Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Gold Resumes Trek Higher as Weak Economic Data Point to Stimulus

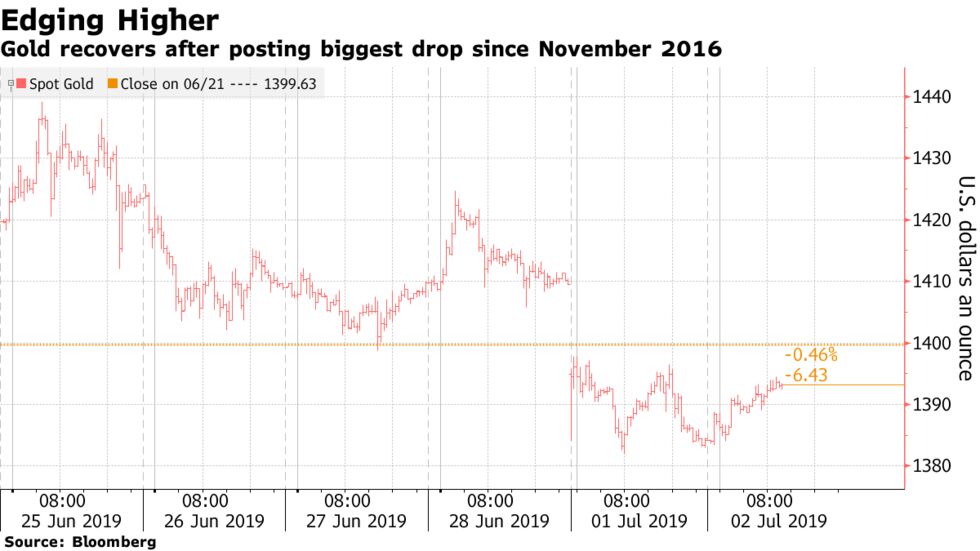

Gold rebounded from its biggest decline in more than two years on signs of fresh strains on the global economy which may prompt stimulus from central banks.

Prices rose after factory activity across Asia and Europe shrank in June, while the U.S. showed only meager growth. Renowned doomsayer Nouriel Roubini warned that the trade war and a spike in oil prices from geopolitical tensions could potentially push the world into recession next year.

Investors will be watching out for the U.S. employment data due Friday for clues on the Federal Reserve’s monetary policy. So far, they’ve been encouraged by the run up in gold prices, with holdings in bullion-backed exchange-traded funds expanding for a 14th straight day. Given the inflows, “you could argue the bullish set-up has yet to be properly tested,” MKS PAMP Group said in a trading note.

Bullion jumped to a six-year high last week on expectations that the Fed would start lowering rates as soon as July, and as rising geopolitical tensions boosted demand for havens. President Donald Trump said a new round of trade talks with China is underway following his meeting with President Xi Jinping, but the damage from the prolonged dispute between the two countries may have already spread as reflected by the weak PMIs.

News that the U.S. added more products from the European Union to a list of goods it could hit with retaliatory tariffs added to the uncertainty. Australia executed its first back-to-back interest-rate cuts in seven years Tuesday.

Spot gold climbed as much as 0.8% and was at $1,392.73 at 11:12 a.m. in London. Prices fell 1.8% on Monday, the most since November 2016, as American equities surged to a record after the resumption of talks between the U.S. and China. A gauge of the U.S. dollar was little changed after rising 0.5% Monday.