Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Gold gets driven toward $1600 as oldest haven shows its mettle

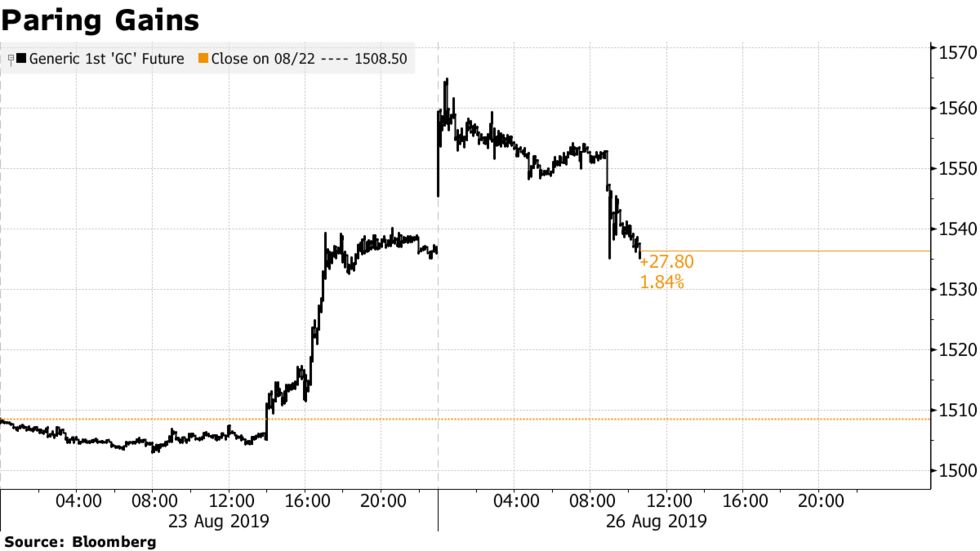

Gold pared gains after U.S. President Donald Trump said China was willing to resume trade talks, easing demand for the traditional haven metal.

Bullion futures traded down 0.1% at $1,536.40 an ounce after earlier surging as much as 1.8% on the Comex in New York, to the highest since 2013. The metal jumped Friday as the world’s two biggest economies traded blows.

China has asked to re-start trade talks, Trump said, hours after Beijing’s top negotiator publicly called for calm in response to a weekend of tit-for-tat tariff increases that sent global stocks plunging.

“China called last night our trade people and said let’s get back to the table,” Trump said on the sidelines of the Group of Seven meeting in Biarritz, France. “They understand how life works.”

Gold has surged this year as Washington and Beijing squared off. The fight is hurting economic growth, boosting the likelihood of additional U.S. rate cuts from the Federal Reserve.

“Gold has demonstrated its safe-haven qualities and we stay long,” Giovanni Staunovo and Wayne Gordon, analysts at UBS Group AG’s wealth-management unit, said in a report before Trump’s latest remarks. UBS raised its 12-month price forecast to $1,650 an ounce from $1,500.