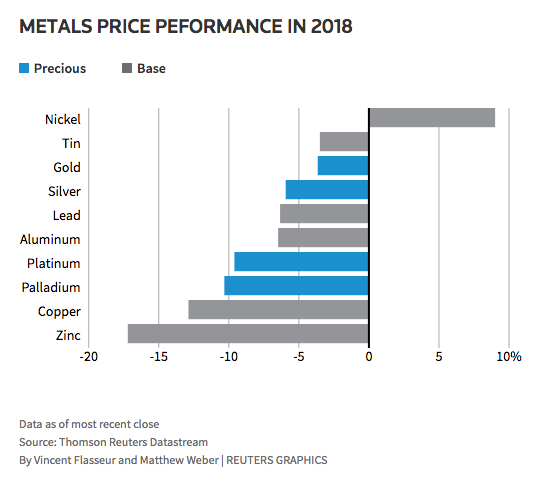

After a gravity-defying run, nickel has now also succumbed to weakness in the industrial metals complex as global trade fears mount, declining to $14,125 per tonne on Monday.

The metal, mainly used in stainless steel manufacture, is down 10% or more than $1,600 a tonne from more than three-year highs hit on the LME a month ago.

Nickel is still up by 62% compared to its June 2017 lows, mostly on the back of falling inventories in top consumer China. On the Shanghai Futures Exchange nickel stocks have dropped for 24 straight weeks while LME warehouses are the emptiest since mid-2014.

And recent weakness has not altered a bullish longer term outlook for nickel with industry research house Wood Mackenzie adding its voice to the plus-column in a note out on Monday.

And recent weakness has not altered a bullish longer term outlook for nickel with industry research house Wood Mackenzie adding its voice to the plus-column in a note out on Monday.

While stainless steel production – currently nearly 80% of total demand for nickel – is expected to stay solid over the coming years, booming demand from the electric vehicle battery market is set to fundamentally alter the structure of the industry.

Michael Sinden, WoodMac Research Director, and Senior Research Analyst, Rory Townsend say in their long term outlook for nickel that demand for nickel in EV batteries will contribute 1.26 million tonnes to nickel demand in 2040.

That compares to total primary nickel production last year of not much more than 2 million tonnes.