Categories:

Base Metals

/

General Market Commentary

/

Precious Metals

Topics:

General Base Metals

/

General Market Commentary

/

General Precious Metals

Is this the start of a hot new metals bull market?

Major U.S. indices slid for a second straight week as President Donald Trump and North Korea both escalated their saber-rattling, with Kim Jong-un explicitly targeting Guam, home to a number of American military bases, and Trump tweeting Friday that “Military solutions are now fully in place, locked and loaded.” The S&P 500 Index fell 1.5 percent on Thursday, its largest one-day decline since May. Military stocks, however, were up, led by Raytheon, Lockheed Martin and Northrop Grumman.

As expected, the Fear Trade boosted gold on safe haven demand. The yellow metal finished the week just under $1,300, a level we haven’t seen since November 2016. Last week, Ray Dalio, founder of Bridgewater Associates, the largest hedge fund in the world, said it was time for investors to put between 5 and 10 percent of their portfolio in gold as a precaution against global and domestic geopolitical risks. The threat of nuclear war is at the top of everyone’s mind, but Dalio reminds us that our indecisive Congress could very well fail to agree on raising the debt ceiling next month, meaning a “good” government shutdown, as Trump once put it, would follow.

Dalio’s not the only one recommending gold right now. Speaking to CNBC last week, commodities expert Dennis Gartman, editor and publisher of the widely-read Gartman Letter, said that he believed “gold is about to break out on the upside strongly” in response to geopolitical risks and inflationary pressures. Gartman thinks investors should have between 10 and 15 percent of their portfolio in gold.

Government shutdowns haven’t always been harmful to the stock market—during the last one, in October 2013, stocks actually gained about 3 percent—but I agree that it might be prudent right now for investors to de-risk and ensure their portfolios include safe haven assets such as gold and municipal bonds. Dalio and Gartman’s allocation percentages mirror my own. For years, I’ve recommended a 10 percent weighting in gold, with 5 percent in bullion and 5 percent in high-quality gold stocks, mutual funds and ETFs.

Analysts Bullish on Metals and Commodities

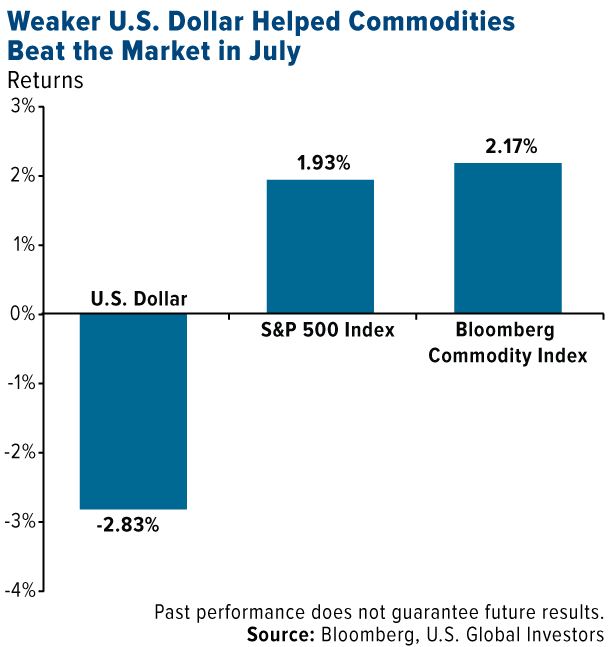

Like stocks, the U.S. dollar continued its slide last week. This has lent support not just to gold but also commodities, specifically industrial metals. The Bloomberg Commodity Index actually beat the market in July, the first time it’s done so this year.

If we look at the index’s constituents, we find that six metals—aluminum, copper, zinc, gold, silver and nickel—have been the top drivers of performance this year, thanks to a weaker dollar, China’s commitment to rein in oversupply and heightened demand. According to Bloomberg, an index of these six raw metals has jumped to its highest in more than two years.

Some market observers believe this is only the beginning. Guy Wolf, an analyst with Marex Spectron Group, told Bloomberg that he doesn’t “see anything” to make him doubt the firm’s belief that metals “are now in a bull market.”

“As people start to realize that the reasons for prices going up are robust and sustainable, that’s going to bring more money into the market,” Wolf added.

This bullish sentiment is shared by Mike McGlone, senior commodities analyst with Bloomberg Intelligence, who writes that commodities’ strong performance in July “could be the beginning of a trend.”

“Supported by demand exceeding supply, on the back of multiple years of declining prices, a peaking dollar should mark an inflection point for sustained commodity recovery,” McGlone says.

I can’t say whether we might eventually see the highs of the commodities supercycle in the 2000s, but this news is certainly constructive.