Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Lithium Miners News For The Month Of September 2017

Summary

Lithium spot and contract price news - Lithium China spot prices continue to rise.

Lithium market news - "China to ban sale of fossil fuel cars in electric vehicle push."

Lithium company news - Critical Elements announces excellent Feasibility Study results, and Pilbara Minerals’ Pilgangoora stage two to plan to lift output to 800,000tpa.

Welcome to the September 2017 edition of the lithium miner news. What an incredible month it was! The China announcement of their plan to ban fossil fuels sent the lithium mining stocks soaring higher as investors scrambled to buy the lithium miners on fear of missing out on the EV/lithium boom.

It was the best month for lithium stocks since April 2016 when I first wrote "Lithium Miners Are Booming As Lithium Spot Prices Rise - Which Lithium Companies Should I Buy?" Back then if you were an early follower of mine you could have bought SQM for $US19.99, FMC for US$38.16, and Albemarle for US$64.50. Now that was great buying! But don't worry if you have not bought yet, we are still in the first stage of the EV boom with EV market share globally only at ~1%.

Lithium spot and contract price news

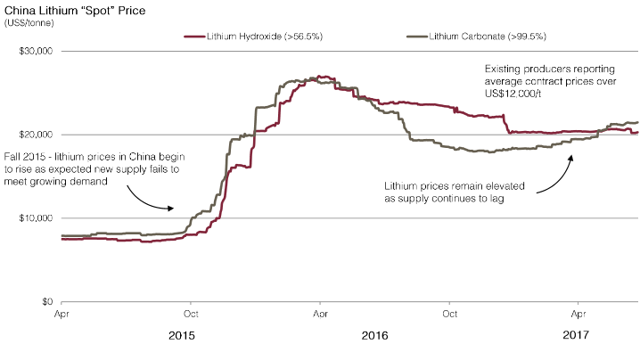

During September, 99.5% lithium carbonate China spot prices were up 2.87%, and are up 20.07% over the past year. Of note Chinese lithium cobalt oxide China spot prices were up 0.03% for the month, and 21.24% over the past year.

China Lithium spot price chart 2015 to 2017

Source: Lithium Americas September 2017 presentation

Source: Lithium Americas September 2017 presentation

On August 29, ThisIsMoney.co.uk reported:"London Metal Exchange (LME) considers plan to cash in on electric car boom by dealing lithium used in batteries. A spokesman said LME was ‘looking into’ lithium opportunities." Investing News also ran an article "Is the LME Lithium Contract Feasible?" They quoted - "Lithium expert Joe Lowry of Global Lithium told the Investing News Network that he expects a lithium contract to be launched at some point, but it is “likely a few years off.” Given cobalt and nickel are already traded on the LME, it would seem lithium will follow.

Lithium demand versus supply outlook

On September 7 Bloomberg Technology reported: "Picking electric car winners is BlackRock's key mining challenge. Blackrock’s Hambro sees large demand growth for EV materials.“The biggest theme over the next 10 or 15 years of investing is going to be getting right the transition away from the combustion vehicle towards EVs,” Evy Hambro, who manages BlackRock Inc.’s World Mining Fund, said in a Bloomberg TV interview on Thursday."

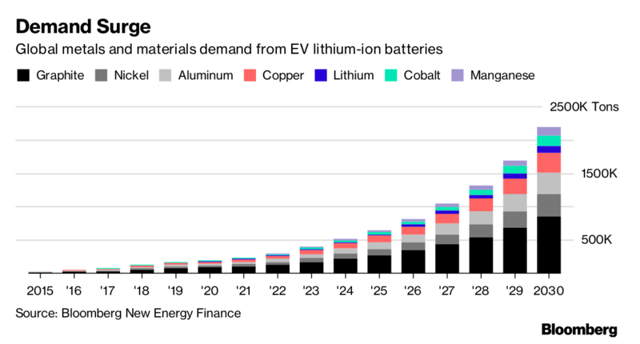

EV metals demand surge coming

Source: Bloomberg New Energy Finance

Source: Bloomberg New Energy Finance

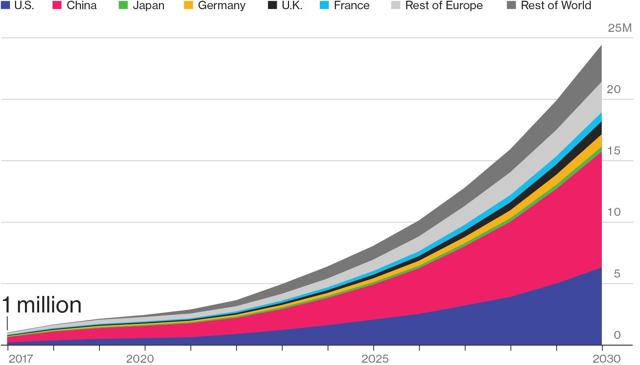

On September 7 Bloomberg Businessweek reported: "We are going to need more lithium. Demand for the metal won’t slacken anytime soon—on the contrary, electric car production is expected to increase more than thirty-fold by 2030, according to Bloomberg New Energy Finance. The total investment in new mines, including some for other elements used in lithium ion batteries, will likely range from $350 billion to $750 billion, according to analysts at researcher Sanford C. Bernstein & Co. Mining companies have promised to add 20 lithium production sites to the 16 currently operating, but the concern remains that they won’t be finished in time to satisfy rising demand."

EV annual sales forecast to 2030

Source: Bloomberg New Energy Finance

Source: Bloomberg New Energy Finance

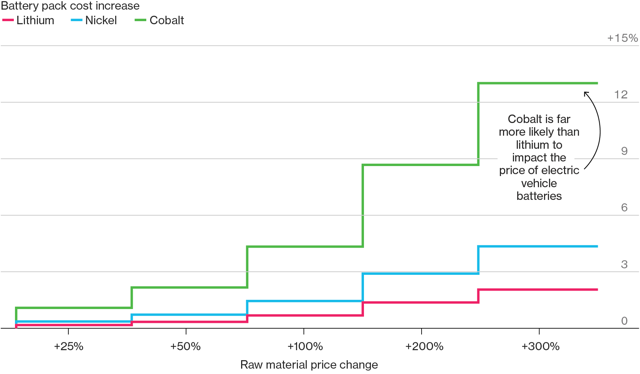

Higher lithium prices have minimal effect on battery pack prices

Source: Bloomberg New Energy Finance

Source: Bloomberg New Energy Finance

On September 11 Investor Insight reported, "New Benchmark needed as batteries, EV drive lithium and cobalt boom." Of interest they mentioned the key EV metals - "Lithium, graphite, cobalt, nickel, manganese, dysprosium, neodymium, praseodymium. Where they all come together and will be important for the future is in the advancement of the electric car revolution." I would also add in copper, and perhaps aluminum/scandium may play a role. Also of interest was the Benchmark Minerals quote - "In 2006, lithium-ion batteries were accountable for 22% of lithium demand, 20% of cobalt demand and 5% of graphite demand. By 2020, lithium-ion batteries will be consuming 67% of all lithium production, 59% of cobalt output and 35% of graphite, according to Benchmark."

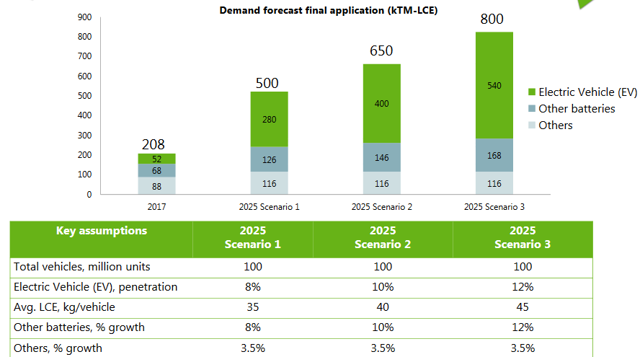

Lithium demand forecasts by SQM - September 2017

Looking at the SQM forecasts below their Scenario 3 of 800ktpa LCE by 2025 almost matches my 783ktpa by 2022 forecast - off course that is their aggressive 12% EVs scenario and my model has that target being reached 3 years earlier (based on 11% EV market share by 2022).

Source: SQM company presentation - September 2017

Source: SQM company presentation - September 2017

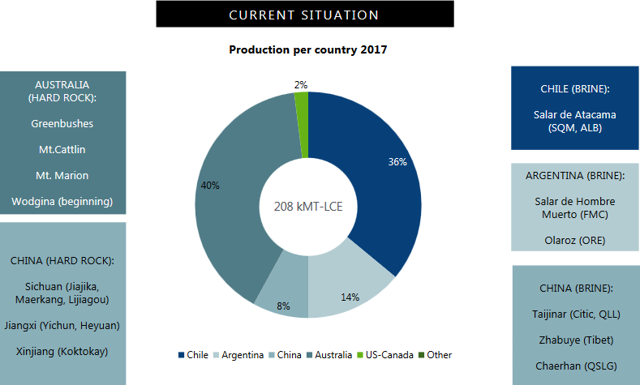

Lithium supply by country & companies listed

Source: SQM company presentation - September 2017

Source: SQM company presentation - September 2017

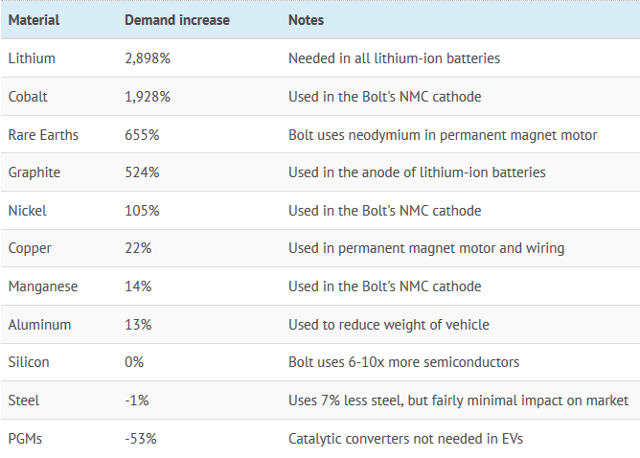

On September15 the Visual Capitalist released, "The massive impact of EVs on commodities in one chart." Below is a great summary table.

Impact on commodities in a 100% EV world

Source: Visual Capitalist

Source: Visual Capitalist

Note: The above table is based on the Chevy Bolt tear down. Tesla's batteries have more nickel and less cobalt.

Lithium battery and market news

On September 11 Bloomberg reported, "China to ban sale of fossil fuel cars in electric vehicle push. Regulators working on timetable for the ban, official says. China joins U.K., France to phase out combustion-engine cars. Xin Guobin, the vice minister of industry and information technology, said the government is working with other regulators on a timetable to end production and sales. The move will have a profound impact on the environment and growth of China’s auto industry, Xin said at an auto forum in Tianjin on Saturday." Benchmark Minerals Simon Moores response was - “Though it’s not a direct comparison, long-term it cements lithium as the heir to oil’s throne." (no link)

On September 21 Reuters reported, "BYD predicts ambitious China shift to electric cars by 2030. All vehicles in the country will be "electrified" by 2030, which could range from full electric cars to mild hybrids, BYD Chairman Wang Chuanfu said on Thursday." Chairman Wang is one of China's wealthiest men and linked to the top tier of Government.

On September 22 Reuters reported, "Exclusive: VW moves to secure cobalt supplies in shift to electric cars. Germany’s Volkswagen is moving to secure long-term supplies of cobalt, a vital component of rechargeable batteries, as the group accelerates its ambitious shift to electric cars. Battery and auto manufacturers need to sign multi-year deals to secure supplies of raw materials including cobalt and lithium."