Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Glencore's Radioactive News May Help Give Cobalt Its Buzz Back

Glencore Plc’s sudden discovery that some of its cobalt is radioactive couldn’t come at a better time.

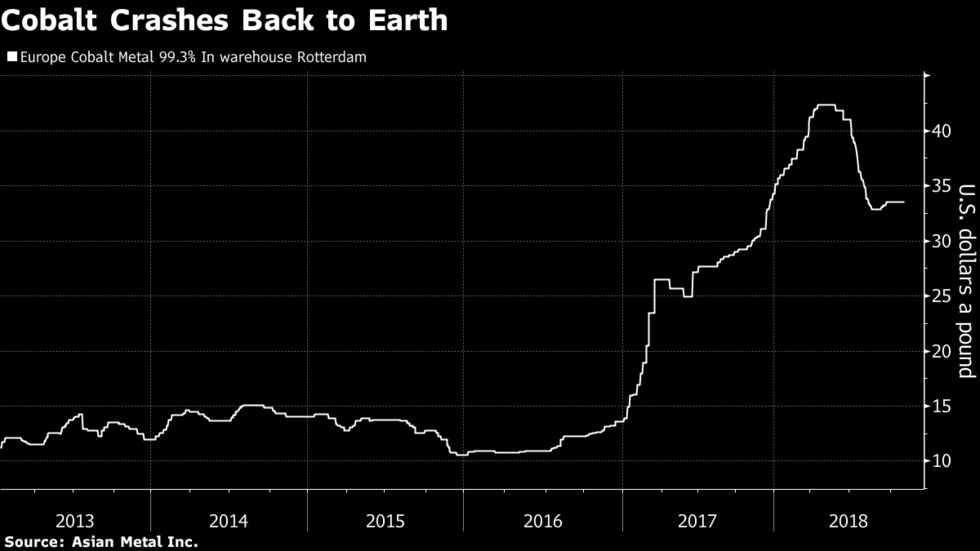

After a surge in prices last year, enthusiasm for cobalt has been fading, partly because of a surge in new supply. But sentiment could be changing after Glencore’s unit in the Democratic Republic of Congo suspended cobalt sales after detecting low levels of radioactivity.

“It’s nice to finally have some positive news in the market,” Gordon Buchanan, a senior trader at Stratton Metal Resources, said by phone from London.

Glencore has a long history of curtailing supply to meet demand, and has long criticized rivals for producing too much and depressing prices. The Swiss commodity giant curtailed zinc output at mines in Australia, Peru and Kazakhstan in 2015 when prices languished at six-year lows. It also limited coal output when prices were low.

Metal Bulletin prices for refined cobalt have fallen 5.6 percent this year, but there have been more pronounced declines in the raw material. As supply increased, mined products like cobalt hydroxide traded at widening discounts. The main impact from Glencore’s halt on sales will be to reverse that trend, Buchanan said.

Shares in Cobalt 27 Capital Corp., which stockpiles the metal, rallied 13 percent. And while it’s not the industry benchmark, the London Metal Exchange’s contract also rose.

Glencore plans to stockpile cobalt supplies until the middle of next year, while it builds a special plant to remove radioactivity. Caspar Rawles, an analyst at Benchmark Minerals, described the timing of the announcement as "opportunistic" because Glencore is currently negotiating 2019 supply deals.