Categories:

Energy

/

General Market Commentary

Topics:

General Energy

/

General Market Commentary

Lithium Mining - Understanding The Emerging Supply Landscape

Summary

A ramp-up in battery production has led to a tight supply which is expected to remain over the next years.

Existing lithium producers are moving forward with facilities expansions which will provide additional supply in the near term.

The market will require new lithium brine facilities beyond 2020 allowing exploration companies to move into production.

In the past year, the entire automotive supply chain has captured headlines as the industry announced its shift towards electric vehicles. Many automakers, both small and large have committed to release a line-up of all electric vehicles or plugin hybrids over the next few years. The wave of announcements has spurred economic activity downstream throughout the lithium supply chain from battery manufacturing to lithium exploration.

In addition, the stationary energy storage industry has also made headlines as utilities and independent power producers begin to integrate large scale battery systems into the energy infrastructure. In 2017, a large group of junior mining companies have flocked to Argentina to lock up land agreements, raise capital and begin to explore within the Argentine Lithium Triangle (See: Lithium Investing – All Roads Lead To Argentina).

The ramp up in battery production to meet the needs of the EV and stationary storage markets has led to a shortage in lithium carbonate which has driven prices to all-time highs. This has further encouraged investment into junior lithium exploration companies and supported heavy market valuations. It is important for investors to understand that there is a shortage of the white metal, which will last for the next years but there is a limit to the amount of new lithium production, which the market requires.

A mid- to long-term lithium investor should expect that only a handful of Greenfield lithium brines achieve commercial production over the next decade. A period of consolidation could occur in a key geographical region by a group of smaller exploration companies or a large multinational mining company. Therefore, investors in junior lithium-producing companies will benefit as these companies are in a good position to quickly and cost-effectively expand lithium production. As existing lithium production companies scale their output, lithium exploration companies will struggle as there will be less need for new supply.

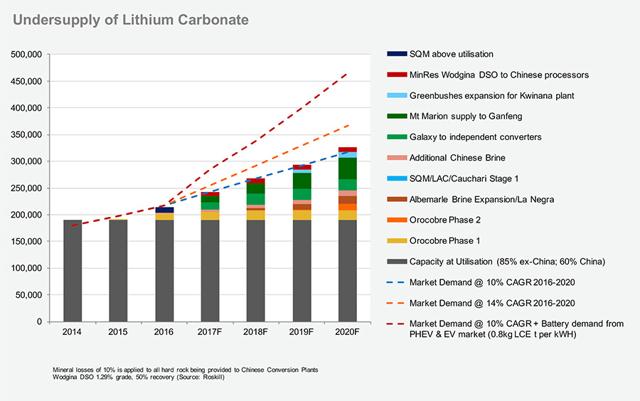

Due to the early stage of the electric vehicle industry, it is difficult to gauge how much lithium carbonate the industry will require in the years ahead. Today, the lithium industry has experienced shortages in material supply leading to significant price increases. Based on the chart “Undersupply of Lithium Carbonate,” the trend of lithium being in tight supply will continue beyond 2020.

New lithium supply will either be provided through new Greenfield projects or existing producers. As illustrated in the chart, current production coupled with the announced expansion will allow supply to meet demand in the base-case scenario. Considerable new supply is only required if the industry hits the mid-to-high case demand scenarios.

Existing Producers Deploy Capital To Increase Production Capacity

The new supply will primarily be derived from current producers rather than new market entrants. The new material supply will be delivered from either existing or new projects. All of this information remains true, until the market can determine the actual impact the electrification of the automotive industry has on the lithium supply chain. It should be assumed that the auto industry cannot ramp their businesses quickly enough creating 24 months of delays throughout the supply chain.

The vast majority of the automakers in 2017 have announced plans to convert lineup of vehicles to electric drive without the necessary battery supply chain in place. LG Chem (OTCPK:LGCLF) amongst others have announced aggressive expansion plans to meet the upcoming supply requirements. Therefore, the high-case scenario should be pushed out until 2022 with the assumption that the low-case scenario or around 300,000 T LCE is required in 2020.

The supply side expects Orocobre (OTCPK:OROCF) and Toyota (NYSE:TM) to successfully ramp up their Olaroz facility to nameplate capacity and double the production at the facility by 2020 (See: Orocobre Set to Expand Lithium Production). Further, Orocobre and Advantage Lithium (OTCQX:AVLIF) are rapidly moving forward the Cauchari Project, which is expected to deliver first brine shipments in 2019 (See: Advantage Lithium – Initiating A Strong Buy Recommendation).

SQM (NYSE:SQM) and Lithium Americas (OTCQX:LACDF) should be delivering considerable supply of lithium by 2020 and Albemarle expands its facilities at La Negra. The balance of the global supply will be delivered from Australia’s growing hard-rock lithium industry.