Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Gold Fails to Crumble as Trade Deal Hit Meets Dollar’s Decline

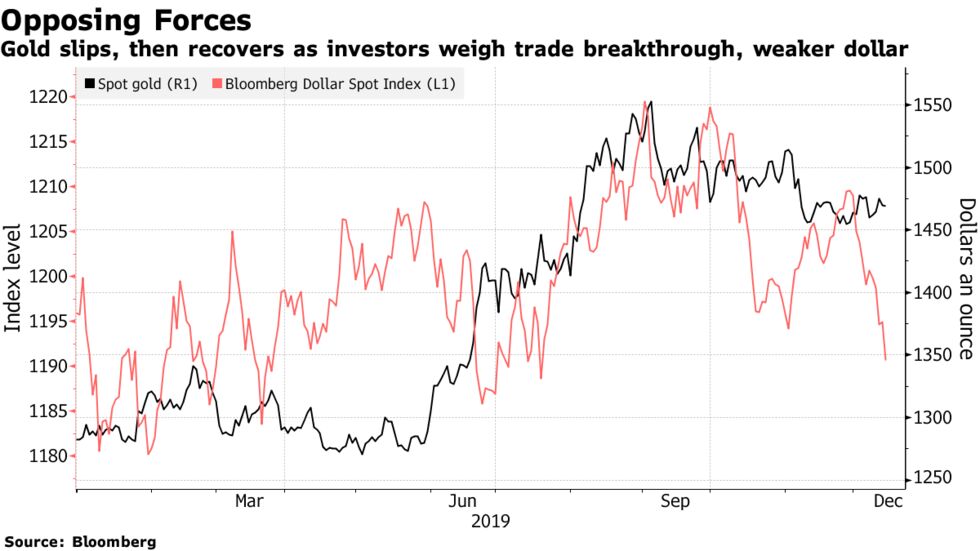

Gold held its own on Friday as investors weighed bullion’s merits heading into 2020 after the U.S. and China managed a breakthrough in their bitter and drawn out trade dispute, with the commodity’s initial losses driven by weaker haven demand offset by a slump in the dollar.

Bullion fluctuated after President Donald Trump signed off on a phase-one deal with China, averting the introduction of more U.S. tariffs, according to people familiar with the matter. Traders were also watching the U.K. general election, the governing Conservative Party was on course for a big majority. Sterling rose.

“The news out of the U.S. that an agreement has been reached with China is positive for growth, and therefore negative for gold,” Michael McCarthy, chief market strategist at CMC Markets, said by phone. “But at the same time, we’ve seen a weakening of the U.S. dollar. And so, they’re the two currents that are pushing and pulling gold at the moment.”

Gold’s heading for an annual advance, with its fortunes in 2019 shaped both by more accommodative monetary policy from central banks globally as well as the ebb and flow of the trade war. The removal of tariff uncertainty will return investors’ focus to signs the global economy is improving as a strong year for risk assets heads toward a close.

Following a 0.3% loss on Thursday, bullion for immediate delivery initially fell as much as 0.5%, but was just 0.1% lower at $1,467.80 an ounce at 5:46 a.m. in London. A Bloomberg gauge of the U.S. currency was 0.4% lower, heading for the biggest weekly drop since October, as the pound rose.