Junior Firm Advancing Major Lithium Resource in Nevada

by Mike Fagan

![]()

Cypress Development Corp. (TSX-V: CYP)(OTC: CYDVF) — currently trading at approximately C$1 per share — has announced completion of an oversubscribed C$19.55 million bought deal financing and, additionally, has commenced development of a pilot plant program for its 100%-owned, 5,430-acre Clayton Valley Lithium Project, Nevada.

Located midway between Las Vegas and Reno, the project is situated immediately east of Albemarle’s Silver Peak mine, which has been in continuous operation since 1966 as North America’s only lithium brine operation.

Exploration and development by Cypress has led to the discovery of a large, world-class resource of lithium-bearing claystone at Clayton Valley wherein the company is working toward a Feasibility Study and permitting of a mine and metallurgical facility.

Last month, the company announced development of a lithium hydroxide pilot plant at the del Sol Refining & Extraction facility in nearby Beatty, Nevada. The plant will enable Cypress to produce marketing samples to support negotiations with potential offtake and strategic partners while also providing essential data to be used in various economic studies including the aforementioned Feasibility Study.

Cypress CEO, Dr. Bill Willoughby — whom you’ll be hearing more from in a moment — commented via press release:

Last year’s PFS (Prefeasibility Study) outlined a mill rate of 15,000 tonnes per day for 27,400 tonnes LCE/yr over a 40-yr mine life and 4.4-yr capex payback period using US$9,500 per tonne LCE.

The project’s after-tax NPV (-8%) came in at US$1.03 billion and 25.8% IRR.

That’s essentially a US$1B valuation for a company boasting a current market cap well below US$100 million.

As mentioned, Cypress Development is led by CEO, Dr. Bill Willoughby — a highly-accomplished mining engineer with nearly four decades of industry experience including as former president of International Enexco and leadership roles at Teck (Cominco).

Dr. Willoughby states, “This PFS is a major milestone for Cypress. These positive results take us closer to our goal of developing a world-class lithium deposit. Cypress' land position and resources afford us the opportunity for a long-life project with low operating costs and potential to be a significant source of lithium for the United States.”

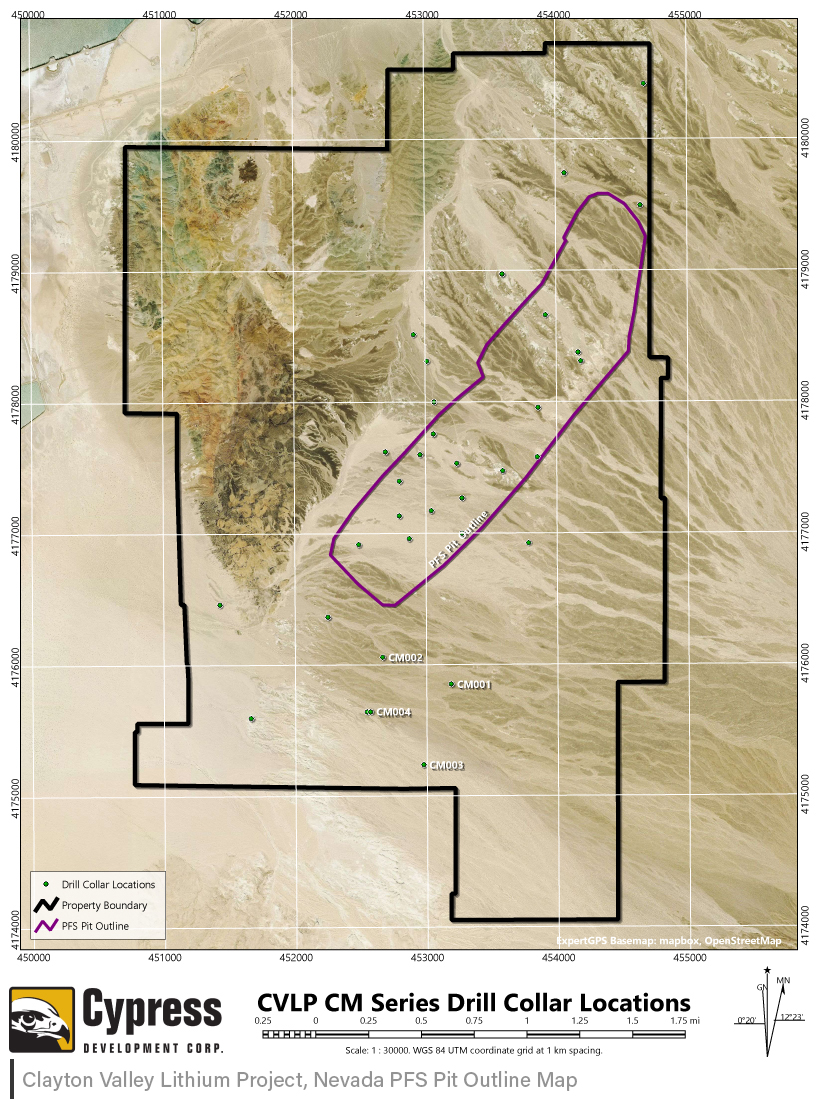

Spanning 8.5 sq mi, the company’s Clayton Valley property is expansive — and, importantly, the resource calculation from last year’s PFS [929.6 million tonnes averaging 1,062 ppm Li or 5.2 million tonnes LCE] was derived using only a small fraction of the property (see aerial image below).

Hence, with the vast majority of the property yet to be explored, ample opportunity exists for resource expansion with which to extend the mine life well beyond 40 years (as calculated in the PFS).

The Clayton Valley Lithium Project boasts a number of potential cost saving advantages over conventional mining including its flat-lying orientation over a large area with mineralization occurring at-surface with almost zero overburden.

The company’s current modeling indicates a relatively straightforward leach extraction process at a low strip ratio of 0.29:1. And since it’s clay, Cypress can move straight into resource excavation without having to do any drilling or blasting.

Of course, that’s not to say that extracting lithium from clay is easy or even the norm. The vast majority of lithium production around the world is from lithium brines and hard rock pegmatites — making clay extraction a truly nascent subsector of the broader lithium industry.

To that end, the Cypress team is deploying its pilot plant program as a means of demonstrating its planned leach extraction process on a larger scale than anything it’s done in the past.

Metallurgical work performed to-date at the site has determined optimum conditions for leaching with results averaging an impressive 86.5% extraction of lithium into solution.

And although nascent, Cypress is certainly not alone in the lithium-from-clay world. The company’s Clayton Valley project is one of a handful of large-scale lithium clay projects in development in North America — including Ioneer Ltd.’s neighboring Rhyolite Ridge project and Lithium Americas' Thacker Pass project in northern Nevada.

And the timing could not be better for the company, and for speculators, with lithium playing an ever-increasing role in the global EV boom.

Bloomberg New Energy Finance projects that by 2040, 58% of all global vehicle sales will be electric. That’s over 55 million EVs being sold annually — a nearly 20-fold increase from the 3 million being sold today.

With a robust treasury of approximately C$20 million, Cypress is well-funded to accomplish its stated goals for 2021, which include, among other things, completing a pilot plant program and producing a Feasibility Study for its Clayton Valley Lithium Project.

Our own Gerardo Del Real of Junior Resource Monthly caught up with CEO, Dr. Bill Willoughby, for an in-depth discussion of all-things Cypress Development. You can listen in to that conversation here, or also read the transcript. Enjoy!

You can also find more information on Cypress Development Corporation here.

Yours in profits,

Mike Fagan

Editor, Resource Stock Digest

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad, Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest and Hard Asset Digest readers.