Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Lithium Giant Eyes New Project to Tackle Electric-Car Boom

One of the world’s largest lithium producers is looking to expand into a new country as prices surge to record highs amid a nascent electric-vehicle boom led by car makers such as Tesla Inc. and Mitsubishi Corp.

Soc. Quimica & Minera de Chile SA is considering opportunities to establish a foothold in a fourth country, according to company officials, who asked not be named because the matter hasn’t been made public.

SQM operates in Chile’s Atacama desert, home to the world’s largest known lithium reserves, is developing a mine in Argentina and has entered into an Australian joint venture. The Santiago-based company once looked into a project in China, but dismissed it for being too complicated, the officials said.

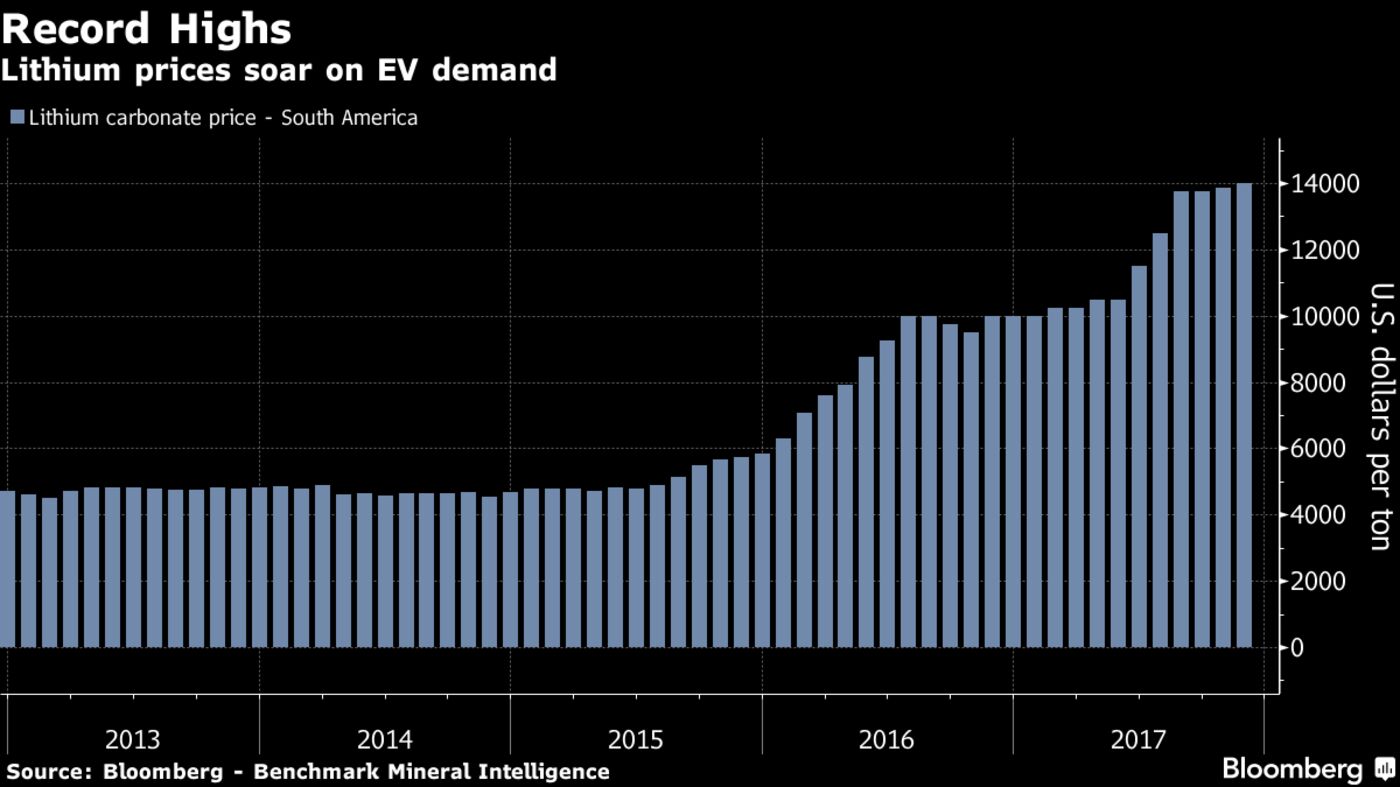

Prices for the mineral used in rechargeable batteries soared to $14,000 a metric ton in South America in November, according to Benchmark Mineral Intelligence. One or two medium-sized lithium projects would have to start producing each year to keep up with estimated annual demand growth of about 15 percent. SQM expects the market to remain tight until the second half of 2018 when new output from two Australian mines will take effect.

SQM is engaged in an arbitration process with Chilean government agency Corfo over its Atacama concession. The company expects to reach a production quota in 2022 under current licenses for Atacama. Its project in Argentina is scheduled to start producing in mid 2019.

The company needs to diversify geographically regardless of the conflict with Corfo and wants to add a fourth country to the mix, the officials said.

Dwindling Debt

With surging lithium prices boosting margins, SQM’s ratio of net debt to earnings before interest, taxes, depreciation and amortization has fallen to 0.3, the lowest in at least a decade, according to data compiled by Bloomberg. That compares with an average of 7.2 among members of the Solactive Global Lithium Index.

SQM shares have jumped 82 percent this year as part of a lithium-producer rally. That would be the company’s best year in the stock market in more than two decades.