Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Gonna Ride My Horse to the Lithium Road

The battery revolution is happening.

It’s being led — and will be dominated — by lithium.

And it’s going to happen faster than we can currently imagine. In vast swaths of the world, internal combustion engines will seemingly be replaced overnight. It’s a horse-to-Model-T moment.

In China, the government is already confiscating gas-powered cars in some cases. The Chinese government is also considering outright banning them. Some Chinese provinces have already announced they will prohibit the sale of gasoline vehicles in the next 10 years.

I won’t go over all the major auto brands that have announced major expansions into the electric vehicle market… because they all have. Some, like Volkswagen, are even moving into the lithium battery manufacturing game, a la Tesla.

So let’s skip the car brands and get to the good stuff.

From 2010 to 2018, global capacity for lithium-ion battery production has grown from 30GWh to 293GWh for 875% growth in less than a decade.

And it’s forecast by Benchmark Minerals Intelligence to grow another 600% in the next 10 years, all the way to 2,027GWh.

Four years ago, there were only three lithium battery megafactories planned globally. Today, over 68 new plants are in the works.

But related stock performance has been abysmal.

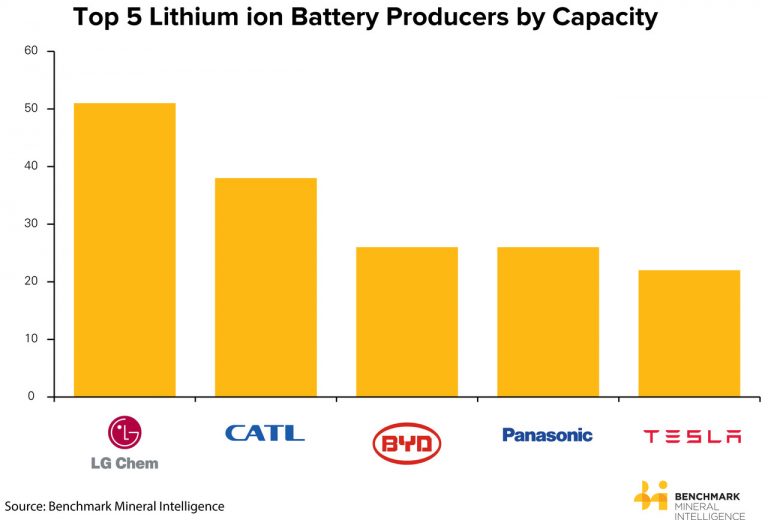

Panasonic (OTC: PCRFY) and Tesla (NASDAQ: TSLA) are two of the largest lithium battery producers by capacity.

But their stocks are down between 30% and 40% over the past two years — despite the overall stock market being at all-time highs.

It’s the same with lithium producers like SQM, Albemarle, and Orocobre. Those stocks have been cut in half over the past two years.

It’s a similar story to uranium.

It’s a similar story to uranium.

The fundamentals all point to a looming bull market. It’s globally needed. It’s clean and green and an important part of the fight against climate change.

But no one cares. No one believes it. Until they do.

Just ask the folks riding horses 100 years ago.

And when it happens, you’ll see the type of explosive bull market resources are renowned for, with the small companies that control quality lithium assets rocketing by thousands of percent.

Call it like you see it,

Nick Hodge