Categories:

Energy

Topics:

General Energy

Global Nuclear Fuel Update

Uranium oxide, the basic fuel for nuclear power plants, has recently sold at prices not seen in the past 13 years. In fact, the price is less than the cost of production in many cases. That could be a problem, because little is being done to increase the fuel supply, even though the world is adding new and larger reactors.

Late last year, the Organisation for Economic Co-operation and Development’s Nuclear Energy Agency and the International Atomic Energy Agency released a joint 550-page report titled Uranium 2016: Resources, Production and Demand. It was the 26th edition of the now-biennial report, commonly referred to as the Red Book,with data current as of January 1, 2015.

One potentially concerning revelation was that total identified uranium resources had only increased by 0.1% since the previous report had been issued. A reason cited for the minuscule uptick was that very little investment had been made in exploration due to depressed uranium market conditions.

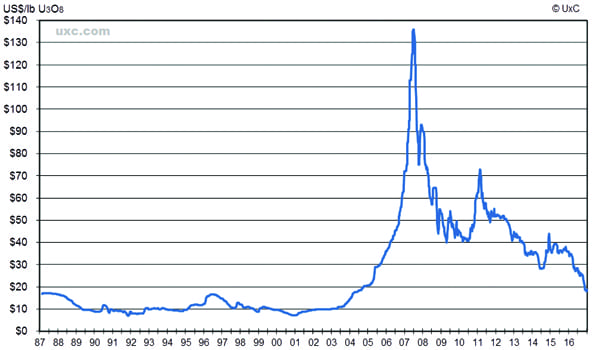

Indeed, the price for uranium oxide (U3O8) has been in a death spiral (Figure 1). In November 2016, U3O8 was selling at prices not seen since 2004. At roughly $18/lb, the price was less than the cost of production for most suppliers.

1. A rollercoaster ride. The spot price for uranium peaked at about $136/lb in June 2007 bolstered by hype of a nuclear renaissance. An economic downturn and the Fukushima disaster quickly dashed hopes of a resurgence, causing the market to plunge. Recently, U3O8 traded at 13-year low—about $18/lb. Source: The Ux Consulting Co.

The Nuclear Fuel Supply Chain

Uranium is a metal—about as common as tin or zinc—that is found in many rocks on Earth in concentrations of two to four parts per million. It is also found in seawater, but at about three orders of magnitude less than on land (around three parts per billion)