Categories:

Base Metals

/

Energy

/

General Market Commentary

Topics:

General Base Metals

/

General Energy

/

General Market Commentary

Nickel, cobalt prices benefit as electric car action shifts to Europe

While electric car sales were crashing in China, the world’s largest EV market by a country mile, customers were still busy kicking tires in Western Europe.

Year to date sales of battery-powered vehicles in the world’s second-largest car market surged 37% compared to last year to 142,000 units, according to Schmidt, a market researcher.

Preliminary data from Schmidt show EVs made up 6.7% of total car sales on the continent in April – in countries like Norway seven out of 10 new cars sold are now electric (mostly thanks to radical incentives – you even pay half-price for ferry rides and until recently, free parking anywhere). In the UK it was one in three.

Total auto sales in Europe (excluding the UK) fell by 80% with cities under lockdown. EU EV sales dropped by a comparatively healthy 30% last month.

Sales in China also slumped by almost a third during April, but that figure constitutes a bounce-back – sales of electric cars slumped 80% compared to 2019 the month before.

Tesla’s boss may be running afoul of the law, but its mass-market Model 3 continues to find buyers (despite a mysterious 64% drop in sales in China and unexplained closure of its new Shanghai factory even as covid-19 wanes in the country), not least in Europe where the Model 3 tops the charts. And with the first Model Ys being delivered, the EV pioneer looks set have a much better year than its ICE rivals.

Upstream, the news is not quite so rosy.

Benchmark Mineral Intelligence, a battery supply chain pricing agency and megafactory tracker, shows a deteriorating market.

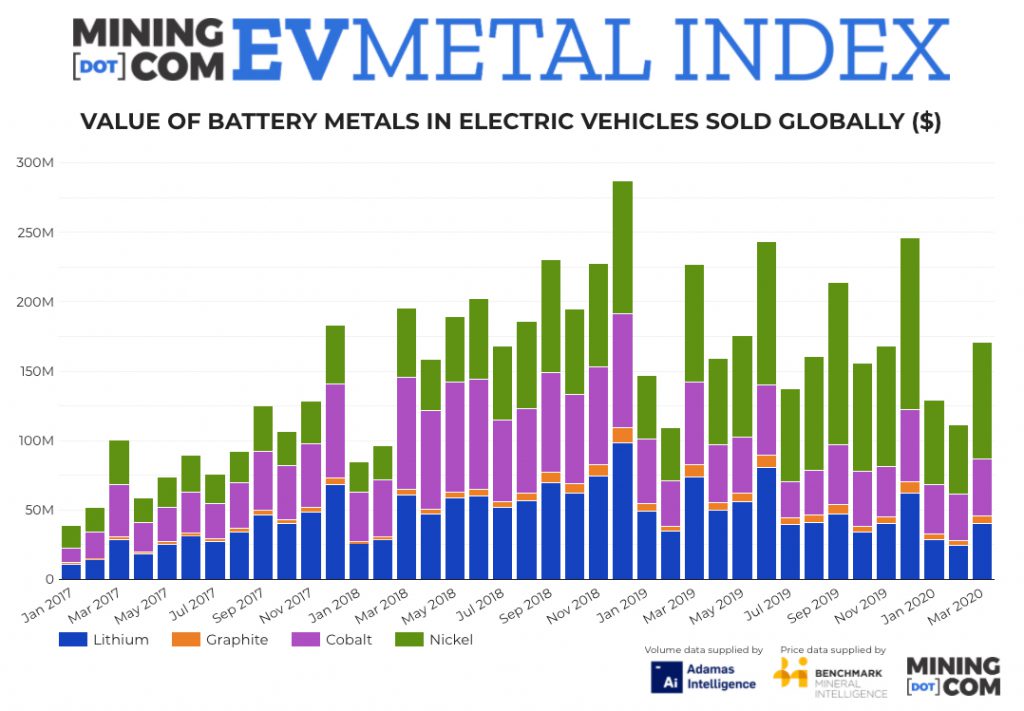

Prices for the raw materials tracked by the MINING.COM EV Metal Index are all down: The price of lithium dropped 40% year-on-year in March, cobalt (–15%), nickel (–2.4%) and graphite (–26.2%).

That leaves the volumes of raw material in batteries of newly sold EVs to do the heavy lifting in the index.

Indeed, data from Adamas Intelligence which tracks passenger EV and hybrid registrations (and the metals contained in their batteries) around the world, shows deployment of lithium (down just 2.7% in Q1 on a year-on-year basis), cobalt (+0.5%) and graphite (–1.3%) holding up. The tonnes of nickel in EVs joining the global car parc jumped by 10.4%.

Overall, the value of battery metals in electric cars sold globally reached $411 million during the first quarter, a drop of 14.7% compared to the same period in 2019, a record year.

Nickel rich, unthrifty cobalt

European carmakers favour higher energy density, longer-range NCM (nickel-cobalt-manganese) cathodes, which together with Tesla’s NCA (nickel-cobalt-aluminum) technology account for over 90% of batteries in passenger EVs.