Categories:

General Market Commentary

/

Precious Metals

Topics:

General Market Commentary

/

General Precious Metals

Golden Arrow Resources Raises C$4.74M, Ramping Up Production at Puna

The Critical Investor admires the way this company with a JV on a silver mine conducted its financing.

Usually the standard modus operandi for juniors doing a financing revolves around three things if they can get the money: take it, take it and take it. Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE)realized that raising the money in very negative sentiment in Q4, 2018, with tax loss selling projected to have significant impact last year for most companies and probably dragging along everything with it until mid-December, wasn't the smartest thing to do. The share price was walked down by interested parties at the time, and management got requests for lower and lower unit prices, but they weren't with their backs against the wall, so they decided to wait and cancelled the financing. The 25% owners of the Puna JV with operator SSR Mining Inc. (SSRM:NASDAQ), based on the ramping up open-pit Chinchillas Mine and the almost depleted Pirquitas Mine in the Jujuy province in Argentina, hoped for better times around the corner.

And sure enough, things started to turn in January, and Golden Arrow launched another attempt on February 12 at a slightly lower unit price of C$0.30 (was C$0.35). Golden Arrow closed the first tranche of the non-brokered private placement through the issuance of 11,051,611 units (common share plus full 2-year warrant @C$0.40) for gross proceeds of $3,315,483 on February 22, 2019. On March 5, 2019, it closed the second tranche through the issuance of 1,290,367 units for gross proceeds of $387,110. Finally, the company closed the third and final tranche of 3,462,034 units for gross proceeds of $1,038,610 on March 22. In total, Golden Arrow issued 15,804,012 units for gross proceeds of $4,741,203 in this round. Despite the full warrant (would have loved to see a half warrant), in my view C$4.74 million is a very decent result these days for a junior producer with a small market cap of about C$30 million.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise

A part of this placement was arranged through finders, and for the last tranche, finder's fees of $6,650.70 were paid in cash to parties at arm's length to the company. In addition, 22,169 non-transferable finder's warrants are being issued. Each finder's warrant entitles a finder to purchase one common share at a price of $0.40 per share for two years from the date of issue, expiring on March 21, 2021. In total for this private placement (PP), finder's fees of $60,090.73 were paid and 196,302 finder warrants were issued. According to management, this accounts for a percentage of 7% in cash and 7% in warrants. The proceeds of the financing will be used for general working capital.

Golden Arrow Resources has, after the closing of the recent financing, C$7 million in cash at the moment according to management, and no long-term (LT) debt. As a reminder, the company has been drawing down from a short-term US$10 million credit facility with JV partner SSR Mining, confined to Puna capex obligations, with an interest rate of US base rate plus 10% and a final maturity date of December 31, 2020. Management confirmed to me that they will make a final payment of C$2.3 million in March, and hereby will have completed the mandatory capex payment obligations.

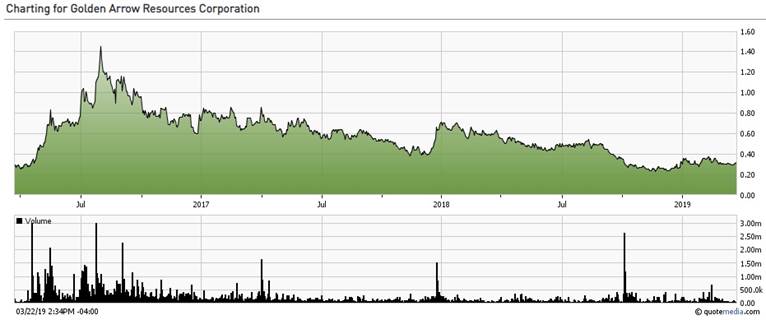

As of March 26, Golden Arrow Resources has a share price of C$0.295 and a market cap of C$34.74 million, with 117.77 million shares outstanding, and fully diluted 131.3 million. All options and warrants are out of the money at the moment. The average daily volume has come down from almost 300k shares but is still a liquid 100,064 shares.

Share price GRG.V, 3 year period (Source: tmxmoney.com)

The worst is behind Golden Arrow it seems, as a combination of negative sentiment, upcoming tax loss selling, lower metal prices and an upcoming private placement weighed heavy on the share price in the last quarter of 2018. As the company has paid off its share of capex for Puna, it can concentrate now on receiving growing cash flow from the ramping-up operation at Puna, as a bonus hoping for a rising silver price, and repaying short-term credit facility before year-end of next year. Let's have a quick look at the production figures and forecast of Puna now.

Highlights from SSR Mining's news release dated January 15th, 2019, include (figures are on 100% basis):

- "In 2018, Puna Operations produced a total of 3.7M ounces of silver, 8.8M pounds of zinc and 3.1M pounds of lead. Silver sold for the year totaled 3.8M ounces."

- "In December ore was sourced exclusively from Chinchillas and achieved a 3,605 tonnes per day milling rate."

- "Puna is expected to produce between 6.0 and 7.0M ounces of silver at cash costs of between $8.00 and $10.00 per payable silver ounce sold."

- "As previously announced, the completion of certain Chinchillas project infrastructure carries over into 2019 with remaining investment of approximately $9 million expected to be incurred in the first quarter. The project remains on budget."

The Chinchillas PFS uses a mine plan based on 4,000 tpd throughput, so the Puna operation is already close to reaching this. As a reminder, the nameplate capacity of the Pirquitas plant is 5,000 tpd, and represents one of the options to meaningfully increase cash flow. The total production of 3.7 Moz Ag is according to plan and exactly the midpoint of the SSR forecast of 3–4.4 Moz Ag for 2018, as the processing of Pirquitas stockpiles was expected to bring in around 1 Moz Ag per quarter, and this came to an end in November 2019, when the switch to just Chinchillas ore was made. Net earnings to Golden Arrow were marginal as cash costs of stockpile processing were predominantly above the current silver price. When Chinchillas is fully operational, I expect cash costs to go down considerably.

As a reminder, the PFS outlines an average annual production during an 8-year life of mine (LOM) at a 4,000 tpd throughput of 6.1 Moz Ag, 35M lb Pb and 12.3M lb Zn, which is 8.4 Moz AgEq. This is based on 81 Moz AgEq reserves. As the total resource stands at 203 Moz AgEq, and nameplate capacity of the Pirquitas plant is 5,000 tpd, there are options to increase the life of mine and revenues/cash flow. With a 5,000 tpd throughput, annual production could go to 10–10.5 Moz AgEq. Adding 40 Moz AgEq by converting Chinchillas resources is another option, and besides this there is the Pirquitas high-grade underground resource, which could add another 10 Moz AgEq when developed. With this expansion scenario, the life of mine could increase to 12 years.