Mike Fagan,

Editor

April 19, 2022

GoldMining Inc. (TSX: GOLD)(NYSE-American: GLDG) — currently trading around C$2.10 per share — has commenced a 3,600-meter drill program at the 100%-owned La Mina gold-copper project located in Antioquia, Colombia.

The current drilling focus is on the La Garrucha target which is situated about 1 km east of the known resource area at La Mina. The property has advanced infrastructure in place including roads, power, and an available workforce and boasts a low capital intensity of just under US$300 million.

Last quarter, GoldMining Inc. released a positive first-pass PEA on the 3,200-hectare La Mina project. The study envisions an open pit mining scenario at a production rate of 102,000 gold-equivalent ounces per annum over a 10.4-year mine life from the La Cantera and Middle Zone deposits with additional potential via further advancement of the La Garrucha deposit area.

The PEA estimates an after-tax NPV of US$232 million and an IRR of 14.5% at an all-in sustaining cost (AISC) of US$698 per gold ounce; of course, the yellow metal is currently trading much higher at approximately US$1,970 per ounce.

GoldMining CEO, Alastair Still — whom you’re about to hear from directly in our exclusive interview — commented via press release:

“The start of our first drilling campaign on the La Garrucha target at La Mina marks an important milestone for our Company as we begin to unlock value from our portfolio of gold and gold-copper projects located throughout the Americas. This exploration drilling program is designed to test an exciting target, which we believe has the potential to expand upon the project's existing resource base and represents an opportunity to enhance the economics of the recently announced Preliminary Economic Assessment (see January 12, 2022 news release). We are planning approximately 3,600 meters of drilling in 6 holes with the core to be logged and sampled at our existing La Mina project facilities. Samples of sawn core will be transported to ALS Colombia LTDA in Medellín for assaying.”

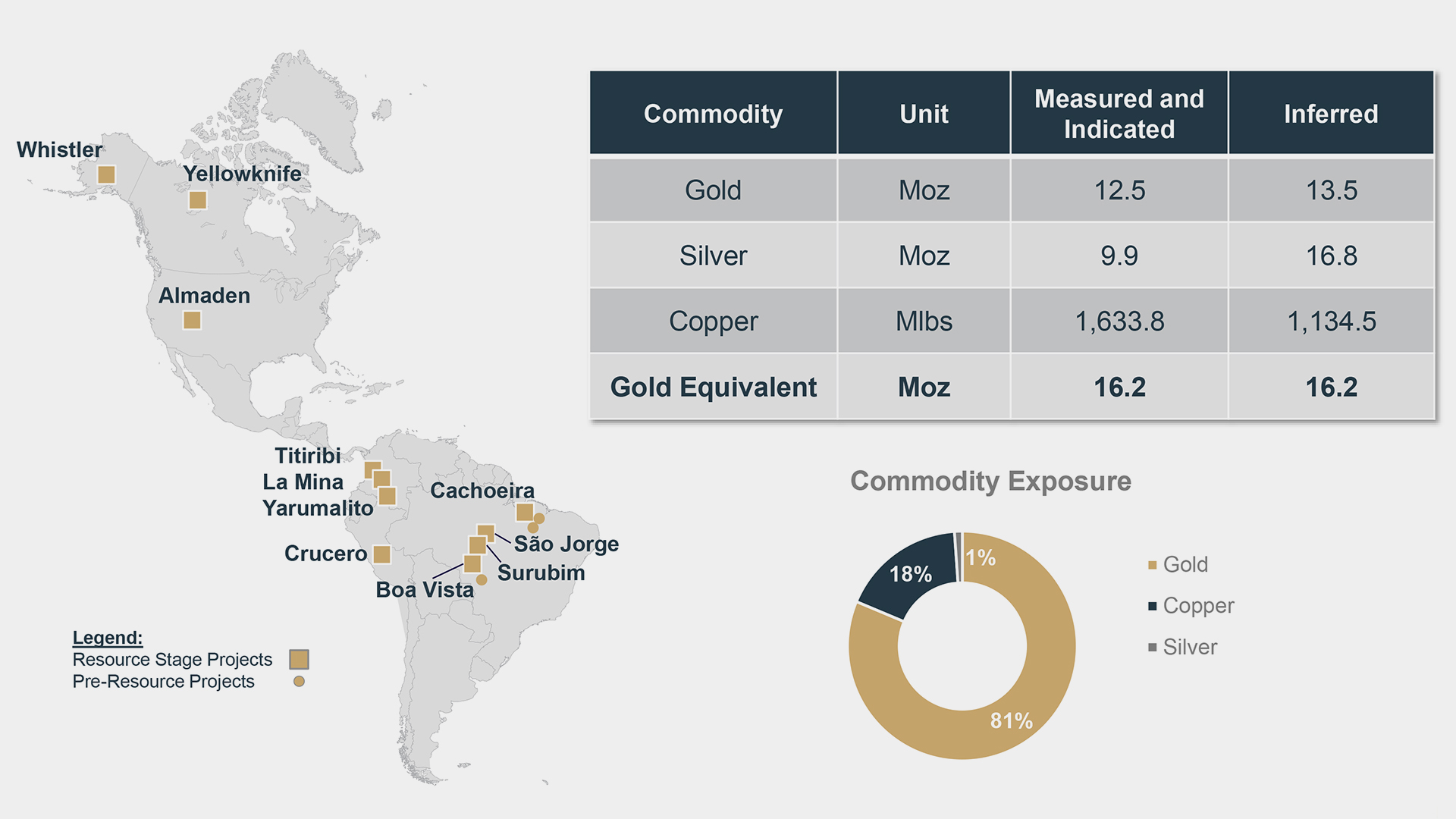

GoldMining Inc. is advancing an impressive portfolio of resource-stage gold and gold-copper projects in the United States, Canada, Brazil, Colombia, and Peru.

View Map

With gold marching toward US$2,000/oz and with copper trading well above US$4.50/lb, GoldMining has been delivering a steady stream of development news across its impressive resource inventory of ~32 million gold-equivalent ounces (M&I plus Inferred).

The company has also announced the creation of a new subsidiary, U.S. GoldMining Inc., to focus on advancing the company’s Whistler gold-copper project located northwest of Anchorage, Alaska.

The new entity will be led, as CEO, by newly-appointed GoldMining Inc. vice president of exploration, Tim Smith. Tim boasts a long-established track record of mineral exploration success, including the discovery of the Coffee Gold Deposit (~5Moz) in the Yukon as then vice president of exploration for Goldcorp.

GoldMining Inc.’s board is putting in motion a strategy to list U.S. GoldMining Inc. as a separate public company via IPO — a process that will likely be completed in the next 4 to 6 months. The new subsidiary will have a dedicated team and an experienced board of directors, led by Tim Smith, to advance the Whistler project — which will become the flagship asset of the new entity.

Our own Gerardo Del Real of Junior Resource Monthly caught up with GoldMining Inc. CEO Alastair Still to catch up on the latest developments including the start of drilling at La Mina. Enjoy!

Yours in profits,