Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Lead Outlook 2018: Supply Tightness to Continue

It’s been a strong year for lead prices, which hit a six-year high in October and have been trading near the $2,500-per-tonne-level since then.

This time last year, analysts were predicting an increase in demand, which was expected to result in a more balanced market. However, throughout 2017 the lead market has remained in deficit, with strong demand and tight supply pushing prices higher than many had predicted.

As the year comes to a close, the Investing News Network is looking back at the main trends in the lead space in 2017 and what’s ahead for prices, supply and demand in the new year. Read on to learn what analysts and market participants had to say.

Lead outlook 2018: Price performance review

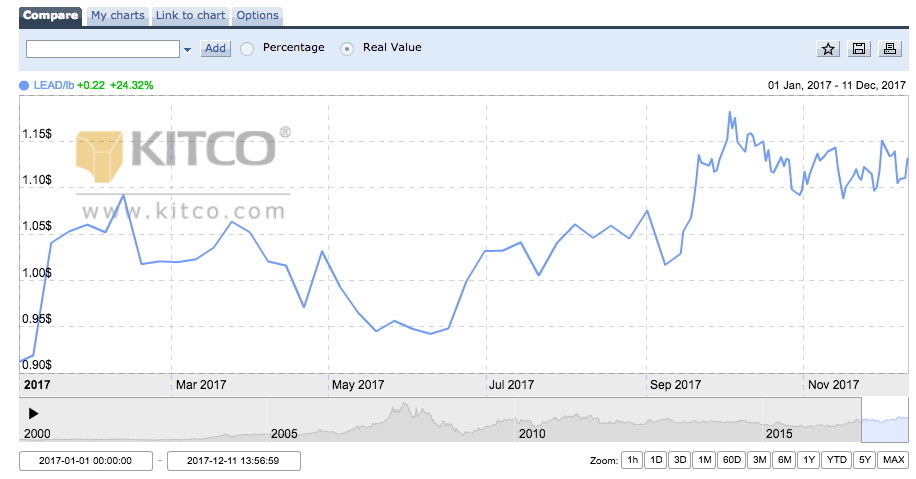

Lead prices have surged more than 24 percent since the beginning of the year on the back of supply tightness and a weaker US dollar.

As the chart below from Kitco shows, the highest point of the year for prices came in October, when LME lead hit a six year-high of $2,620. China’s environmental crackdown along with declining lead stockpiles supported the increase.

Chart via Kitco.

Meanwhile, lead’s lowest point of the year came in January, when prices were trading at $2,006.50. Geopolitical tensions and a stronger US dollar offset gains for the base metal during that time.

According to FocusEconomics economist Jan Lammersen, the key trend in the lead market this year has been a mismatch in supply and demand, with the latter generally outpacing the former throughout the year. “The underlying fundamentals of the lead market have been strong this year,” he added.

Similarly, analysts at CRU Group said they correctly predicted the direction of lead prices this year, but were surprised by the strength of the rally. “[This was] not just a story of firmer lead industry fundamentals, but also one of broader uplift in metal prices (including sister mining metal zinc), with lead being pulled up by greater investor interest in the tightening metals story,” they said.

In terms of demand, robust car sales in China, as well as solid industrial production data from China, Europe and North America, supported prices. “Demand from producers of stationary industrial batteries, which use lead, was expected to continue to grow, but turned out to be subdued,” Lammersen explained.

Looking at supply, “the ongoing environmental crackdown in China, which is aimed at solving its pervasive pollution problem, led to disrupted supply chains and decreased Chinese output,” he added.