Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

How Batteries Sparked a Cobalt Frenzy and What Could Happen Next

Cobalt left other metals in the dust this year, driven by demand from electric carmakers like Tesla Inc. But with new supply coming online and high prices likely to spur substitution and recycling, the market for the key battery component could prove choppier next year.

Here are five themes that will capture the market’s attention in 2018.

Record Prices

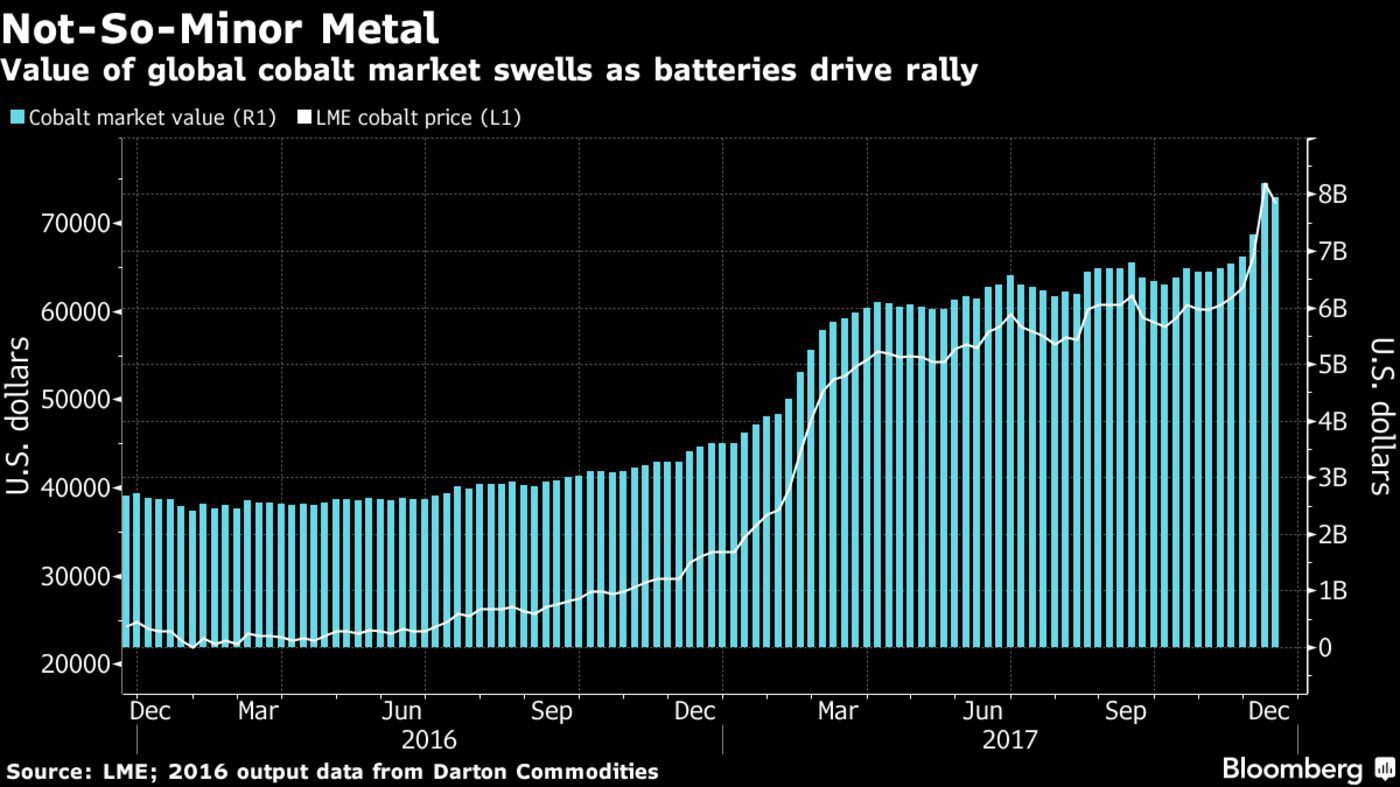

After prices more than tripled in the past two years, cobalt has become a valuable prize for the handful of miners producing it at scale. The global market has increased from about $4 billion a year at the end of 2016 to about $8 billion now and is roughly equal in size to the tin market.

But cobalt could be set to level out in 2018. BMO Capital Markets sees prices averaging about $68,200 a ton from about $72,000 now as Glencore Plc and Eurasian Resources Group ramp up major new projects in 2018 and 2019.

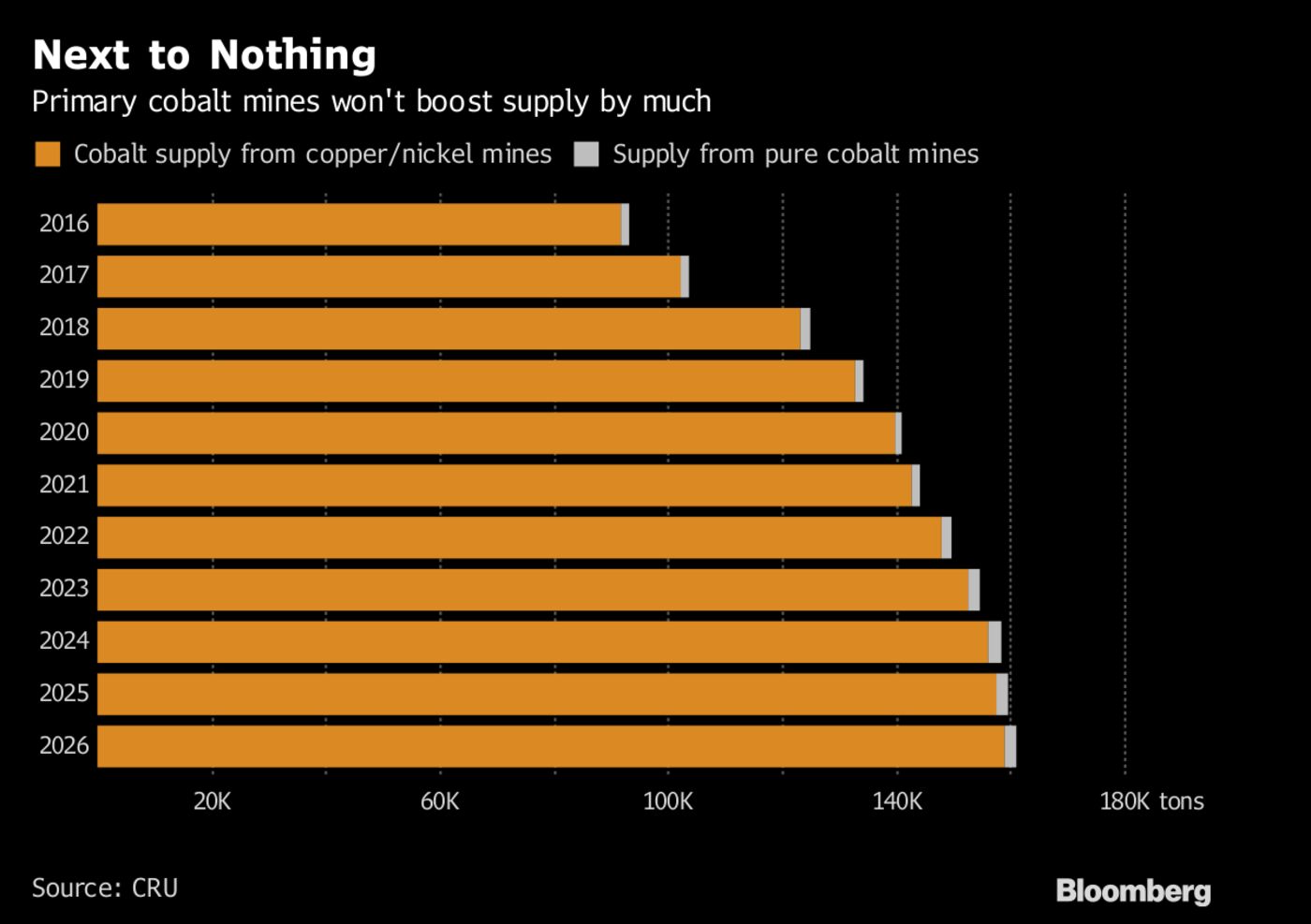

New Supply

Because cobalt’s mainly mined as a byproduct of copper and nickel, higher prices don’t tend to stimulate new supply in the way they would in other commodity markets. But with cobalt delivering major windfalls, producers are doing their best to ramp up output.

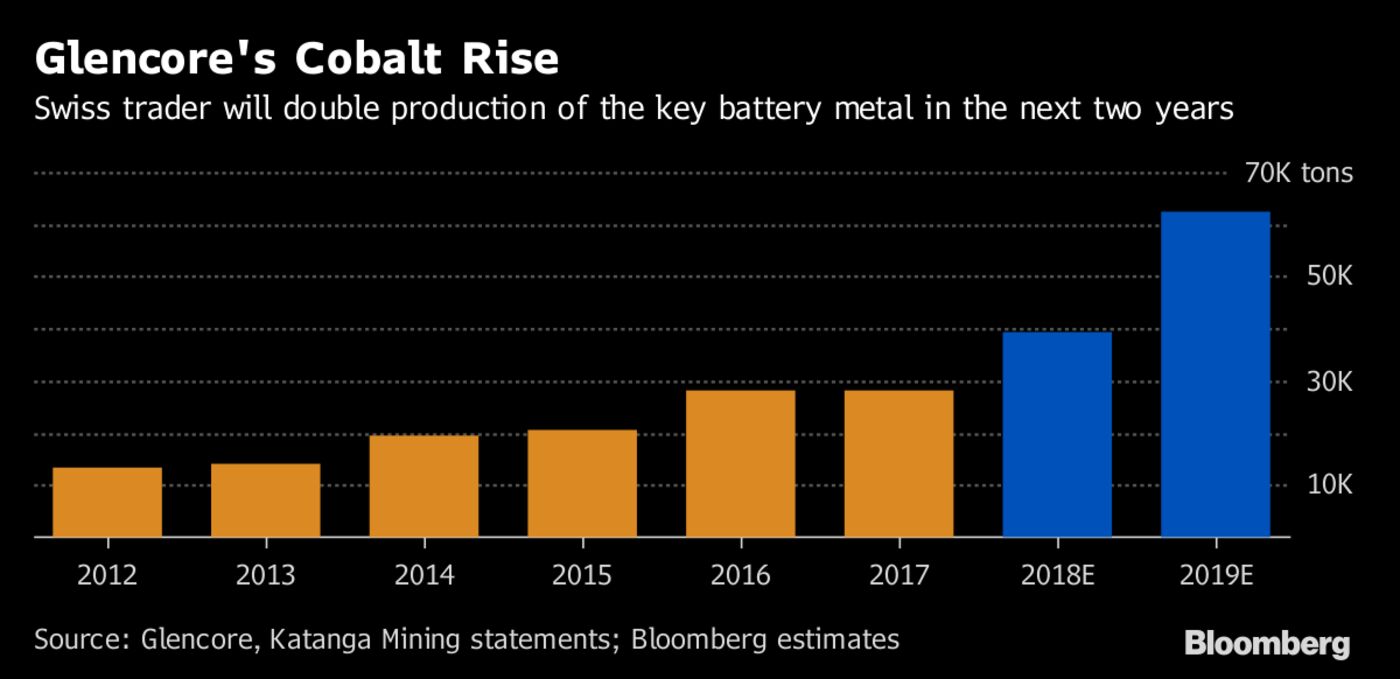

The larger-than-expected expansion at Glencore’s Katanga project, in particular, looks set to delay the onset of a shortage that many analysts see emerging as usage in electric vehicles starts to spike toward the end of the decade.

“Katanga changes our view on cobalt over the medium term,” George Heppel, a consultant at CRU Group, said by phone from London. The researcher has changed its forecast for 2019 from a market deficit to a surplus.

At the same time, few greenfield projects are likely to make it to production in the foreseeable future. “We’ve got a database tracking about 400 potential cobalt projects, but at this stage there are only about three that we’re taking seriously,” Heppel said.

Supply Contracts

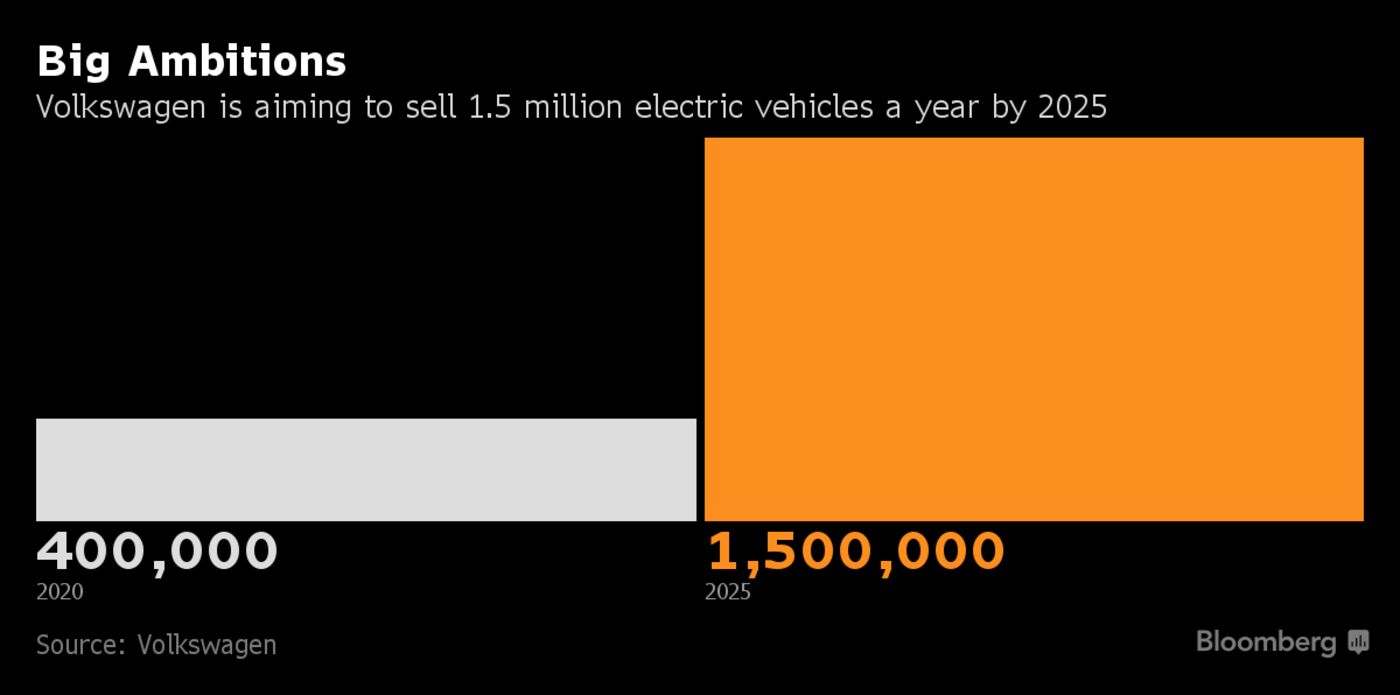

That’s likely to leave cobalt consumers nervous about long-term supplies. Glencore boss Ivan Glasenberg confirmed the miner’s already in talks with buyers including Tesla and Volkswagen AG, and those negotiations are likely to progress with urgency next year as the automakers move forward with ambitious plans to roll out mass-market electric vehicles.

Demand from automakers in China also looks set to rise amid a surge in electric vehicle sales. Orders for battery-powered automobiles were up 51 percent at 609,000 in the first 11 months of the year, and Bloomberg New Energy Finance says sales could surpass 1 million next year, almost equal to this year’s global total.

Carmakers hunting long-term supplies may be more willing to link sales to floating spot prices. Volkswagen asked producers to supply cobalt at a fixed price in a long-term tender in September, but has since relaxed its demand , according to people familiar with the matter.

Easing sales constraints may help bridge the divide between consumers wanting long-term supply and miners worried about leaving money on the table. “There are a lot of customers who want to lock in a supply, but, naturally, we will keep the price floating,” Glasenberg said on an investor call this week.