Categories:

Base Metals

/

General Market Commentary

/

Precious Metals

Topics:

General Base Metals

/

General Market Commentary

/

General Precious Metals

Goldman Predicts Commodities Will Soar in 2019

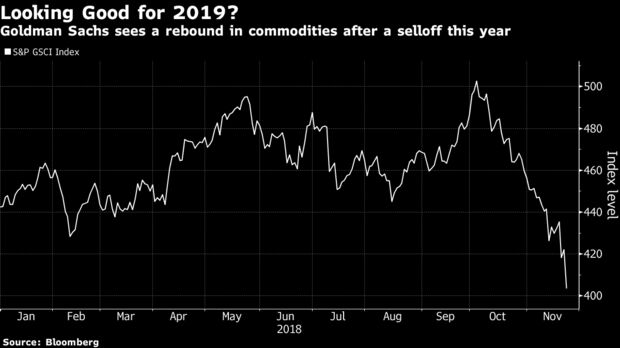

Commodity bull Goldman Sachs Group Inc. is undaunted by the sell-off in raw materials and is forecasting returns of about 17 percent in the coming months, describing the current situation as unsustainable and touting this week’s G-20 meeting in Buenos Aires as a potential turning point.

“Given the size of dislocations in commodity pricing relative to fundamentals -- with oil now having joined metals in pricing below cost support -- we believe commodities offer an extremely attractive entry point for longs in oil, gold and base,” analysts including Jeffrey Currie said in a report. The note listed its top 10 trade ideas for 2019, including a rebound in Brent as OPEC cuts supply.

Raw materials have been battered in November on a toxic cocktail of drivers, with crude sinking amid speculation there’s too much supply, metals getting hit on concern growth is slowing, and investors fretting about the outlook for the trade war between the U.S. and China. This week, leaders from the G-20 gather in Argentina, offering presidents Donald Trump and Xi Jinping a chance to address their trade spat, while Russia’s Vladimir Putin has an opportunity to address crude policy with Saudi Crown Prince Mohammed bin Salman.

“Many of the political uncertainties weighing on commodity markets have a significant chance of being addressed in Buenos Aires,” Goldman said. “This includes some improvement on the China-U.S. relationship and, like in the 2016 G-20 meetings, some greater clarity on a potential OPEC cut.”