Categories:

Base Metals

/

Energy

/

General Market Commentary

Topics:

General Base Metals

/

General Energy

/

General Market Commentary

Nickel is new headache for automakers as cobalt fears abate

Locking in supplies of key battery raw materials lithium and cobalt has been a headache for electric car manufacturers, but these days it’s the supply of nickel and graphite that’s keeping them up at night.

Carmakers bracing for a surge in electric vehicle sales in the early 2020s are increasingly worried about where they’ll get enough nickel and graphite to go into batteries, according to Simon Moores, managing director at Benchmark Mineral Intelligence. Concern about lithium and cobalt has eased as miners ramp up production at new projects.

“It was lithium and cobalt for the last few years that they worried about,” Moores said at a press briefing in London. “In the last four months it’s shifted; they seem pretty confident that the lithium and cobalt will be there in that timeframe.”

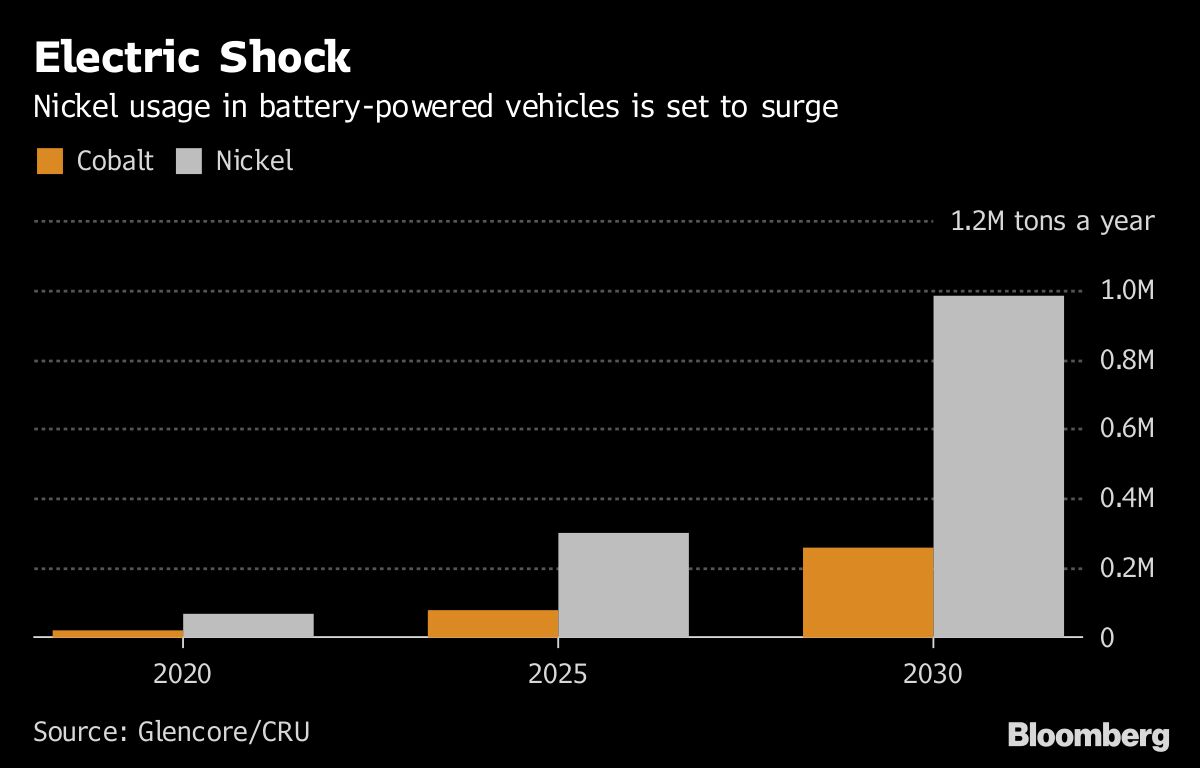

Investors and miners are already alert to the risk that supply will fall short of demand. Research commissioned by commodities trading giant Glencore Plc indicates that global demand for nickel in electric vehicles will hit nearly 1 million metric tons by 2030. That amounts to 55 percent of the metal produced globally in 2017. Prices look set to double by 2022, but producers still aren’t likely to keep up with demand from the automotive industry, according to Wood Mackenzie.

The buoyant outlook for battery demand has helped insulate nickel from a selloff in base metals over the past few weeks. Prices are up 5.7 percent so far this year at $13,490 a ton, while other base metals trading on the London Metal Exchange are down across the board.