Categories:

Base Metals

/

General Market Commentary

Topics:

General Base Metals

/

General Market Commentary

Nevsun Finds a White Knight in Zijin With $1.41 Billion Deal

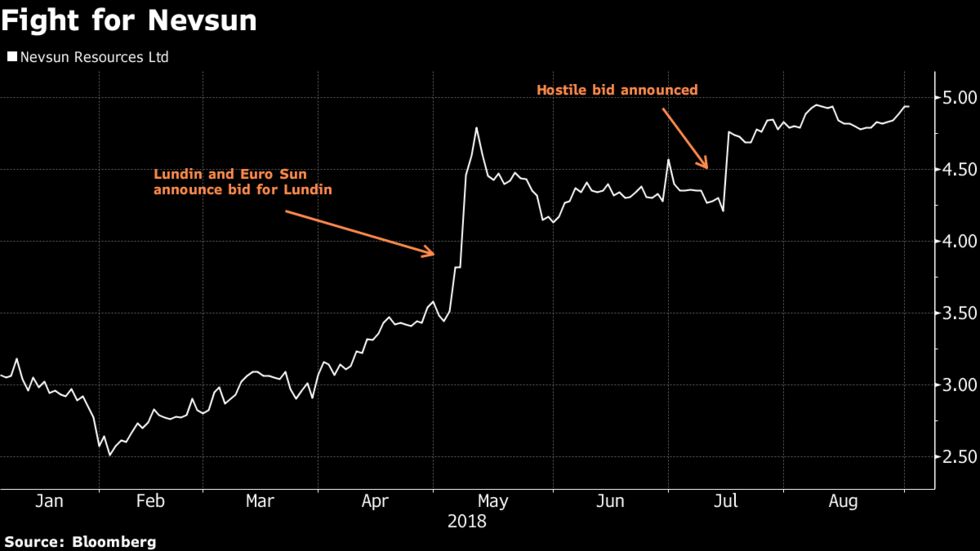

Zijin Mining Group Co. agreed to buy Nevsun Resources Ltd. for $1.41 billion to add copper assets in Serbia and Eritrea and enable the Canadian firm to ward off a hostile bid from rival Lundin Mining Corp.

Zijin, a Chinese gold and base metals producer, will pay C$6 per share in cash, trumping Lundin’s C$4.75 a share bid launched in July, the companies said Wednesday. Nevsun rejected repeated overtures from Lundin this year, saying that its offers undervalued the company and its assets.

The fight for Nevsun highlights how miners are scrambling to acquire copper reserves amid forecasts that supply of the metal used to make cables and wires will be tight in coming years on increasing demand for power generation and new energy vehicles. The company’s prized Timok copper-gold deposit is among just a handful of projects that aren’t already controlled by a big miner.

Lundin Chief Executive Officer Paul Conibear argued that his company was better positioned to provide the financing needed to develop Timok, as well as Nevsun’s Bisha mine in Eritrea. However, Nevsun CEO Peter Kukielski said last month the company had received interest from several companies and expected to find a better offer. Vancouver-based Nevsun’s board had spurned a joint offer made public in May by Lundin and Euro Sun Mining Inc. as “complicated” in structure and too low.

The deal also comes days after Zijin won a tender to buy Serbia’s state-owned RTB Bor. It offered to invest almost $1.5 billion in the country’s biggest mining and smelting company over six years, according to the energy and mining minister last week.

Click here to continue reading...