Categories:

Base Metals

/

General Market Commentary

/

Precious Metals

Topics:

General Base Metals

/

General Market Commentary

/

General Precious Metals

Fed's Powell Shakes Gold Out of Its Doldrums, Energizes Copper

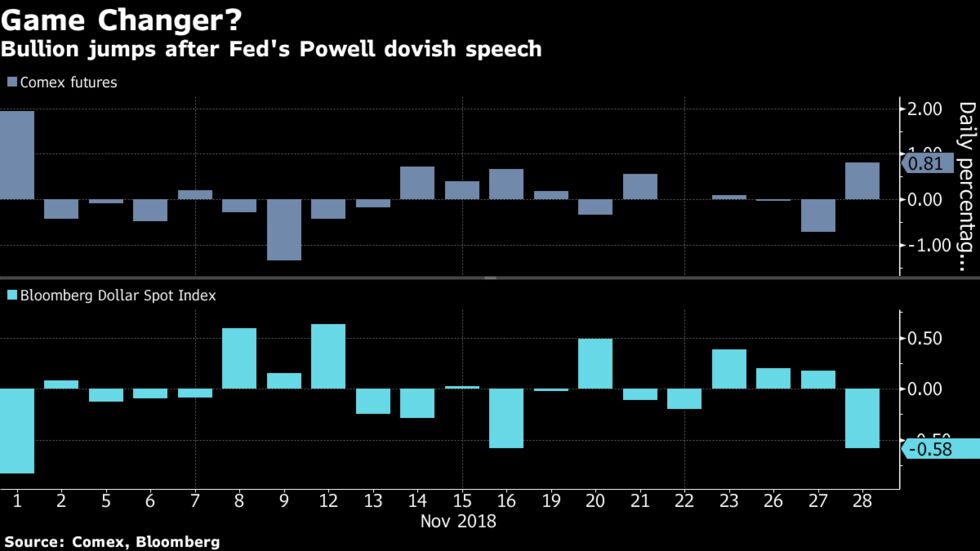

Dovish comments from the Federal Reserve’s Jerome Powell suggesting slower-than-anticipated interest-rate hikes awakened gold from its recent slumbers and boosted most base metals.

The Fed chairman said interest rates are “just below” the so-called neutral range, softening previous comments that implied steady rate hikes were in the central bank’s foreseeable monetary policy. That helped send the Bloomberg Dollar Spot Index crashing and gold, which doesn’t pay interest, to its biggest gain in almost four weeks.

Greenback strength has dogged most metals this year as investors flocked to the American currency as a hedge against the impact of the simmering U.S.-China trade war. The presidents of both nations will have a chance to discuss the spat this weekend during a Group of 20 meeting in Argentina.

Bullion for February delivery jumped 0.8 percent to settle at $1,229.80 an ounce at 1:30 p.m. on the Comex in New York, the biggest increase for a most-active contract since Nov. 1. The yellow metal had drooped in six of the past seven months. Copper for delivery in March climbed the most since Sept. 21, while most of the main metals on the London Metal Exchange ended higher. Meanwhile, spot palladium prices reached another record high, drawing further support from tightening supplies.