Categories:

Base Metals

/

Precious Metals

Topics:

General Base Metals

/

General Precious Metals

Gold Leading the Way on Recovery in All Metals

When you add in Newmont, Rio Tinto and Xstrata the actual total number (brokered, private and bought-deals) comes to over $40B dollars. The largest number of companies are the advanced exploration projects having 1–10 million ounces in the ground. The balance are cash rich profitable producers. Where did all this money come from? I do not believe these vast sums are all coming from institutional investors and gold funds, although that will account for part of it. I believe the major source of capital is from cash rich families and individuals throughout the free world. The wealthy are concerned as we are with preserving the value of their wealth and are nervous about worldwide currencies and dollar related investments.

They want to see a significant portion of their money in gold whether it be physical or in companies with sizable gold resources in the ground. This is only the beginning and there are only a few dozen companies holding one million plus gold resources. We are in the early stages of investor demand for gold. Most investors are not aware that the gold bull has begun and will only get on board after the waterfall effect gets down to those companies having resources in the 100’s of thousands of ounces. By that time the gold exploration companies will have appreciated 3 to 4 times and pure exploration companies will catch on fire.

Debt for juniors, developers and producers continues to be a black cloud for most companies but a silver lining for cash rich companies. ( View my list of North American companies which have shut down production.)

A few of these companies have already recommenced production or are gearing up to begin. Shut-downs in North America are declining although a lot of mines in other areas of the world continue to shut-down, especially nickel and zinc mines. We are seeing take-over's by the cashed up companies at virtually pennies on the dollar. Again, the Chinese companies are the most prominent with deals amounting to billions of dollars as the case with Rio Tinto and Australian based Oz ($3 – $20 billion). Good projects are going down as companies struggle to refinance their debt while the best projects are being picked up by companies with the cash to do so. We have to look at the silver lining here as acquiring companies believe the metal commodity prices and precious metals are going higher. It should give us confidence that an icon in the business has put up $40 million personally to pay down the debt and meet obligations in a company he is a director of, while another icon is purchasing a private placement for $5 million in a Copper/Moly/Silver company. This reinforces my speculation that the wealthy are getting heavily involved in the ownership of gold and gold resources. The U.S. Federal Reserve announcement to buy $300 billion in longer term Treasury Bills (March 18, 2009) had an immediate effect on the gold price which turned from $40.00 down to $37.00 up on the day. The positive effect has spilled over into all of the major indexes.

The effects (perception) of the proposed infrastructure replacement and build-out are beginning to stabilize world equity markets and banking systems. This will not impede the investment in gold/silver and precious metals as the underlying strength in these commodities is based on the weakening confidence in paper money. How will this effect base and specialty metals? Not only will demand outstrip supply resulting in stronger base metal prices but it will also eventually become a hedge against paper currencies, which will only help accelerate the recovery in the base and specialty metal companies around the world. See the following comparison of some of the commodity price losses in the past 10 months.

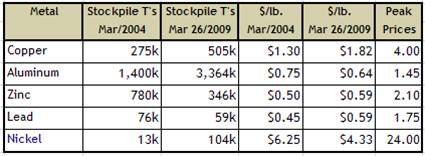

In the February 2009 letter I mentioned that the LME stockpiles of base metals would fall significantly and rapidly. Since that time two of the five base metals I follow have had decreases in the amounts held in the LME warehouses. Stockpiles of copper have been rising since May of 2008 and have recently fallen from 550,000 tonnes to 505,000 tonnes and zinc has fallen from 350,000 tonnes to 346,000 tonnes, the zinc stockpile has been rising since October 2008.

Lead has begun to flat line with nickel continuing to increase since they began to rise in November 2008 and June 2008. Aluminum is the only exception with stockpiles rising 164,000 tonnes since March 1, 2009. Stockpiles of aluminum have been rising steadily since February 2007.

The metal to follow here is copper as it is a strong indicator of what is happening in the base metal markets. Copper producers share prices have been recovering with some up 100% to 200% from recent lows. In an earlier article I pointed out that electrical power had been out by 50% to primary and secondary industries in China for about six months during the 2008 Summer Olympics creating a backlog of all metals (The 495,000 tonnes in the LME warehouses represent just over one month’s consumption in China.) The rise in copper signals good times for base and specialty metals as follows:

1. Lead will appreciate in price at faster rates than zinc and nickel.

2. Specialty metals like molybdenum will begin to appreciate in price once the iron ore contracts are settled. Molybdenum usually follows close on the heels of copper.

3. Again once the iron ore contracts are completed we should see an increase in the price of manganese which is essential in the production of steel. There is no substitution. Consumption of manganese (the fourth largest consumed metal just behind copper) has increased 13.3% from 11.8 million tonnes (2006) to 13.3 million tonnes (2007).

4. Aluminum will be the laggard here but should start to show a reduction of LME warehouse stocks in the next few weeks.

I have compiled a comparison of the LME prices and stockpiles of five base metals over five years as follows: Copper, the bell-weather base metal commodity has had the most significant stockpile contraction and the best price appreciation.

I believe the stockpiles will shrink rapidly once the iron ore contracts are satisfactorily completed by the Chinese. They have recently stated their lack of faith in the US dollar and their bullishness on precious and base metals. It is in their best interests to own the stockpiles rather than hold their US dollars in cash. During the late 1950’s to the early 1980’s the economies of United States, Europe and Japan expanded their infrastructure and modernization efforts, creating a super-cycle in commodities. Populations were a quarter of today’s population yet this fueled the best years in the mining industry.

China alone plans to literally relocate 400 million people from the urban to suburban locales. The size of their country and population makes it hard to comprehend how the mining industry expects to meet their demands over the next 10 – 15 years? Mining built North America and it will be a significant contributor to the world economy as we move into the future.

I have covered a lot of ground now and in my previous articles, as to why I believe commodity prices will break old historic highs and it really boils down to a few significant points as follows:

1. Significant supply has been disrupted by lower commodity prices and unsustainable debt (mine shutdowns).

2. Western economies to create jobs by massive spending on infrastructure requiring vast amounts of metals to achieve these goals.

3. With the printing of currencies by the free world to spend our way out of the recession (or depression) gold has emerged as the ultimate currency followed by hoarding of all precious and ultimately base metals.

4. Inevitable economic tension created by a fragile economy will lead to stockpiling of strategic metals by concerned governments throughout the world.

5. BRIC countries are caught on a tread mill to expand their infrastructure bringing the newest and the largest group of consumers to the table at any time in our history.

6. Mining companies will be reluctant to bring on new production, after their recent experience resulting from falling commodity prices and debt defaults.

7. China’s stimulus package of close to $600 billion US is already beginning to affect demand – specifically on copper which China is a net importer of.

8. Commodity prices today will have a negative effect on recycling certain metals.

9. As mining companies struggle to survive various governments in other parts of the world are making it difficult for companies to proceed with bailout plans or shut down money losing operations (Australia and Zambia).

In conclusion, from time to time, I’ll be updating this article, and if you’d like to receive those updates, please send an email to: lwreaugh@rdminerals.ca .

Larry W. Reaugh is not an investment advisor and any reference to specific securities in the list referred to in the article does not constitute a recommendation thereof. The opinions expressed herein are the express personal opinions of Larry W. Reaugh. Nothing in this article should be construed as a solicitation to buy or sell any securities referred to in the list or in the article. The author bears no liability for losses and/or damages arising from the use of this article. www.reacompanies.com