Categories:

Base Metals

/

Energy

/

General Market Commentary

Topics:

General Base Metals

/

General Energy

/

General Market Commentary

New projects for battery material nickel need a price spur

LONDON (Reuters) - Rapidly rising use of nickel in the batteries that power electric vehicles over coming years means higher prices are needed to incentivize the development of new projects to boost supplies of the metal.

Demand for nickel is expected to soar as governments, companies and individual consumers aim to cut the noxious fumes emitted by fossil-fueled vehicles.

Graphic: Electric vehicle sales penetration

To compete with conventional cars powered by internal combustion engines (ICEs), electric vehicles must be able to go further on a single charge. That means more nickel, used to store energy in the cathode part of lithium-ion rechargeable batteries, is needed.

Consultancy Roskill estimates most new greenfield nickel projects would need prices at $22,000 a tonne or above, though that would to an extent depend on byproducts such as cobalt, whose prices have slumped. Nickel prices on the London Metal Exchange are around $15,700 a tonne.

Graphic: Nickel prices

Prices need to be higher now as nickel mines can take five or more years to develop.

Prices need to be higher now as nickel mines can take five or more years to develop.

“You need a much higher purity nickel for batteries. To build more capacity you need significantly higher prices,” said Jack Anderson, an analyst at Roskill.

“Nickel has been dominated by the stainless steel industry, which uses the lowest-cost, low-grade material coming from Indonesia and the Philippines.”

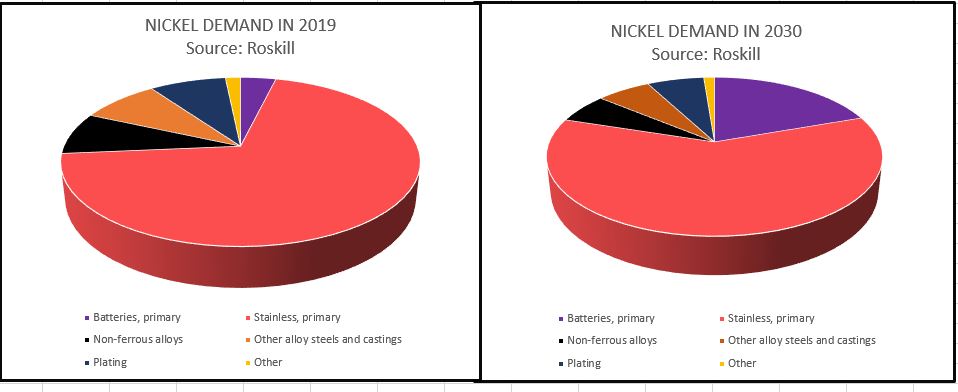

Stainless accounts for about 70% of global nickel demand estimated at 2.4 million tonnes this year, while batteries’ share was about 4%.

Demand will rely on the adoption of batteries containing higher levels of nickel. Originally, cathodes comprised one part nickel, one part cobalt and one part manganese.

Graphic: Battery cathode chemistry

That 1-1-1 ratio has largely given way to 5-2-3 and 6-2-2. Cathodes with 80% nickel are expected to dominate within years as technology advances to limit the use of cobalt, which stabilizes and extends the life of batteries.

“Depending on the adoption of 8-1-1 technology, the amount of nickel per car could on average go from 20 kg to between 40 and 50 kg by 2025,” said Jim Lennon, managing director at Red Door Research.

Graphic: Nickel demand from batteries

As electric vehicle sales climb, Roskill forecasts nickel demand from the battery sector to rise to 258,000 tonnes or nearly 10% of the total in 2022, when many expect parity between the costs of making battery- and ICE-powered cars.

Graphic: Nickel demand breakdown

Roskill sees batteries’ share at 20% of global nickel demand totaling 3.69 million tonnes by 2030, while stainless steel mills will account for 60%.