Welcome to the August 2017 edition of the lithium miner news.

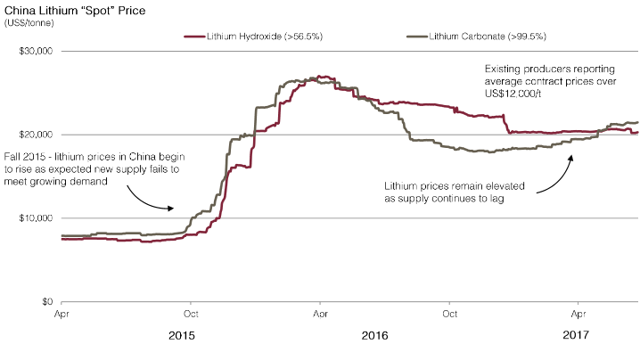

Lithium spot and contract price news

During August, 99.5% lithium carbonate China spot prices were up 3.17%, and are up 17.13% over the past year. Of note Chinese lithium cobalt oxide spot prices were up 1.87% for the month, and 27% over the past year.

China Lithium spot price chart 2015 to 2017

Source: Lithium Americas August 2017 presentation

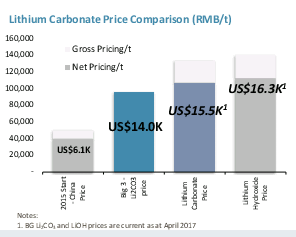

Source: Lithium Americas August 2017 presentation

Lithium US$ price chart as of April 2017 - noting prices have moved up around 10% since then.

Source: Galaxy Resources May 2017 presentation

The graph above shows April 2017 lithium carbonate contract prices at US$14-15,500/t, and lithium hydroxide at US$16,300/t. LCE prices have risen 11.32% in the past 6 months.

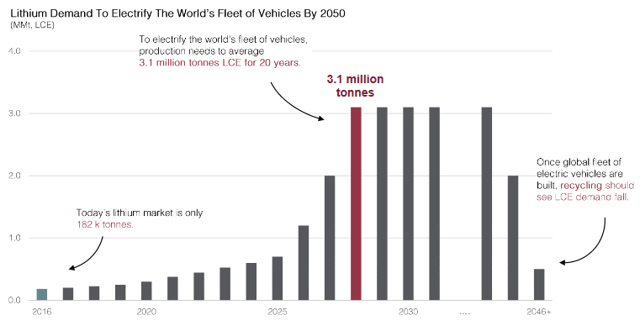

Lithium demand versus supply outlook

On August 7, Reuters wrote, "Lithium processors prepare to meet demand in era of electric car. Demand for battery-grade lithium compounds is expected to skyrocket in the next decades in tandem with soaring demand for electric cars. Battery makers and other end-users such as car manufacturers will need to sign multi-year deals that encourage large producers to invest more, and faster, industry sources say. The production and use of electric cars is projected by Morgan Stanley analysts to rise to 2.9 percent of 99 million new vehicles in 2020 and to 9.4 percent of 102 million new vehicles in 2025, from 1.1 percent of 86.5 million this year. By 2050, 81 percent of 132 million new auto sales will be electric, Morgan Stanley says."

On August 17, Benzinga reported analyst firm Oppenheimer saying: "We estimate annual demand for lithium will grow by 153K MT LCE in 2016-2021, with about 90K MT coming from BEVs and hybrids, 25K MT from e-buses, and the balance mostly from consumer products."

By comparison Orocobre quotes on their website that LCE demand will rise by 50,000 tonnes pa each year to 2020. That is very close to my model forecasts.

Lithium demand forecast

Source: Dr. David Deak, CTO of Lithium Americas

Source: Dr. David Deak, CTO of Lithium Americas

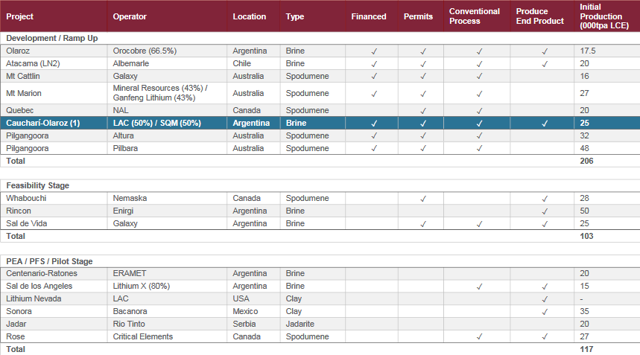

Next lithium projects

Source: Lithium Americas August 2017 presentation

Source: Lithium Americas August 2017 presentation

Lithium battery and market news

On August 1, Kirill Klip, International Lithium CEO, wrote a great blog "Lithium race at IMF: "Electric cars can replace motor vehicles in the next 10 To 25 years." A key quote in his article for lithium investors is:

Please note that in IMF's view for the electric cars my forecast of 36 million tonnes of LCE (Lithium Carbonate) to be produced by 2040 is very conservative and must be tripled in order to accommodate this transition to a fully electric fleet of new cars. According to The Economist, in the case of all new cars being electric by 2040, this fleet will count 1.8 Billion electric cars. We are talking here about over 100 million tonnes of LCE being produced by 2040 in order to make it happen. The starting point today is 200,000 tonnes of LCE produced in 2016. We are facing the total disconnect between the coming demand for lithium and the available supply.

Note: The 36mt LCE is based on building a 600m EV fleet. Both the 36 and the 100 million tonnes of LCE refer to a cumulative total. My model forecasts LCE needs at about 4.5mt pa once we are at 100m EVs being built pa (say 2040). Whichever way you look at it lithium demand is set to skyrocket. Remember LCE demand in 2016 was only 209,000 tonnes pa, based on Deutsche Bank research.

On August 7, Bloomberg wrote, "Electric car boom drives rush to mining's $90 billion hub. A scramble by the lithium market’s biggest players to tie up supply of the high-tech metal is gathering pace in the 170-year-old heartland of Australia’s $90 billion mining industry. Western Australia has four operations in production and three more major projects being advanced to begin output. Simon Moores, managing director of Benchmark Mineral, said "it’s a land grab like in the petroleum industry when BP, Shell and others rounded on the Middle East in the 1960s and 1970s.”

Lithium miner news

Albemarle (NYSE:ALB)

On August 7 Albemarle announced Q2, 2017 earnings.

Second quarter 2017 highlights included:

- Second quarter net sales were $737.3 million, an increase of 10% over the prior year.

- Second quarter earnings were $103.3 million, or $0.92 per diluted share.

- Second quarter adjusted EBITDA was $218.9 million, an increase of 15% over the prior year; adjusted diluted earnings per share from continuing operations of $1.13, an increase of 22% over the prior year.

- Completed the $250 million accelerated share repurchase program, retiring approximately 2.3 million shares during the first half of 2017.

On August 17, Benzinga reported, "Oppenheimer initiated coverage of Albemarle Corporation at outperform, with a $133 price target, which suggests about 17-percent upside from current levels. They expect Albemarle to benefit from its No. 1 position in the lithium market, as the transportation industry moves toward BEV/PHEVs on its way to autonomous vehicles along with the affordability of grid-tied stationary engine storage. The company accounts for over 35 percent of the industry supply."

Investors can read a recent article "Albemarle:The Lithium Juggernaut" by The Lithium Spot on Seeking Alpha.

Sociedad Quimica y Minera S.A. (NYSE:SQM)

On August 23, Seeking Alpha/PRNewswire reported, "SQM reports earnings for the second quarter of 2017."

Highlights included:

- SQM reported net income for the six months ended June 30, 2017 of US$204.4 million.

- Earnings per ADR totaled US$0.78 for the first half of 2017, higher than the US$0.54 reported for the first half of 2016.

- Revenues for the first half of 2017 were US$1,023.9 million, 16.2% higher than revenues for the first half of 2016.

FMC Corp. (NYSE:FMC)

On August 1, FMC announced Q2 results.

Highlights included:

- Consolidated revenue of $657 million, up 7 percent versus Q2 '16.

- Consolidated GAAP earnings of $0.56 per diluted share, up 14 percent versus Q2 '16.

- Consolidated adjusted earnings per diluted share of $0.48, up 4 percent versus Q2 '16.

- Agricultural Solutions segment earnings of $96 million, down 5 percent versus Q2 '16.

- Lithium segment earnings of $24 million, up 47 percent versus Q2 '16.

- Narrowing guidance range for 2017 adjusted earnings per diluted share to $2.30 to $2.50.

- FMC's previously announced transactions with DuPont on track to close November 1, 2017.

Investors should also be aware that FMC have long discussed the idea of selling of their lithium business, perhaps to do a spin off or an IPO.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466]

No news for the month.

Jiangxi Ganfeng Lithium [SHE:002460], Mineral Resources [ASX:MIN], Neometals (OTC:RRSSF), [ASX:NMT], International Lithium Corp [TSXV:ILC] (OTCPK:ILHMF)

On August 16, Neometals announced, "Mount Marion lithium project - Financial update." Included was "EBITDA A$14M during the second half of FY17 and forecasts approximately A$72M for the first half of FY18." Shows a rapid ramp up in FY18 for Mount Marion.

You can view a video on GL/MIN/NMT Mt Marion mine here, and read my recent article on International Lithium here.

Orocobre [ASX:ORE], [TSX:ORL], (OTCPK:OROCF)

On August 11, 4-traders reported, "UBS Group AG and its related bodies corporate became a substantial holder." A very positive sign for the company's future prospects.

You can read the Orocobre July 2017 investors presentation here or a recent aerial video of Orocobre's operations at Salar de Olaroz here. You can read more on my latest article on Orocobre here. Cannacord in their June analysts report, have a price target of AUD 5.80. 4-traders has analyst consensus target at AUD 4.21.